Beyond Satoshi: Digital Wildcatters 101

Posted October 07, 2024

Chris Campbell

The Grandview Cafe in Columbus, Ohio is where this story begins…

Where history seeps through the floorboards like spilled bootleg whiskey from the Prohibition era.

It’s been a staple of Columbus since 1925.

Over a couple of beers, Andrew Burchwell -- the brains behind the Ohio Blockchain Council -- and I dove into a conversation that touched all aspects of the digital asset revolution.

With HBO’s new documentary coming tomorrow, claiming to unveil the real Satoshi Nakamoto, the thought did arise:

“Who do you think created Bitcoin?”

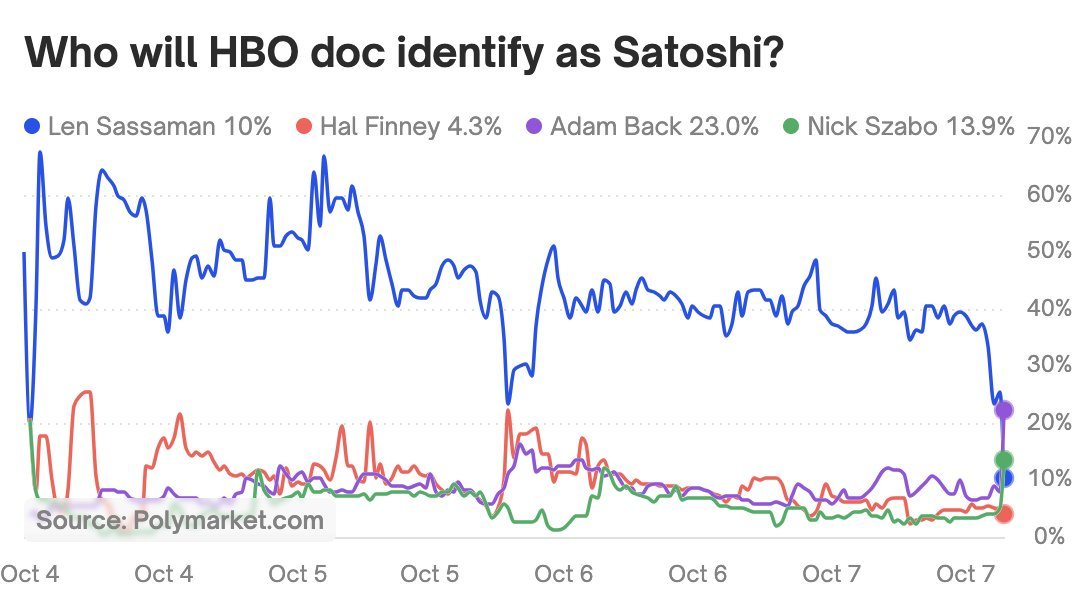

Right now, Polymarket suggests the HBO doc is going to identify Len Sassman as the figure…

But Andrew doesn’t believe it’s that simple.

"My personal belief,” he said, “is that this game has been at work for a very long time.”

He drew connections to historical economic trends and geopolitical shifts, positioning Bitcoin as a strategic development in a changing global order.

Two words: rabbit hole.

BUT…

It was clear that, for Andrew, the puzzle of Satoshi is interesting but not the main focus.

What really caught my ear is him talking about the potential of Bitcoin… and the positive unintended consequences the industry is bringing to the energy markets.

Bitcoin’s Energy Revolution

"There's nothing more equitable in the world than the kilowatt hour,” said Andrew.

As you know…

The laws of physics are immutable everywhere. And Bitcoin mining -- the process of using powerful computers to secure the network and earn rewards -- is intimately tied to energy consumption.

This connection, Andrew argued, could be the key to solving some of our most pressing energy challenges.

Sounds counterintuitive, but hear me out.

"Most people who argue against Bitcoin mining do so because they simply believe there's no value in utilizing power for this purpose," Andrew says. "But they're missing the bigger picture."

Put simply, Bitcoin mining represents the most flexible, large industrial load that has ever existed.

Traditional power grids struggle with supply and demand imbalances. When there's excess supply, energy often goes to waste. When demand spikes -- like during a heatwave -- it can lead to brownouts or blackouts.

"Enter Bitcoin mining," Andrew said. "We can turn massive amounts of computing power on or off in less than a minute. It's a tool for grid operators to play the harmonics of the power system at a much more effective response rate."

No less, this flexibility could be a game-changer for my home state of Ohio.

The state sits atop the largest natural gas reserve basin in the world. As global energy demand skyrockets, Ohio is uniquely positioned to capitalize on this resource - if they can manage it effectively.

Moreover, Ohio itself is a unique battleground for digital infrastructure, especially for Bitcoin mining.

The state’s abundance of underutilized power assets—a leftover from its manufacturing heyday—makes it a prime spot for miners.

Of course, this isn’t Texas -- a leader on this front -- but Ohio has its own draw.

As Andrew puts it, “It’s always about finding low-cost power, and Ohio’s industrial corridors offer just that.”

Best part? "We have a government that's willing to take advantage of this opportunity.”

The Ohio Blockchain Council is working to communicate how flexible compute like Bitcoin mining can complement the development of energy and power systems.

Andrew paints a picture of a future where Bitcoin miners act as a responsive buffer for the power grid.

During times of low demand, they soak up excess energy. When demand spikes, they can instantly power down, freeing up electricity for homes and critical infrastructure.

This Isn’t Just Theory

Andrew pointed to examples like Bitdeer, one of the largest public Bitcoin mining companies, which announced two major developments in Ohio.

One Energy is working on power infrastructure and microgrid solutions tied to high-performance computing.

Intrigued to see how much work is being done, I attended the Ohio Blockchain Council’s Amplify 2024 summit last week, focusing on digital wildcatters in the U.S.

The lineup included leaders from cryptocurrency mining operations, energy management firms, blockchain advocacy groups, financial institutions, and even a political candidate running for Senate.

I’m pulling my notes together tonight to lay it all out.

More to come tomorrow.