Alert: Chaos at Coinbase

Posted May 11, 2022

Chris Campbell

The following is a portion of an alert James and I sent to our Early Stage Crypto Investor subscribers. We know Altucher Confidential subscribers are also interested in what’s happening with Coinbase, so we’re sending this excerpt your way. Read on.

James and Chris here.

Lots happening in the crypto markets and we want to get ahead of it.

So let’s talk about one thing that’s top of mind: Coinbase.

People are worried about two things when it comes to Coinbase: Coinbase failing and the recent disclosure about customer’s funds.

Let’s take a step back.

There are two types of brokerage firms:

"FIdelity-style" or "Wall St-style".

As far as we can tell, Coinbase is the former: they do not invest customer funds at all (so VERY different from the banks of 2008).

Lehman Brothers was like a hedge fund in disguise. That's why they went bankrupt. Coinbase is a bit more like Fidelity. They simply help customers buy and sell crypto assets (plus the growth strategies below). They don’t speculate in the crypto markets and, as it stands, have no risk of bankruptcy.

Coinbase basically has three strategies for growth:

- Allowing customers to invest in crypto. To grow, Coinbase plans to make this easier and easier, to add new cryptocurrencies to invest in, adn to provide professional traders with sophisticated trading tools similar to how brokerage firms do. They want to do this so institutions feel good using Coinbase to invest in crypto.

- Expanding the ecosystem of crypto use: build tools that help crypto holders spend their coins, access decentralized tools, borrow and lend, stake, and set up tools to help businesses accept crypto. Most of their acquisitions are in this area.

- Crypto apps. They will use Coinbase Ventures to fund and build apps that will further expand the ecosystem of crypto and the use cases of crypto currencies.

None of these are about speculating in the crypto market.

They have $6 BILLION in cash. Their loss this quarter was $429 Million with profits still expected for the ongoing year. This is not a bankruptcy situation.

A lot of people are worried about something else. In the company’s latest disclosure, the company wrote this:

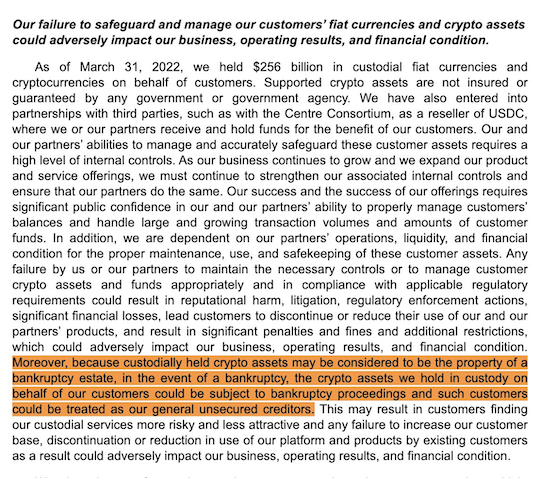

"Moreover, because custodially held crypto assets may be considered to be the property of a bankruptcy estate, in the event of a bankruptcy, the crypto assets we hold in custody on behalf of our customers could be subject to bankruptcy proceedings, and such customers could be treated as our general unsecured creditors.”

The CEO of Coinbase Brian Armstrong just released a statement about the disclosure on Twitter. (Read it in full here.)

The disclosure item that people are nervous about is a mandatory disclosure the SEC requires of any company holding crypto just reminding people that in the case of a bankruptcy, crypto assets are like any others.

This has nothing to do with Coinbase's financial situation which is quite healthy. It's just a mandatory disclosure required by all companies in the crypto business and has nothing to do with Coinbase specifically.

(Investors who make money are the ones who see beneath the headlines.)

Armstrong ended it with this: “Finally, of course, we offer a self-custodial wallet solution (Coinbase Wallet) for those who prefer to store their own crypto.”

The benefit of crypto is that you get to choose to hold your assets in your own custody, eliminating this risk. We have a report on how to take custody of your crypto and have written about it extensively in our weekly updates.

Of course, we’re always open to talking about self-custody in our weekly calls.

[Ed. note: If you want to join in on the conversation and become a member of ESC, click here for everything you need to know.]

James Altucher

Chris Campbell

For Altucher Confidential