Crypto Success 101

Posted August 13, 2021

Chris Campbell

There are many ways to make money in crypto.

There are many ways to make money in crypto.

If you’re committed to learning about this space, it’s a good idea to dip your toe in everything -- just to get a feel for it. In the end, however, it’s usually best to play to your strengths.

Though there are plenty of ways to make money, there are plenty more ways to lose it. If I’ve learned anything in this space, it’s that those who capitalize on their strengths are more likely to come out on top.

Are you a strong trader (do you like to zoom in)? Or do you prefer to zoom out and take the long view? Does the burgeoning idea of decentralized finance (DeFi) sound fascinating and worth exploring? Or are you more interested in earning interest in less experimental, more established “blockchain banks”?

Perhaps a couple of stories will help. (Forewarning: I’m biased.)

Since 2013, I’ve talked to quite a few crypto traders. A few of them are still kicking. Most gave it up a while ago.

Although a lot of people think crypto is sketchy (and in many ways, of course, they’re right)...

In the early days, crypto was VERY sketchy. Nobody knew who was behind many of the exchanges. With the exception of Mt. Gox (which ended in disaster), there were no faces -- no Brian Armstrong (Coinbase), no Winklevii (Gemini). Just logging into these sites felt like you were buying drugs on the Dark Web. Though I had no interest in trading, it was exciting because the ideas behind this space were so new, dynamic, and full of optimism about the future.

One early crypto trading platform had a chatbox. It was an awful idea -- pure chaos -- but it added to the feeling of being a part of the Wild Wild West. They hired moderators to keep out the riff-raff. But it was all riff-raff. Everything felt like it was on the brink of crashing. Hackers were constantly targeting the exchanges with simple DDOS hacks. Somehow, for the most part, it kept working.

And, yes, some people were making money.

Case-Study #1: Dalin Anderson

One fledgling trader I met in 2016 still sticks out -- a young guy named Dalin Anderson. He started with just $25.

(There’s a caveat here, but I’ll get to that in a moment.)

He turned that $25 into $250.

And then he turned that $250 into $4,000 and bought his first car: a BMW.

This is the success story. And he has collected many more since then.

The other side of the story? He “started” with $25… because he’d already lost quite a bit. That’s all he could afford to lose. In his words, he “paid his dues.”

To get good at trading, he said, you have to spend a lot of time zooming in and trading. You have to learn the technical indicators inside and out. And, of course, “pay your dues.”

He said: “I started learning technical trading the same way a lot of people do -- I lost money.”

Also, you have to love it. Or at least like it: “It’s crucial to have a passion for trading in order to be successful. Most people will give up when it gets rough if they aren’t driven. Passion will help get you through the rough spots.”

You might have the skills. I’m not a trader. But I’ve learned a lot from traders about mindset. Upon request, Anderson recommended two books. They had little to do with day trading:

One is Finite and Infinite Games by James P. Carse. And the second one is Antifragile by Nassim Taleb.

Both, he said, are about learning how not to get wrecked and grow with each failure. Being good at trading, in this way, is a lot like being good at life.

Upon writing, Anderson’s still going strong. He also leverages his knowledge to teach others how to trade crypto through his High Altitude Trading program.

Play to Your Strengths

As mentioned, there are many ways to make money in crypto. If trading is playing to your strengths, perhaps it’s not a terrible choice.

Day trading requires zooming in. I want to zoom out. I want to see how crypto potentially applies to the space economy in 100 years. I want to see how this technology connects in 1,000 ways to the physical world. How will it change the way we behave? How will it change the way we do business? How will it change the way we think about money, capitalism, economics, and jobs?

Like Michal K., I’m keen on the long-view, despite having to white-knuckle it through the volatility.

Case-Study #2: Michal K.

Michal first heard about bitcoin in 2014. He had $4,000 in his savings account. Inspired by his programmer friend, a rabid bitcoiner, he went all-in.

“At the time,” he wrote on his Medium page, “I invested my $4k, the price of a bitcoin was about $600. I got 6.55 BTC. I will never forget that number. Over the next half a year, bitcoin’s price kept steadily declining, until it bottomed out at $152, in January 2015. That’s a 75% loss just like that before I knew anything about how investment (or crypto) cycles work!”

But Michal was committed. He held. More importantly, he had other things occupying his time. He was zooming out.

In April 2017, the price of bitcoin hit $1,200.

He held. And he kept learning.

Between April and December of 2017, it shot up to $20,000.

He held. And learned more.

And then, it crashed down to $6,000. While most people were panicking, what did Michal do? He bought more.

Recently, he began leveraging that crypto in “blockchain banks,” making about $3,000 per month. And now that DeFi is maturing, he’s begun pulling in, on average, $20,000 per month.

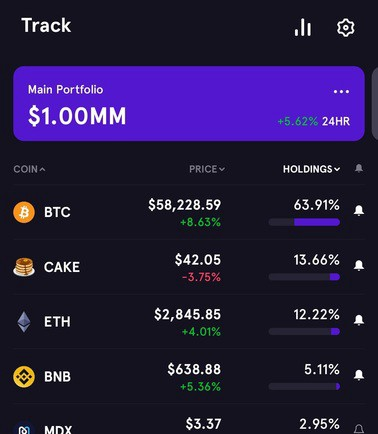

His portfolio recently hit the $1 million mark.

He wrote:

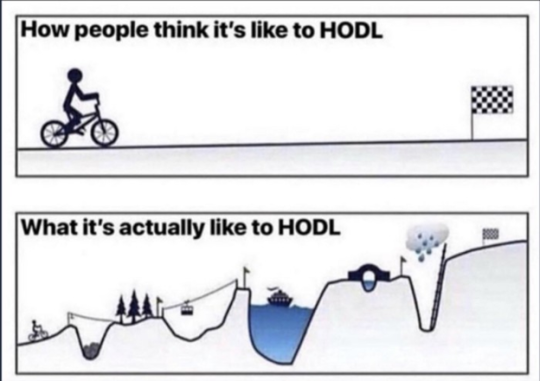

“The reason most people who invest in crypto don’t end up rich is that they can’t hold — or, in the crypto parlance HODL. HODLing is much harder than it sounds.”

Michal offers these three pieces of advice:

- Patience and calm. I watched my holdings dip 75% almost right after I bought them. I held. Then I watched them dip 85% again in 2018. I held. And I bought more. I’m not even counting all the other 20–40% dips in-between.

- Timing is king. Yes, I was lucky that I heard about bitcoin in 2014. But it was my decision to seize the day and not wait a couple of years to see if the technology proves itself. Then again, in 2019, when the price was low, I topped up. It was the right time to do so, even though the returns were far from immediate.

- Less is often more. I know many people who at some point became active traders in crypto. All of them either lost money or made several times smaller gains than they would have if they just held BTC, as I did. The first rule of trading is — don’t lose money. Don’t trade the market if you lack the experience... or the patience to wait for the right opportunities.

Again, if you’re interested in crypto in general, dipping your toes in all it has to offer isn’t a bad idea. Being well-rounded can only help.

But, in the end, those who play to their strengths win out.

Until tomorrow,

Chris Campbell

Managing editor, Laissez Faire Today