2024 Election Playbook

Posted July 16, 2024

Bob Byrne

Hillbilly Elegy was a great book.

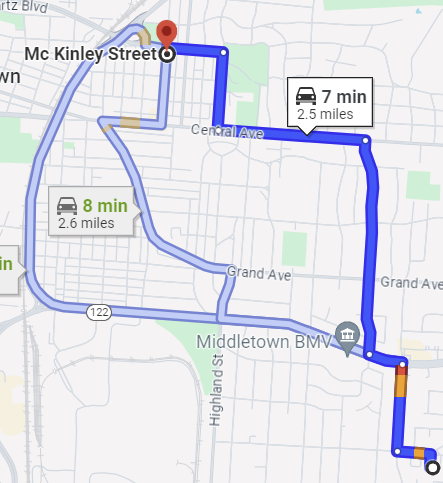

Vance and I grew up in the same city: Middletown. According to Google, our houses sat seven minutes away.

Interestingly, both of our families also hailed from eastern Kentucky.

His from Jackson, mine from Hazard. They were a part of a mass-migration from the south in search of opportunity.

(Growing up, everyone called Middletown “Middletucky” because of the large influx of hillbillies.)

As part of this heritage, Vance called the matriarch of his family “Mamaw.”

I called mine “Wawa.”

Vance’s birth name was Bowman, which has Scottish origins - it means “archer.”

Campbell? Scottish as it gets. (Campbell means “crooked mouth.”)

As far as personal history goes, that’s where I hope the similarities end.

The Campbells are famously associated with various curses and dark tales, largely due to their involvement in events such as the Massacre of Glencoe in 1692.

(Never cross a Campbell. That stuff rubs off.)

Fortunately for Vance, I couldn’t find any such curses from strange witches.

And yet, even if Vance sits in the VP seat… as the homespun “tech bro” that’s pro open innovation…

I remain a political skeptic.

Ultimately, I subscribe to the Douglasian political philosophy… as detailed in the second-greatest text on political theory in the universe, The Hitchhiker’s Guide to the Galaxy:

"Anyone who is capable of getting themselves made [Vice] President should on no account be allowed to do the job."

Our strategy remains the same: We like to invest in ways that bolster our portfolios no matter which way the wind blows.

And, no less…

There are still economic realities we have to contend with - no matter who wins in November.

Our go-to numbers guy Bob Byrne, who's traded through more market swings than a playground in a hurricane, recently broke down the economic flavor of each White House crew.

Bob, never one to sugarcoat, noted both scenarios come with headaches - but also some juicy investment opportunities.

Check it out below.

Read on.

The 2024 Election Playbook

Bob Byrne

For better or worse, the days are winding down until Americans can vote for incumbent Joe Biden or his predecessor, Donald Trump.

Prediction market sites like PredictIt give Trump a big edge over Biden.

I agree.

But I’m less concerned with making a political prediction and more focused on preparing my portfolio for whoever the winner is.

If you examine the performance of stocks under Democratic and Republican administrations, you’ll find that the markets have typically performed well under both parties. Neither party can claim to have consistently delivered superior economic or stock market performance.

According to Bloomberg, the S&P 500 has delivered an average annual return of around 10% through Democratic and Republican administrations over the past 67 years.

The only time the stock market failed to produce a positive return was during a financial crisis, as we saw in 2008, or during periods of stagflation, as we witnessed in the 1970s.

The key word here is stagflation.

From everything I’ve seen, including recent economic data, the governing records of both presidents, and proposed policies for 2025 and beyond, investors need to prepare for higher inflation under a Trump administration and stagflation under a second Biden administration.

Thankfully, we can prepare beforehand for how to best invest under either scenario.

The Road to Stagflation Begins with Bidenomics

Stagflation, which is high inflation combined with high unemployment and stagnant economic growth, isn’t something investors have faced for decades.

Our most recent case study is from the 1970s. Even then, we can’t point to a single event that triggered stagflation.

A combination of loose monetary policy, oil supply shocks, cost-push inflation, and Federal Reserve policy mistakes caused the economic debacle.

[cost-push inflation occurs when the cost of production increases, resulting in higher prices for finished goods and services]

While our situation doesn’t look as dire, the late April release of first-quarter gross domestic product (GDP) was terrible. The personal consumption expenditures price index (PCE), a key inflation metric for the Federal Reserve, also came in red hot, suggesting that inflation is beginning to heat up.

