Blackrock, Bitcoin, and ESG

Posted September 05, 2023

Chris Campbell

In the world of money and power, few things are as they appear.

Take Texas.

For all its bravado, the Lone Star state showed its Achilles' heel in 2021. As winter storms wreaked havoc, Texas' independent power grid stumbled, leaving millions shivering in the dark.

But here's where it gets interesting.

After the 2021 disaster, Governor Greg Abbott recognized an ally in… wait for it… Bitcoin miners. And come winter 2022, as icy gusts again threatened Texas’ grid, a curious thing happened.

These Bitcoin miners, pariahs of the energy world, stood ready to lend a hand.

And lend a hand they did.

They dialed back their operations, easing the load on the grid. For example, the Riot One Stone mining facility throttled back a whopping 99% of its consumption. All in a bid to keep Texan hearths and homes warm.

Many people see this as a bug.

If you can just turn off Bitcoin miners willy-nilly, what good are they after all?

In reality, it’s a feature.

And it’s why, in two years’ time, Bitcoin will be officially hailed as an “ESG-friendly” asset.

In fact…

It might be why Blackrock has taken a sudden interest.

And when that happens? The floodgates are open for crypto.

More on that, though, in a moment. We have some ground to cover first.

Bitcoin as an ESG asset

Bitcoin uses approximately 110 terawatt hours of energy per year. This is equivalent to the amount of energy required to run the world’s tumble dryers.

Gas flaring (which Bitcoin is helping to solve) produces about 4X more emissions than the Bitcoin network. Air conditioning? 29X.

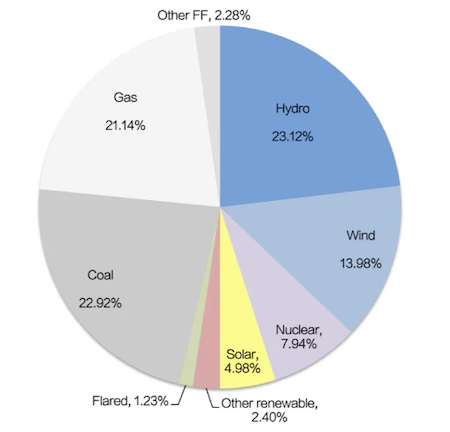

What Bitcoin admonishers don’t mention -- or don’t realize -- is that more than 50% of Bitcoin’s energy is from renewable sources.

No small sum.

And there’s a simple reason why:

Renewable energy providers aim to produce as much electricity as they can due to their contracts. Sometimes, they make more energy than needed, causing prices to drop, even going negative at times.

This makes expanding renewable energy infrastructure more difficult.

Put simply…

Bitcoin miners can set up near renewable energy sources anywhere in the world. They can also adjust their energy use based on supply and demand. This helps encourage the building of more renewable energy sources.

Former CEO of ERCOT, which operates most of the energy systems in Texas, put it this way: “Bitcoin allows those renewables to earn money during those times rather than having to shut off their service, or even having to pay customers to use their power.”

Also worth noting: Texas produces far more renewable energy than any other state in the country. As a result, it’s a popular state for Bitcoin miners to set up and represents about 59% of the total Bitcoin volume in the US.

These days, Miners sign contracts with the energy companies to stop mining when demand spikes so their energy can be dispersed during these times. The speed at which miners can lower their consumption is very quick, which is exactly what power companies need.

And, as a result, this helps to stabilize the grid.

But it’s not just Texas that benefits. It’s all of the rust belt, too.

Saving the Rust Belt

There are many places in the US that have the grid infrastructure for mass-manufacturing, but the manufacturing is long gone.

Being able to bring on a new consumer of the supply (Bitcoin) is not a burden to these systems, and brings in revenue for those places that, right now, are without it.

Now, here’s why that’s important for everyone.

If you’re the CEO of a public utility company, and you have a ton of supply but low demand, you have three options.

1.] You raise the prices for everyone to afford to maintain the excess infrastructure.

2.] You degrade the service for everyone, because you can’t afford to maintain all of it.

3.] You find a bigger customer.

Bitcoin miners are that bigger customer.

Brass tacks…

Bitcoin can help in times of excess energy. And it can help places where the demand for energy is too low.

And Bitcoin miners are in search of the lowest-cost sources of electricity, which is often tied to under-utilized hydro, wind, or solar.

In the US, we overproduce energy by about 14%. That doesn’t sound like a lot, but the United States is huge. That’s a lot of electricity.

And, by the way, that’s several Bitcoin networks’ worth of energy.

If we can monetize that normally-wasted electricity, and invest that money gained into grid infrastructure? We’ll be better off.

Now, here’s the opportunity.

ESG is a Scam, But…

As you know…

BlackRock, a big investment company, decided to get involved with Bitcoin.

And maybe there’s more to this move than meets the eye.

Is ESG authority Larry Fink endorsing Bitcoin as an ESG asset?

Consider that KPMG, a big four accounting firm, just released a report stating that Bitcoin will play a key role in ESG goals.

(And for the reasons I just listed.)

Don’t get me wrong.

ESG is a scam.

It’s a way for elites to legally shift capital toward sectors and businesses that serve their interests. But by their own metrics, Bitcoin is perhaps the most “ESG-friendly” asset in the world.

And it’s a big deal: An estimated $50 trillion is expected to be funneled into ESG investments by 2025.

And yet…

Even the best ESG ETF, EGF, has only a Compound Annual Growth Rate of 5.57% over 10 years.

Bitcoin? 77%.

If even a small part of that $50 trillion goes into Bitcoin, boom.

Keep an eye on this. In a world where things can change fast, the Bitcoin haters could turn heel at any time. (They already are.)

But, as mentioned…

Even bigger opportunities than Bitcoin are brewing in the crypto space. And they have everything to do with the AI boom.

More to come on that soon.