Follow Up: AMD Says Buy NVDA

Posted October 24, 2024

Davis Wilson

For some reason, people think AMD is the better investment over Nvidia.

For the life of me I can’t understand why.

On Tuesday, I told you about a conversation I had over the weekend.

“I’m going to buy AMD instead. They’re the next Nvidia.”

My eyes immediately rolled back in my head…

In my Tuesday alert, I focused on the products that each company produces to make my point why Nvidia is the better investment.

Today, let’s talk about the stock fundamentals.

[Note: Whether you’re looking to invest in the chip space or not, I believe the investing lesson that I’m about to share is important for any stock picker.]

First and foremost, it’s important to know that stock prices are forward looking, meaning they reflect investors' expectations about a company’s future performance rather than just its current or past results.

This is especially important right now during earnings season.

While many investors focus on whether or not a company “beats” earnings expectations, what really matters is a company’s guidance for future growth.

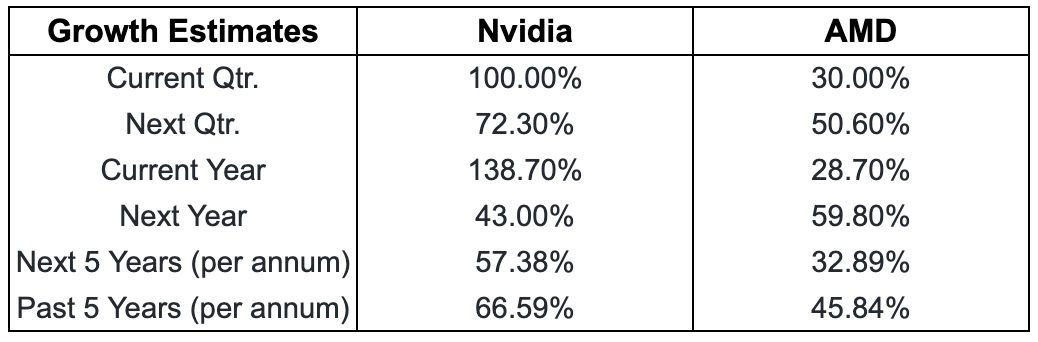

Here’s a few important growth estimates for Nvidia and AMD going forward:

These numbers are straight from Yahoo! Finance, available for anyone to see.

You can clearly see that Nvidia’s future growth expectations are significantly higher than AMD’s.

Most importantly, Nvidia’s “Next 5 Years” growth expectations outpace AMD by 25% annually!

Now let’s go one level deeper…

Price-earnings ratios (P/E ratio) tell investors how much they are paying for each dollar a company earns.

The higher the P/E ratio, the more expensive the stock.

Currently, AMD trades at 184x while Nvidia trades at a 65x P/E ratio.

Stocks within the same industry typically trade at higher P/E ratios when they’ve got higher growth expectations, higher profitability, or a unique competitive advantage.

AMD is trading at triple the P/E ratio with lower growth projections, lower profitability, and (if you remember from Tuesday) an inferior product!

Can you see why I’m tired of hearing “I’m going to buy AMD instead. They’re the next Nvidia”?

I equate P/E ratio to the “cost per ounce” metric you see on packaged foods in the grocery store.

Buying AMD is like going to the grocery store and spending more money per ounce for an inferior product. It doesn’t make sense!

Performing simple analyses like this has made me a much better stock picker.

Starting next week, I’m going to be putting my skills to the test when I start investing $100,000 of my own money in plain sight for you to see.

My goal is to turn it into $1 million through stock and options strategies.

And the best part… As an Altucher Investment Network member you’ll get every step of the journey delivered straight to your inbox.

I hope you're as excited as I am to share it with you.

This is sure to be a wild ride.

And it all starts on Monday.

Talk to you soon.