Bitcoin is Crashing in Reverse… Here’s Why

Posted November 10, 2023

Chris Campbell

Yup. Bitcoin is flying.

“Crashing in reverse,” as they say.

Let’s look at what’s happening on the surface.

Starting with basic numbers Bitcoiners love to cite:

Of 19.54 million Bitcoins in existence, 20% are lost.

Forever.

Global adoption rate is at about 0.11%.

There are currently around 2 million BTC on exchanges. 76% of the supply hasn’t moved an inch in over a year.

There are approximately 1.46 million Bitcoins left to mine, with the next “halving” -- where the miner rewards get cut in half -- happening in 160 days.

BUT

Beneath all of that something else is brewing…

And most Joes and Janes aren’t paying a lick of attention.

Mark January 10 on Your Calendar

The SEC is about to make a potentially game-changing decision on the Bitcoin ETF.

And guess what? We've got at most 60 days until that decision lands on our doorstep.

January 10 is when the SEC will either give the thumbs up or the thumbs down to a big Bitcoin ETF.

Actually, at this point, it could happen sooner than that.

Of course, they could say "No," BUT: It’s less likely than it was even a month ago.

You may recall…

The SEC recently lost a case with Grayscale. The judge basically called their reasons for delaying a decision on the Bitcoin ETF total crap.

(Not in those exact words.)

Since, the SEC has opened up lines of communication with the ETF applicants, tweaking the applications to meet their standards.

That’s new.

Though the crypto market is indeed the ultimate trickster…

All signs are pointing towards a likely approval.

What does this mean for you?

Expect Chaos!

Michael Saylor, King Bitcoin, reckons a spot Bitcoin ETF will at least double the demand for Bitcoin.

These three things, he says, could send Bitcoin to levels that seem unrealistic right now.

1.] Spot ETF approval.

2.] Banks custody and lend against Bitcoin as collateral.

3.] Fair value accounting rules from FASB (CHECK) ← You are here.

On top of that, consider:

Coinbase’s stock COIN is up 156% YTD.

Microstrategy is up 250% YTD.

Grayscale’s GBTC is up 265% YTD.

The average return of the top 11 public Bitcoin mining companies is over 150%.

In fact, all but two mining companies have outperformed Bitcoin this year.

Finally…

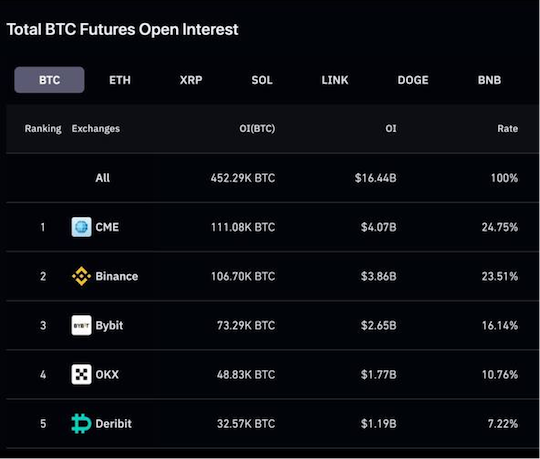

This is the first time the derivative marketplace heavyweight Chicago Mercantile Exchange (CME) has “flipped” Binance in terms of open interest for Bitcoin futures contracts.

Context: Open interest is a term used in the futures and options markets to describe the total number of contracts that are currently active or "open."

It's a count of all the futures or options contracts that have not yet been settled or closed. Open interest increases when a new buyer and seller enter a trade, creating a new contract, and decreases when both parties close an existing contract.

It's an important metric because it gives an idea of how much trading activity there is in a particular market: more open contracts mean more activity.

All of this suggests the appetite for a spot Bitcoin ETF exists.

But Bitcoin isn’t the best way to play it.

The Best Way to Play It

Right now, people are front-running the spot Bitcoin ETF.

James and I have long predicted that once the spot Bitcoin ETF is approved, another ETF will follow…

An Ethereum spot ETF.

Seems it’s happening quicker than even we thought.

A recent leak indicates that BlackRock, the world's largest asset manager, has just filed for a new iShares Ethereum Trust in Delaware.

Some might say, Well this is a trust. Not an ETF.

They’d be right.

And yet…

Blackrock did the same exact thing with Bitcoin DAYS before filing for a spot Bitcoin ETF.

This is not just a signal that a spot Ethereum ETF is coming…

It’s also a signal that Blackrock is confident its BTC ETF is going to get approved.

Meaning? Once the spot Bitcoin ETF is approved, the excitement and capital will look for the next big trade.

Right now could be a big opportunity to frontrun the frontrunners into ETH.

But we see an even bigger opportunity playing out. Bigger than Bitcoin and ETH.

Expect Volatility

While we might see some “god candles” in crypto…

Brace yourself for some brutal pullbacks along the way.

If you're a crypto trader, be prepared.

If you've been dollar cost averaging crypto, you’re probably doing pretty well.

This is a marathon, not a sprint.

We're still in the early stages of this crypto cycle.

As usual, James and I have our sights set on the plays with the biggest risk-reward ratio.

Right now, we’re looking at three things…

AI. Gaming. DeFi.

More on that next week.