David Sacks, the Crypto Czar

Posted December 13, 2024

Chris Campbell

Crypto’s recent price surge is signaling a lot of things.

One thing we haven’t seen in a while: optimism.

If you were a crypto founder in the US of A, the past four years has been a minefield of legal threats and regulatory whiplash.

The SEC and CFTC have kept crypto founders guessing. Is your token a security? A commodity? Both? Neither?

Nobody knew anything.

Banking access was a nightmare.

Several crypto-friendly banks collapsed or pulled back from the sector, and founders struggled to find financial institutions willing to handle their business.

The collapses of Silvergate, Signature, and the fallout from Silicon Valley Bank left a gaping hole for crypto on-ramps.

Many founders were debanked completely, cut off from the US financial system.

Sam Bankman-Fried’s trial and the implosion of FTX cast a long shadow over the industry. Trust eroded, and regulators doubled down on their scrutiny.

Many also had to fight the stigma that their project might be "the next FTX."

Meanwhile, while the U.S. hesitated, other countries rolled out red carpets.

Dubai, Singapore, and Hong Kong opened their doors with crypto-friendly policies, creating a brain drain as founders relocated to jurisdictions with clearer regulations and better incentives.

Now? Markets are betting that the US will finally flip the tables.

Why does that matter? Because when the US moves, the world pays attention. And in crypto, what starts in Washington often ripples across the globe.

So…

Let’s talk about the billionaire elephant in the room.

The David Sacks Effect

David Sacks—the new AI and crypto czar—has a significant role to play.

(Alongside Paul Atkins, who was nominated as SEC chair. More on him, though, next week.)

Although some critics are skeptical about Sacks, and they’re not entirely wrong (I was personally hoping for Chris Giancarlo, former CFTC chair)…

Sacks’ experience—his insider understanding of tech, finance, and regulation—is a net-positive for the space.

With Sacks behind the wheel, the US won’t just draft a set of rules. The US will create the playbook for global crypto (and AI) regulation.

And when this happens, it could trigger a cascade of:

- Institutional Investment: Big money likes rules. Clear regulations will unlock institutional dollars that have been sitting on the sidelines.

- Clarity for Companies: Startups and exchanges can stop guessing what’s legal and start building. Many of them will flood back into the US.

- Consumer Protection: With guardrails in place, the average user will feel safer diving into crypto.

Again, the impact won’t stop at US borders.

The Global Ripple Effect

As the largest economy in the world, US policy sets the tone for everyone else. This means countries and companies worldwide are watching closely.

- European Crypto Startups: They’ll look to align with US standards to attract American investors.

- Global Exchanges: Regulatory clarity in the US will embolden global platforms like Binance to expand their offerings into the US.

- Asian Tech Giants: Companies in Asia, already ahead in blockchain innovation, will find new opportunities in the US market.

But let’s not sugarcoat it.

Success in this environment will depend on being prepared.

What You Should Do Now

Here’s what I’m doing:

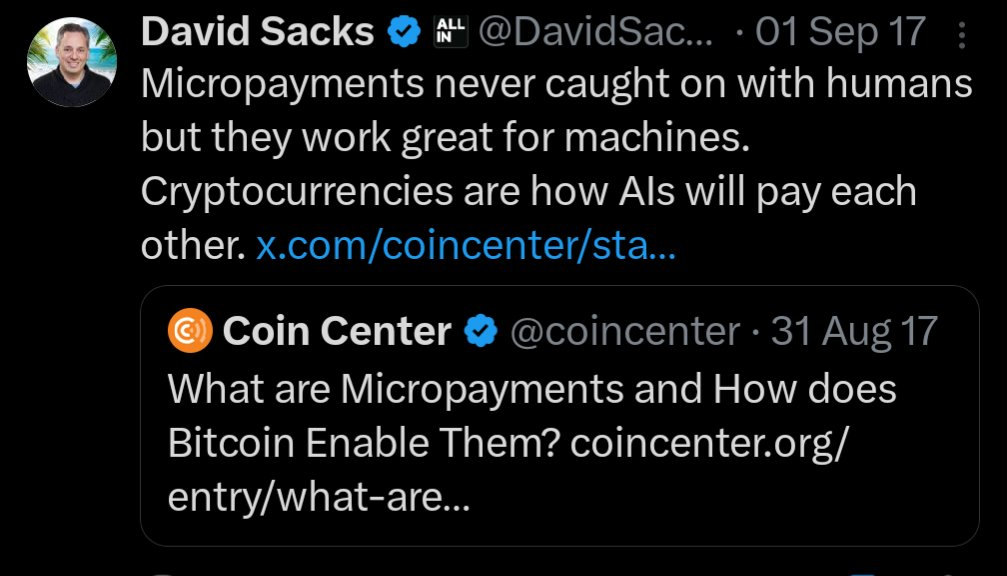

- Watching Sacks and Atkins Like a Hawk: I’m doing everything I can to get inside his mind right now. His policy moves will shape the industry. Here’s something from 2017 to chew on. Turns out, Sacks was WAY ahead of the curve here:

- Positioning for Regulatory Clarity: Adapt now to avoid scrambling later.

- Exploring US Expansion: The world’s biggest crypto market is about to get more accessible.

In short, we’re standing at the edge of a seismic shift.

The next few years will define not just the future of crypto, but the future of technology itself.

And it all starts now.

Stay tuned for more on what this means moving forward.