2026: Blackouts, Burnouts, and Breakthroughs

Posted September 19, 2025

Chris Campbell

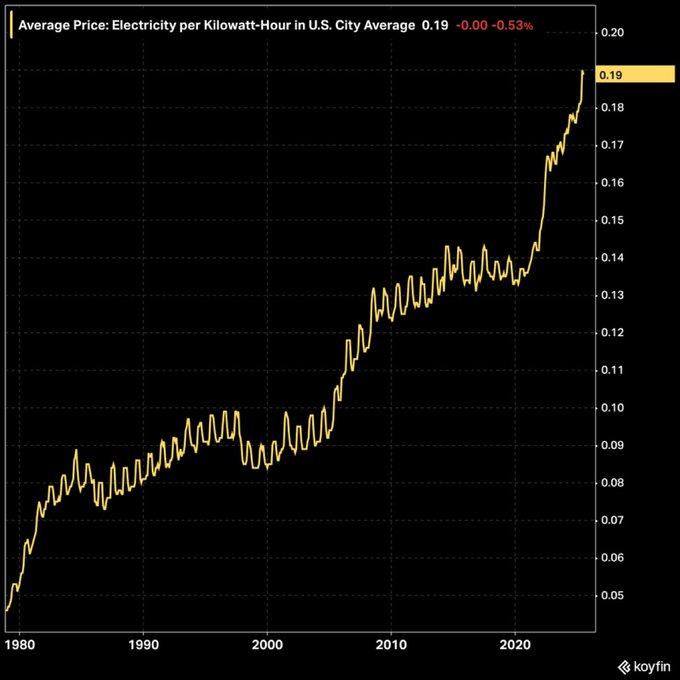

Behold…

The average price of electricity per Kilowatt-hour in the United States.

Notice the jump just at the turn of the decade.

Back in 2020, only about 4.4% of U.S. electricity went to AI.

By 2028, the Department of Energy projects that figure will explode to 12%—roughly 508 terawatt-hours.

That’s more than a tripling in less than a decade.

Meanwhile, the power grid itself? It’s barely budged, growing only 1.2% a year for the past two decades.

The only logical conclusion is as simple as it is terrifying…

We’re on a collision course: demand is climbing vertically, supply is crawling sideways.

We’re screwed.

Unless!

Blackouts, Burnouts, and Breakthroughs

By 2026, Gartner estimates that 40% of AI data centers could simply run out of juice.

That’s when the tough choices hit—do you prioritize homes or GPUs? I’d like to think the answer is obvious.

But when the choice is between keeping Grandma’s lights on or keeping ChatGPT-7 training, the decision may not always favor Grandma.

Nuclear could help, but the last plant took 14 years to build. We don’t have 14 years. We don’t even have 4 of them.

Moreover, each reactor generates around a gigawatt. By 2030, training the next-gen frontier model might require that much energy by itself.

I wish I was exaggerating.

So far, training demand doubles every two years. OpenAI’s Texas facility already draws 300 megawatts. At this rate, by 2030, ChatGPT-7 will be the energy equivalent of an entire nuclear reactor.

Literally.

That’s why Meta says it’s building a data center bigger than Manhattan. And Musk wants 50 million GPUs online by 2030, even though Nvidia only shipped 2.5 million H100s in 2024.

Like I said. We’re screwed.

Unless!

DAING Fixes This

Distributed AI training (DAING) is exactly what it sounds like: Workloads moving fluidly across the country (and globe), following the cheapest and cleanest power in real time.

With the rise of AI and crypto, it’s not only possible… It's already happening.

Before I go there, consider this…

The grid problem isn’t just that we don’t have enough energy—it’s that we waste staggering amounts of what we already make.

Take California.

On sunny afternoons, so much solar floods the grid that prices go negative. Utilities literally pay people to use electricity because there’s no storage and no way to push it elsewhere.

But at night, that surplus vanishes, and the system flips back to gas and coal.

Similar dynamics exist with wind in the Midwest: turbines spin hardest at night when demand is low. Much of that power gets wasted, too.

Recent studies reveal that, around the world, anywhere from 5–30% of generation is wasted at any given time because it can’t be stored or transmitted.

DAING fixes this by following the surplus.

Instead of wasting California’s daytime glut or Kansas’s midnight winds, you point GPU workloads directly at those electrons.

Of course, DAING can’t invent new electrons, but it can soak up the ones we already waste.

Back of the napkin math suggests the U.S. alone could reclaim 150 to 325 terawatt-hours annually—enough to cover up to 45% of domestic AI demand without building a single new plant.

Of course, this figure assumes a static world.

It assumes innovation stalls, the grid never modernizes, and no new supply gets built.

But that’s not what will happen.

DAING won’t just capture today’s wasted electrons; it will supercharge innovation itself.

Once workloads can migrate to wherever energy is cheapest and cleanest, the incentive to build more supply, more storage, better algorithms, and smarter grids explodes.

It creates a feedback loop: more distribution → more efficiency → more investment → more supply.

There’s already proof-of-concept for this: Bitcoin.

Brass tacks…

Better distribution doesn’t just buy us time—it accelerates the breakthroughs that push us closer to planetary energy abundance.

Nothing New, But Necessary

This feels like a brand-new thing—elastic, planetary-scale computing that arbitrages electrons.

But the pattern is right at home in the Internet Age.

The internet itself was built on packet-switching, routing data through the cheapest, least congested paths.

Wall Street made billions from high-frequency trading, pushing orders to the exchanges with the best spreads in microseconds.

Bitcoin miners have done it for years, chasing cheap hydro in Sichuan or flared gas in Texas.

Even Netflix relies on content delivery networks, scattering workloads across servers wherever bandwidth is abundant.

It’s only natural that energy itself would follow this path.

Distributed training is the same logic, only magnified: packet-switching for terawatts instead of kilobytes. It’s arbitrage at the scale of civilization’s energy budget.

Crypto x AI is the Answer

Again, blockchains solved the incentive problem for Bitcoin: millions of independent machines, spread across the globe, competing and cooperating at the same time, all while securing the world’s most valuable network.

Now imagine applying that same model to AI training and inference.

You suddenly have a continental-scale supercomputer stitched together from every region’s natural energetic advantages.

Crypto’s role is to coordinate and incentivize that distribution.

The blockchain layer will let spare GPUs—from every solar-rich cluster in Nevada to every Ikea rack in a central Ohio garage—plug into the same network, get paid transparently, and keep the workloads provably secure.

Imagine it as a decentralized mesh of American compute, secured by market incentives, resilient against attack, and far less vulnerable to the kind of energy bottlenecks adversaries could exploit.

The compute market becomes a living, breathing organism that follows the cheapest, cleanest power in real time—turning the U.S. itself into an energy-aware AI engine.

Without it, we’re stuck with brittle grids, centralized chokepoints, and trillion-dollar vulnerabilities.

With it, we have the blueprint for Kardashev 1.

James and I have been tracking this trend closely on the crypto (and AI) side. Early Stage Crypto Investor members are ahead of this curve.