Before You FOMO Into Bitcoin (Read ASAP!)

Posted August 30, 2023

Chris Campbell

Bitcoin! ETF! SEC! Grayscale!

These are the buzzwords lighting up social media, giving many crypto investors that sweet tingling sensation…

As if they're about to miss out on the biggest run of the century.

(AKA, FOMO.)

Grayscale won its dispute against the SEC, they say. It's a momentous occasion, they shout. The guarantee of a Bitcoin ETF is just around the corner, they bellow.

They’re not entirely wrong. But they’re not entirely right, either.

First of all, everyone loves an underdog story.

I’m no exception.

The little guy beats the giant—in this case, Grayscale taking on the gargantuan SEC—and hits it in the face with a stone.

Hurrah!

But if you know anything about bureaucracy, you know that a win in court doesn't mean you've won the war.

In other words, beware of celebrating prematurely.

Of more importance:

Don’t let this Grayscale story distract you from the real opportunity brewing in crypto.

(More on that in a moment.)

The Red Tape Brigade

Here’s the rub.

The recent court decision merely obliges the SEC to give Grayscale’s Bitcoin ETF application the review it deserves.

That's it.

It's a battle won, but the war?

The SEC has an entire armory of bureaucratic red tape it can still deploy. It can delay, it can reject, and it can even take the case to the Supreme Court.

This process could be dragged out until next year.

To be sure, I'm no Bitcoin bear—far from it.

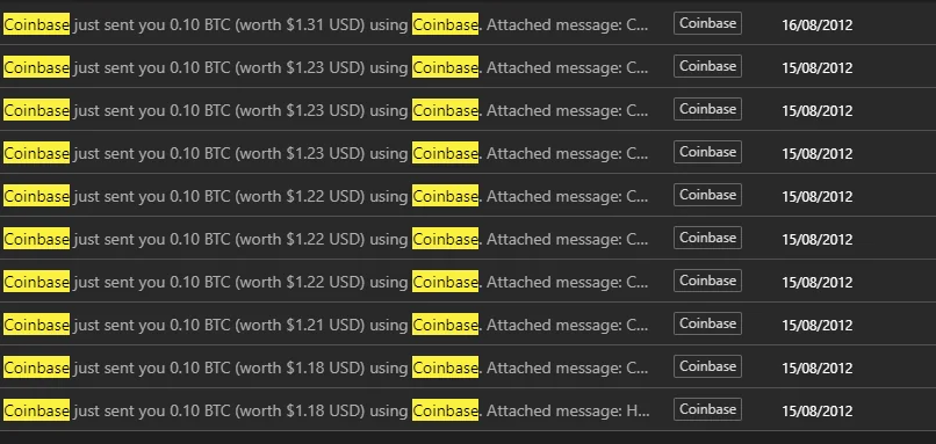

And I’ve been a staunch advocate of Bitcoin’s emergence into “TradFi” since Coinbase was doling out 0.1 Bitcoin per referral.

(Alas, this screenshot is not mine.)

But wanting something doesn't make it so.

If it did, we'd all be Bitcoin billionaires, flying to the moon in our personal rockets, singing folk songs with Musk and Bezos.

The Problem with the Numbers

Let’s talk data.

The news broke, and what happened? A puny 6% move in Bitcoin's price.

If this were really the game-changer they’re claiming it to be, we’d expect a much more significant bump, something that at least reclaimed the 200-day and 200-week moving averages.

The bulls gave us a whisper when we were expecting a roar.

Recall Ripple and its big win against the SEC? You'd think it would have rocketed to the moon, given the headlines.

But what happened? It’s stagnating, practically where it was a year ago. The SEC is already appealing the decision.

Also, zoom out to the macro landscape.

Uncertainty is in vogue.

People are talking a big game, but their actions are singing a different tune. Rather than diving into the stock market, they're playing it safe and stacking up on bonds.

In July, investors pulled a cool billion dollars out of stocks. Fast forward to this month, and they've yanked out over $16 billion in just three weeks.

Ironically, that could be bullish.

See what I mean? The crystal ball is foggy as ever.

The Bottom Line

Again, I’m all for a Bitcoin ETF. It’s inevitable.

But…

Don’t get suckered into FOMO.

As they say, the devil’s in the details. And in this case, the details say we’ve taken a step forward, but it’s not time to start the moonwalk yet.

Hey. Maybe I’m wrong.

Eric Balchunas, a senior ETF Analyst for Bloomberg, just upped his odds: “Spot bitcoin ETFs have a 75% chance of launching by the end of this year.”

But…

EVEN IF I'm wrong about Bitcoin, there’s a much bigger opportunity brewing in crypto. One that could leave Bitcoin in the dust -- AND prove paradigm-shifting for the rise of AI.

As you read this, we’re putting together a special report on just that.

More to come. Stay tuned to these cyber leaves for updates.