Source: Michael Renolds/Shutterstock

Recent GDP and PCE reports indicate that stagflation is a risk, but that’s only the beginning.

Long before the GDP report revealed a weakening economy, Biden’s policies were stoking inflation.

We can point to programs like the $1.9 trillion COVID-19 relief package, the $1.2 trillion Infrastructure Investment and Jobs Act, and the $739 billion Inflation Reduction Act as policies that injected too much money into the economy.

While not as dramatic, the president’s cancellation of the Keystone XL Pipeline, the moratorium on oil and gas production on Federal lands, and his pursuit of uneconomic green energy initiatives are criticized for reducing oil supply and increasing energy costs for consumers and businesses.

Then there are his trade and tariff policies (which are similar to Trump's) and student loan forgiveness programs, both of which are wildly inflationary.

The bottom line is that massive fiscal stimulus, restrictive energy policies, protectionist trade, and tariff policies contribute to higher inflation.

Remember, inflation is only part of the equation. We also need economic stagnation.

Biden’s made it clear that if re-elected, he’ll hike taxes on the ultra-wealthy and corporations, increase the tax on stock buybacks, and add a 25% minimum income tax on billionaires. Oh, and if there’s a way to squeeze in a tax on unrealized capital gains, he’s also open to that.

Increased taxes on corporations or individuals remove spendable and investable cash, restricting economic growth.

In other words, while Bidenomics may intend to “even the playing field” among lower, middle, and upper-income earners, the result will be reduced economic output. And between Biden’s inflationary policies and desire to stick it to corporations and the wealthy, the ingredients are in place for stagflation to take hold.

A Recipe for Trumpflation

I have always believed that while Americans will tell you how important issues like health care, immigration, and clean energy are to them, in the voting booth, it all comes down to their wallets.

If a voter’s financial health – can they feed, house, and provide for their family – has improved under the current president, he’s inclined to give him a second term. If not, the challenger gets consideration.

An inconvenient truth for President Biden is that Americans believe Donald Trump is better equipped to grow the economy, tame inflation, and improve their living standards.

Despite what the government tells us, we know inflation is a problem.

And unless you don’t eat, consume energy, or need housing, it’s safe to say the government-reported inflation numbers are wildly underestimating the actual price increase.

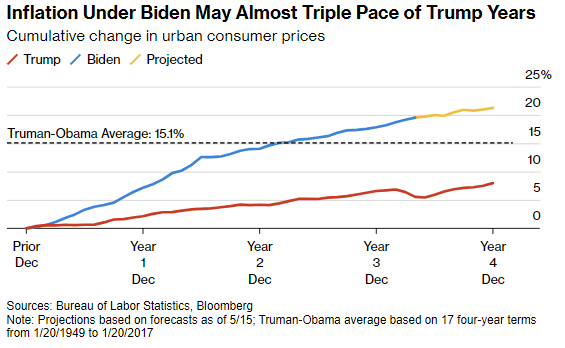

Under President Trump, inflation remained tame.

Sure, he came to office during an economic expansion, when interest rates were low, and left after the economy had been ravaged by COVID-19, again, when interest rates were low, but that doesn’t change the fact that inflation and interest rates were low during his tenure.

Fast-forward to President Biden and Americans have seen their living standards flatline (if not decline), the cost of virtually everything skyrocket, and mortgage rates surge.

The stock market may be at all-time highs, but if wages and disposable income aren’t outpacing inflation, all the green arrows on Wall Street won’t mean a thing.

Americans don’t believe they're better off financially under President Biden’s leadership.

Sounds great for Trump, right?

Well, sort of.

Trump has called for 10% tariffs on all imports, 100% on automobiles made outside the U.S., and a minimum of 60% on Chinese goods.

He even sat down with TIME Magazine at his Mar-a-Lago Club in Palm Beach, FL, in mid-April and said that he does not believe his tariffs and protectionist policies will drive up prices in the U.S.

Anything’s possible, but I doubt many economists outside Trump's circle of trust will support his economic views.

Trump’s inflationary woes don’t stop with his protectionist policies.

