Coinbase's Secret Master Plan Revealed

Posted June 03, 2024

Chris Campbell

In a 2016 blog post titled "The Coinbase Secret Master Plan", CEO Brian Armstrong laid out an ambitious vision for turning Coinbase into the key platform for a new "open financial system".

While much has changed in the crypto landscape since then, a closer analysis of Armstrong's four phase plan shows that the “master plan” hasn’t changed.

And it’s pretty bullish for both crypto and $COIN.

The Path to 1 Billion Users

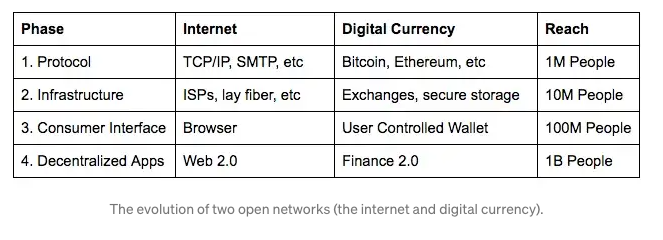

Armstrong split the evolution of crypto into four distinct phases.

In the first phase, protocols (Bitcoin and Ethereum) emerged and people began to use them.

In the second phase, Coinbase led the way in the United States by becoming a secure way to trade and store your bits.

Phase three calls for building a "mass market interface" for crypto apps. At the time, Armstrong predicted this would look like an easy-to-use wallet that lowers the barrier to entry for average consumers.

Coinbase built it.

Coinbase Wallet is now the best browser wallet in crypto, allowing users to take custody of their crypto.

(Coinbase can still charge you a small fee when you trade inside the wallet, so they’re making money regardless.)

With over 100 million verified users and its spot as a leading fiat onramp, Coinbase has undoubtedly succeeded in the third phase.

But it's the fourth phase that’s really going to make the difference.

The JPMorgan of Crypto

With the recent launch of Base, their layer-2 blockchain built on Ethereum, phase four is in full swing.

The goal is to make interacting with crypto and decentralized apps radically easier for the average user.

Just as the web browser brought the internet to the masses, Coinbase envisions Base as the mainstream gateway to the decentralized web.

Reading between the lines, Coinbase's true end goal is not just to be a major crypto exchange, but THE global platform for all on-chain financial activity.

The “JPMorgan of Crypto”.

And I think it has a real shot.

The Opportunity

Consider:

Coinbase reported an earnings per share (EPS) of $4.40, nearly nine times higher than some analysts expected, and a revenue of $1.6 billion, surpassing some forecasts by $500 million.

Wall Street analysts consistently underestimate the potential of Coinbase for one simple reason.

They wildly underestimated the rapid adoption of crypto, especially new innovations like Layer 2 solutions (Base) and the expanding use of stablecoins.

They didn’t account for:

- Transaction revenue shot up, which hit approximately $1 billion.

- Transactions from Base, which generated $56 million.

- Stablecoin-related revenue, which reached $200 million, largely due to increased USDC usage.

- Blockchain rewards revenue (from staking mostly) came in at $150 million, boosted by rising Ethereum prices.

This will keep happening.

And, of course, it presents a MASSIVE opportunity.

In fact…

In the coming weeks and months, one unexpected sector might drive Coinbase’s short-term success in ways few will see coming:

Two words: Meme coins.

More on that later this week.

Tomorrow, we’ve got a special announcement -- and a secret phone call.

Stay tuned.