11 Crises Beyond the Debt Ceiling

Posted May 26, 2023

Chris Campbell

The debt ceiling crisis looms above, fixing upon it the gaze of the entire nation.

But perhaps… perhaps!... we’re watching a little too closely.

As we obsess over this singular crisis, oblivious to the perils lurking in the shadows, a consortium of other crises quietly brews.

Take the municipal crisis, for instance.

A Wall Street Journal article recently shed light on the possibility of the Biden administration bailing out local and state funds. It seems mismanagement and excessive risk-taking during the heyday of easy money borrowing have brought us to this brink.

(Who could’ve predicted this?)

Then there's the commercial real estate crisis, the one that even Morgan Stanley warns could surpass the dreaded turmoil of 2008.

Even Elon Musk has chimed in, saying it’s “by far the most serious looming issue.”

Oh, and let's not forget the Nordstream crisis.

After Seymour Hersh's article, murmurs circulate in the European Parliament, insinuating potential US involvement. As a result, American allies are cautiously creating some distance, signaling a new era of strained relations.

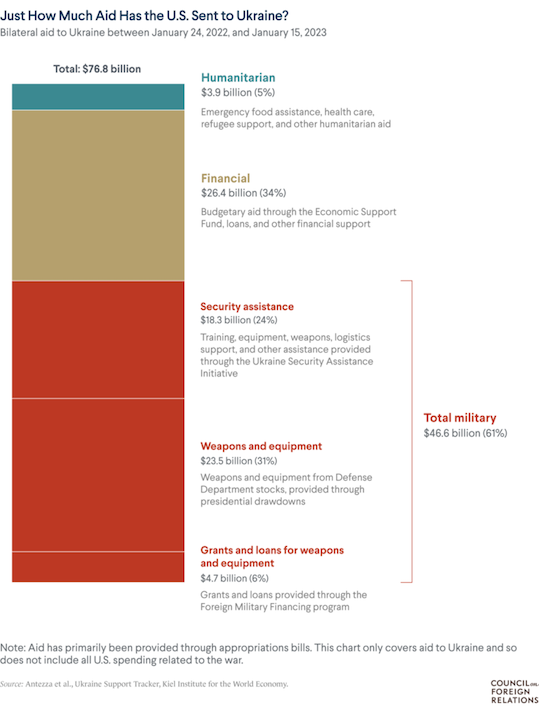

There's the ongoing crisis in Ukraine, a quagmire that has not only claimed an exorbitant price tag of above $100 billion for Americans but also wreaked havoc on global trade and exacted a devastating toll in human lives.

Then we have the crisis that simmers in Taiwan, where the ominous beat of war drums grows louder by the day. Tensions mount, threatening to unleash a storm that could have far-reaching consequences.

Let us not forget the rapidly growing de-dollarization crisis, wherein countries worldwide are embracing decentralization, distancing themselves from the once-dominant dollar.

As proof of this shift, Putin expressed the need for a new, decentralized global financial system.

He said this:

"Many rapidly developing economies are switching to national currencies in foreign trade settlements. It's important to coordinate joint efforts to form such a new decentralized global financial system... the more decentralized it is, the better for the global economy."

But wait, there's more.

An auto loan crisis spirals out of control, intertwining with a credit card crisis, where debt has soared to unprecedented heights, reaching a staggering $930 billion.

And let's not overlook the weighty burden of a $1.8 trillion student loan crisis, bearing down on the shoulders of countless individuals.

The private equity crisis casts its shadow too, as investors flee in fear, seeking refuge from impending storms. Meanwhile, the insurance industry grapples with its own crisis, navigating treacherous waters fraught with uncertainties.

And then there’s the bond crisis… sitting at the center of the spider web.

And, if that’s not enough, the final crisis is a real doozy.

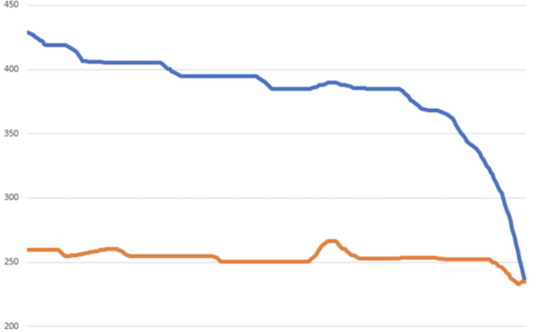

And it has everything to do with this shocking chart that barely anyone’s talking about.

Our colleague Jim Rickards calls it the “Big Steal.”

And once you see what the Biden administration’s trying to do…

Try not to let it get your blood boiling.

Rickards’ full talk on “Biden’s Big Steal” just dropped today.