Conspiracy: Iran’s Bitcoin Nukes

Posted June 27, 2025

Chris Campbell

So here's the question that exploded across the cryptosphere this week:

Did the U.S. just take out Iran’s Bitcoin mines?

It started with a viral post.

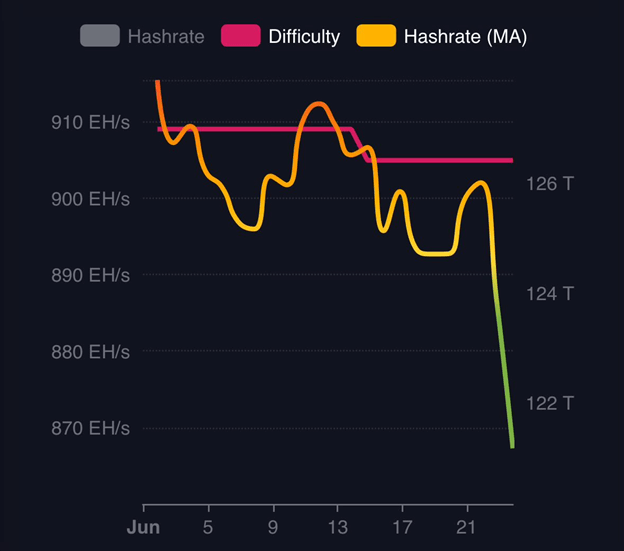

The claim? A sudden dip in Bitcoin’s hash rate perfectly coincided with U.S. airstrikes on Iranian nuclear sites.

The theory? Iran’s been secretly using nuclear reactors to mine Bitcoin—turning uranium into Bitcoin—and the USA just blew it up.

Crazy? Yes.

But… not entirely impossible.

Iran’s Not New to This Game

Let’s get one thing straight: Iran has been mining Bitcoin for years—legally.

Since 2019, they’ve been flipping the “sanctioned” switch to “sovereign workaround.” Why beg for U.S. dollars when you can mint your own borderless, censorship-resistant money?

According to Elliptic, Iran accounts for about 4.5% of the global hash rate (mining power), leveraging cheap, subsidized energy.

Some of those rigs—including one 175-megawatt Bitcoin mining farm in Rafsanjan, Kerman Province—are reportedly linked to the Islamic Revolutionary Guard Corps (IRGC) in partnership with Chinese investors.

So yes, this is geopolitical.

Groups like the IRGC don’t need billions—a few hundred million in flexible capital goes a long way for regional operations or arms procurement. This is what prompted Elizabeth Warren to sound the alarms on Iran’s Bitcoin mining last year.

Let’s do some math.

If Elliptic’s numbers are true, that means Iran is (or was) mining roughly 20 Bitcoin a day. At over $100,000 per BTC, that’s more than $2 million per day, or over $700 million a year.

$700 million in Bitcoin = less than 1% of Iran’s total budget. Not much to scream about. But it's off-the-books, sanction-resistant, and liquid—which makes it way more valuable than its size suggests.

Enter the Nukes?

The theory says Iran’s been using nuclear power to mine Bitcoin.

Why? Because nuclear power gives you uninterrupted, industrial-scale juice—perfect for powering ASICs around the clock. And when those bombs dropped on June 22, the global hash rate plummeted.

Cue: conspiracy.

I’ll admit… the timing of the drop in mining power is weird.

Maybe there’s something to this. But perhaps something else is happening.

Something way more boring—but way more quantifiable.

What (Probably) Happened

Let’s break it down:

1. Texas Grid Curtailments

When it’s hot in Texas, miners shut off to help stabilize the grid. ERCOT (their grid operator) even pays them to do so. And guess what? The weekend of June 22 saw a massive grid surplus. Miners cashed in by powering down. That’s normal. That’s profitable. That’s documented.

2. Whale Games & Profit-Taking

Bitcoin recently hit a fresh all-time high—and right on cue, the whales showed up. When price action looks stretched, they don’t hesitate. They send coins to exchanges, take profits, and reset the board. This time? Roughly 30,000 BTC hit the market last week. Classic playbook: accumulate in silence, sell into strength, wait for the dip. Rinse and repeat.

3. Mining Got Harder

When Bitcoin’s halving took place in April 2024, the world was relatively stable—temperatures were steadier, energy costs manageable, and the geopolitical landscape, while tense, wasn’t boiling over.

Fast forward to summer 2025, and miners are facing a far harsher reality: record heat waves are straining power grids, global electricity prices are climbing, and geopolitical flashpoints are driving up energy volatility. In short, mining rewards were cut in half and the world got twice as chaotic. This means it’s now harder and more expensive to mine Bitcoin—less reward, higher electricity costs, and growing grid pressure.

But here’s the upside and the genius of Bitcoin: these constraints incentivize innovation. Stranded and wasted energy—like flared gas, off-peak renewables, and isolated hydro—suddenly becomes more economically viable to tap.

Bitcoin mining flows like water: it seeks out the cheapest, most overlooked sources of power. When traditional energy markets tighten, Bitcoin doesn’t stop—it adapts, often by turning what was once wasted into something profitable.

Why This is Bullish

Sometimes the truth is stranger than fiction.

Other times? It’s boring.

This week, I lean toward the latter.

But even false narratives have real consequences.

In all, this is bullish for Bitcoin.

Short-term mining slowdowns reduce selling pressure and allow for more organic accumulation. It’s often a signal of local bottoms, as miners capitulate and long-term holders step in.

But that’s just the beginning…

Right now, Bitcoin and crypto are seeing an infestation of tailwinds.

As usual, James and I are scouting out the best opportunities and buying up the dips.

More on that next week.