He wants to lower interest rates, make the 2017 tax cuts permanent (and reduce them further), and deport millions of illegal immigrants from the U.S.

Wanting to lower interest rates is fine. President Biden would also like that, preferably before Americans vote in November.

However, a loose money policy (lower interest rates) before inflation is under control ultimately sends inflation through the roof.

Making the 2017 tax cuts permanent, while likely adding trillions to the deficit over the next decade, will help stave off stagflation. Tax cuts are likely the medicine the economy requires to help stave off stagflation.

A massive crackdown on immigration is a whole other can of worms. While illegal immigration is a huge problem, removing cheap labor from the U.S. economy doesn’t bring prices down – it sends them straight up.

The bottom line is that while a Trump presidency accompanied by tax cuts and deregulation will likely stimulate many areas of the economy, there’s no question that his positions are a recipe for surging inflation.

Your Stagflation Investing Playbook

If Bidenomics leads us into stagflation, we’ll face a nasty combination of high inflation, slow or no economic growth, and rising unemployment. In this environment, stocks, especially growth-oriented or economically sensitive companies, and bonds trade poorly.

The stocks that emerge unscathed from a period of stagflation are those with low price-to-earnings ratios, strong dividend yields, and pricing power. Focus on value-oriented, consumer staples, utility, and healthcare companies.

Tangible assets like real estate, commodities, and precious metals can act as inflation hedges. Similarly, commodity-based stocks (oil & gas, agriculture, base, and precious metals) should outperform during stagflation.

Long-term bonds will likely perform terribly during high inflation and a rising interest rate environment, but shorter-duration Treasuries and Treasury Inflation-Protected Securities (TIPS) that carry little interest rate risk are a great way to preserve purchasing power.

Cryptocurrencies didn’t exist during the 1970s stagflation.

Still, if you can stomach the volatility, this alternative asset could outperform as it’s not tied to economic output and could be viewed as an inflation hedge.

The bottom line is that if Bidenomics leads us into a period of stagflation, we’ll want to focus on assets with intrinsic value, pricing power, or some method of protecting against inflation.

Diversifying between gold or gold stocks, oil companies, stocks in defensive sectors, and Treasury Inflation-Protected Securities (TIPS) is a great way to navigate a Bidenomics debacle proactively.

Putting Money to Work During Trumpflation

Putting money to work during moderate economic growth accompanied by high inflation isn’t terribly different from investing during stagflation.

We still want to focus on tangible assets that hedge against inflation, like real estate or investment trusts (REITs), commodities, precious metals, the companies that mine them, and TIPS.

But when it comes to investing in traditional stocks, we don’t only want to consider things like healthcare and consumer durables.

While it’s true that high inflation can negatively impact stocks with high valuations, like growth stocks, the bluest of the blue chips like Nvidia, Microsoft, Amazon, and Advance Micro Devices should outperform.

The key to investing in growth stocks during periods of inflation is to focus on companies with rock-solid balance sheets (strong cash flow and little to no debt), far above-average revenue growth, and no need to borrow money.

We haven’t talked about cash.

If holding a large cash balance while inflation surges scares you, that's good. It should scare you. Every day that inflation surges, the purchasing power of your cash plummets.

A simple way to remain “liquid” while hedging against inflation is to look at an ETF like the iShares 0-3 Month Treasury Bond ETF (SGOV). This ETF mimics the returns of U.S. Treasury Bonds with remaining maturities less than or equal to three months.

I use this ETF anytime I have spare cash in my account that I’m not ready to deploy into other investments. At current rates, I’m paid about 5.1% (annually) to park my cash in SGOV. Best of all, the market for SGOV is liquid, and I can sell it at any time without penalty.

The media portrays inflation as the boogeyman, but it doesn’t have to be as scary and painful as the talking heads on CNBC make it out to be.

The key is to ensure that your money works for you, offsets the effects of high inflation, and maintains your purchasing power.

Investing in tangible assets like real estate or REITs, commodities, precious metals and mining stocks, blue chip growth stocks, and TIPS will keep your portfolio balanced and diversified and shield you from the effects of inflation.

And remember, if you have spare cash gathering dust in your account, consider an ETF like SGOV to earn a nice dividend while you wait for another investment opportunity.

Disclosure: Bob Byrne is long SGOV.