Buy Crypto Like BlackRock (OTC)

Posted October 30, 2023

Chris Campbell

Behind the neon glow of popular crypto exchanges, a quiet storm is brewing.

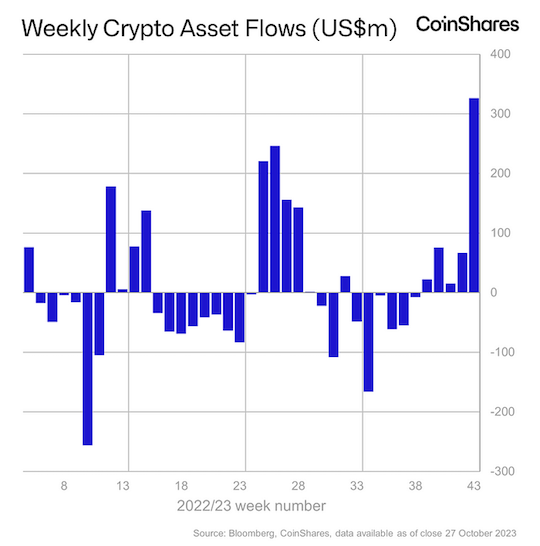

Crypto funds just saw the largest single-week inflow since July 2022.

CoinShares data let us in on this: some $326 million flowed in just last week.

But here's the twist: This money isn’t flowing in from the usual bustling aisles of crypto exchanges you might be familiar with...

Much of it is happening on over-the-counter (OTC) desks, which allow individuals or institutions to trade crypto without using an exchange.

Whales use it.

Institutional investors use it.

Private wealth managers use it.

Crypto funds use it.

But what is it!?

OTC Explained Simply

Imagine you're at the supermarket.

You're pushing your cart along, and every item you toss in—whether it's a guilty pleasure like chocolate or a healthy choice like tomatoes—gets broadcast on the store's loudspeaker for everyone to hear.

“John Doe just added a 30-pack of beer, a tub of ice cream, and, oh, six frozen pizzas!”

Sure, the public might not immediately pin it to you, but anyone curious enough could probably piece it together.

This is pretty much what happens in traditional stock market exchanges. Every buy, every sell, out there for everyone to see.

Big moves? They get their own special shoutout with “block trade” alerts.

Now, ask yourself: Would you shop at this supermarket? Many big institutions wouldn't. They prefer a more discreet shopping experience.

Hence, they sneak into the quieter lanes of the OTC markets.

The OTC market is more like a private auction house. Just you, the item, and the seller. No noisy crowd. You haggle, you agree on a price, and the item's yours.

Quietly.

While the plebs might ogle at the New York Stock Exchange, OTC is where the real giants play.

Did you know more U.S. stocks are traded OTC than on the NYSE and Nasdaq combined? Most people don’t.

No surprise, it’s also a growing market in crypto.

How it Works

Say you’re a high net worth individual or an institution. You want 500 BTC.

Thinking about snagging 500 BTC in one go on an exchange? Ha! Good luck.

It's like trying to buy all the tickets for a sold-out concert, but each one gets pricier as you go. You might nab the first few at face value, but the last ones? You're paying a premium.

But with a crypto OTC desk, it's one-stop shopping. One price, no fuss. They handle the mess.

It happens in three steps.

You Want to Buy: Hit them up. "I want 500 BTC." They'll shoot back with a price.

Seal the Deal: Once you agree, they get to work. Their mission? Buy BTC for less than they're selling it to you. That's where they make their profit.

Pay Up and Collect: Wire them the money. They send you the BTC. Voila!

How to Do It

If you or your organization is interested in purchasing Bitcoin OTC, here are the steps you would typically take.

First, you need to find a reliable and experienced OTC desk.

Keep in mind, most of them have a trading minimum of at least $50,000. (It can go up to $250,000. Even higher.)

There are many OTC desks offered by established crypto companies. Some of the notable ones include:

- Circle Trade

- Genesis Trading

- Kraken OTC

- Coinbase Prime

- And others, including some that might be region-specific.

Before you can start trading, you will need to undergo a KYC and AML verification process. This typically requires providing:

- Personal or corporate identification documents.

- Proof of address.

- Source of funds (especially for large transactions).

Once you've been approved, you'll be assigned an account manager or a point of contact.

Discuss your requirements, such as:

- The amount you wish to purchase.

- The price you are looking for.

- And any other specific needs.

From there, your OTC desk will provide a quote. If you agree, they will execute the trade. Settlements can be done in various ways:

- Bank wire transfer.

- Cryptocurrency transfer to a specific address.

- Sometimes even physical cash or gold, though this is less common.

If you're buying a significant amount, consider secure storage solutions.

Options include:

- Hardware wallets (e.g., Trezor, Ledger).

- Multi-signature wallets.

- Custodial solutions offered by some of the OTC desks or specialized services.

Remember that while OTC desks offer convenience and reduced market impact, they might have slightly higher fees than standard exchanges.

(However, for large trades, the benefits usually outweigh the costs.)

Finally, always do your research and ensure you're dealing with reputable OTC desks or brokers. The crypto space, while maturing, still has no shortage of bad actors.

Also, there are other ways for smaller buyers to buy BTC in a peer-to-peer way.

More on that soon.

Stay safe.