1951: When the Fed Didn’t Want to Print

Posted May 30, 2023

Chris Campbell

"LITTLE GIRL OF 4 LIKES HER CIGARS”

While browsing an old bookshop yesterday, I came across this yellowed Atlanta Journal news brief clipping from 1951.

Elizabeth Quetulio picked up the habit at 15 months old by raiding the tobacco counter of her father’s grocery store.

“He thinks it doesn’t hurt her,” the final line reads of the father, just before the “AP” sign-off.

Times have changed.

But what caught my attention even more was the article on the opposite side of this clipping.

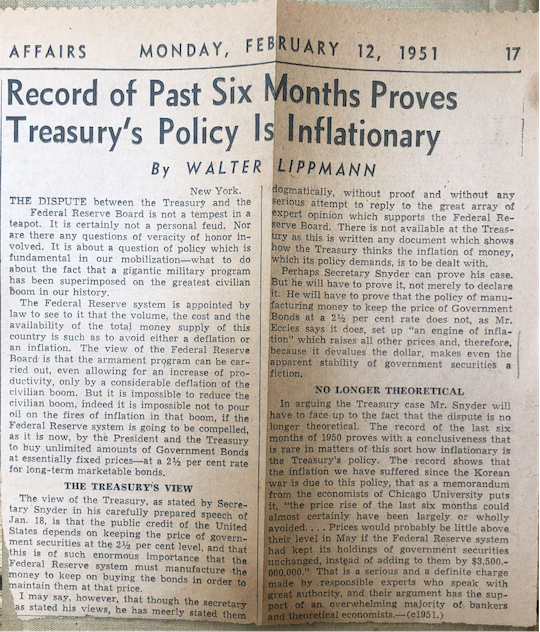

It was written by Walter Lippmann, titled "Record of Past Six Months Proves Treasury's Policy is Inflationary.”

When the Fed Didn’t Want to Print

Lippmann, if you’re not familiar, was a popular political commentator, known for introducing the concept of the “cold war,” and for coining the term “stereotype.”

Back in the 1950s, he was witness to a unique economic situation brewing in the US.

On one hand, there was a massive military program, the Korean War, underway. On the other hand, there was the extraordinary post-WWII economic boom.

Lippmann's article revealed the clash of views between the Fed and the Treasury.

The Treasury argued that maintaining the price of government securities at 2.5% was crucial for the country's public credit. Thus, the Treasury heads believed the Fed should continue to "manufacture the money" to buy these bonds.

The Fed, on the other hand, worried that this policy would “pour oil on the fires of inflation” and opposed the unlimited bond-buying program.

Lippmann said that the Federal Reserve's position had the backing of a majority of bankers and economists.

For example, he cited a memorandum from the economists of Chicago University that says, “the price rise of the last six months could almost certainly have been largely or wholly avoided... Prices would probably be little above their level in May if the Federal Reserve system had kept its holdings of government securities unchanged, instead of adding to them by $3,500,000,000.”

Neither Inflation Nor Deflation

Lippmann, taking the side of the Fed, challenged the Treasury to prove that it wouldn’t set off a chain reaction of inflation that devalued the dollar and undermined the apparent stability of government securities.

Lippmann also pointed out that (emphasis mine): “The Federal Reserve system is appointed by law to see to it that the volume, the cost and the availability of the total money supply of this country is such as to avoid either a deflation or a inflation.”

Back then, the Fed didn’t have a formal inflation target like the 2% pursued now. (In fact, the Fed didn’t adopt the 2% inflation rate target until 2012.)

In the 1950s, the memories of the Great Depression and World War II were still fresh. High inflation and its detrimental effects on purchasing power influenced the perception that inflation was a just as dire threat to economic stability as deflation.

For the time, they believed that maintaining a balanced money supply, one that neither caused deflation nor inflation, was crucial for sustaining economic growth and preserving the value of the currency.

They understood that excessive money creation could potentially lead to a devaluation of the dollar, eroding its purchasing power and disrupting the stability of financial markets.

They were cautious about the potential consequences of unrestrained money creation, which could fuel inflationary pressures and undermine the stability and confidence in the nation's currency.

Of course, the Fed and the Treasury were also still restrained by the Bretton Woods Agreement and the gold standard.

Fast-forward to today…

After over a decade of unrestrained money creation, and the disasters that now follow…

Again…

My how times have changed.