Fred Gets Lucky (Gamestop)

Posted May 15, 2024

Chris Campbell

Meet Fred, a pretty normal fireman in Arkansas.

Fred is new to the stock market.

He buys a stock at a certain price. He’s hoping the value will go up so he can sell that stock for more money and make a profit.

Fred has now joined the ranks of the speculator.

And the more Fred learns about this new phase of his life, the more excited he becomes.

For example, Fred learns you’re allowed to do all kinds of stuff with stocks.

You can borrow shares, sell them, buy them back at a lower price, and return them. (Short selling.)

You can borrow funds from brokers to buy more stocks, using your existing shares as collateral. (Leverage.)

You can borrow shares to hedge against other positions you hold, reducing your overall risk. (Hedging.)

You can even lend your shares to other investors in exchange for a fee, generating income. (Share lending.)

Fred is fascinated.

But then, one night, Fred slips down a rabbit hole. Right down into the underbelly of finance.

He learns that Wall Street can do things he’s not allowed to do.

Fred is Horrified

Fred learns about “Dark Pools,” or private exchanges where large investors trade stocks without publicly revealing their orders.

He discovers that this lack of transparency can lead to conflicts of interest and market manipulation. He finds that guys like him -- retail investors -- are at a he-yuge disadvantage.

Fred reads somewhere that the Big Boys use high-frequency trading algorithms to create unfair advantages, allowing institutions to profit from tiny price differences before other investors can react.

Fred learns that institutions pressure analysts to release favorable or unfavorable reports on a company to influence its stock price. Enron, he discovered, was probably just the tip of the iceberg.

Fred learns that institutions can even sell shares without first borrowing them or ensuring they can be borrowed.

This practice, called “naked short selling,” can lead to market manipulation and artificial price drops, harming investors.

Then one day, Fred finds a subreddit called r/WallStreetBets, where a community of retail investors like himself discuss these things.

Fred is Pissed

It’s on WallStreetBets where Fred learns that GameStop, a struggling brick-and-mortar video game retailer, has over 100% of its shares sold short.

Hedge funds are betting big on GameStop's failure.

BUT

If the stock price rises, short sellers will be forced to buy back the shares they borrowed at higher prices, driving the price even higher.

Fred loves the idea of sticking it to the fat cats.

Fred buys shares of GameStop, not only hoping to profit but also to send a message to the hedge funds.

Fred is Euphoric

As the days go by, Fred watches in astonishment as GameStop’s stock price starts to climb.

What began as a small movement on Reddit turns into a massive rally, with the stock price soaring from around $20 to over $400 at its peak.

Media outlets pick up the story, and GameStop becomes the talk of the financial world.

Fred feels a sense of camaraderie and excitement as he participates in this historic event. He’s not just a speculator anymore; he’s part of a movement.

Fred goes all-in.

Get rich or go broke.

Fred Goes Broke

Fred is a cautionary tale for those who get swept up in the meme stock frenzy.

Sure, people make money. But a lot of people don’t.

And it’s happening again.

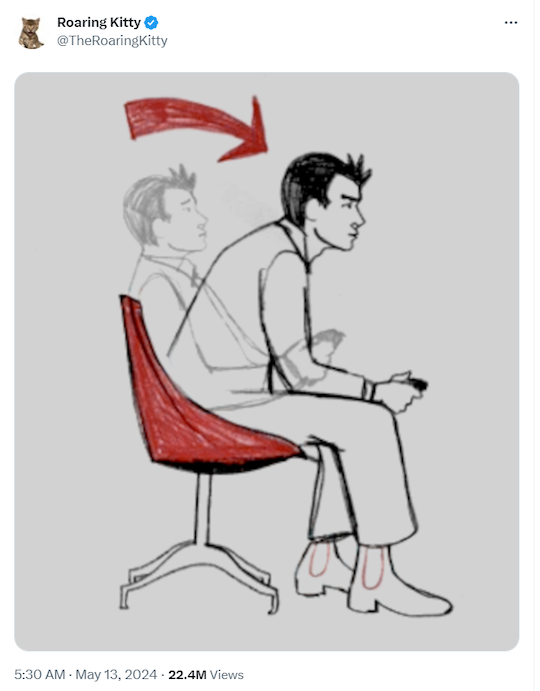

Two days ago, Roaring Kitty -- the guy who started the last GME run-up -- posted a picture that caused Gamestop’s stock to surge.

Short sellers are down bad. Naked and afraid.

Many buyers of GME see this -- once again -- as a “David vs. Goliath” situation…

“Don’t give up your chance to destroy a hedge fund,” says one famous influencer. “Keep buying the stock! Refuse to sell!”

I love the energy, I really do, but…

Don’t Be Like Fred

Take it from Paradigm’s in-house trading maven, Greg Guenthner:

“One of the main mistakes I see when I venture onto the message boards is inexperienced traders putting way too much money into a single play – almost as a “get rich or go broke trying” strategy.”

But, says Greg, “when you’re dealing with these extreme stock moves, you don’t have to risk a ton of capital to get involved and put up some impressive gains. Why bet the farm on what amounts to a spin of the roulette wheel?”

In short: “Don’t get sucked into the hype. These are not long-term investments. Don’t sweat perfect entries. Take what you can get with tiny positions.”

In other words…

Don’t be like Fred.

Fred got lucky. He picked up a winning lottery ticket. And then he let it slip through his fingers.

If you want to learn how to seize the opportunities and keep them…

For a limited time, Greg is showing any would-be meme trader how to keep from being like Fred.

And instead, create their own luck in the markets -- despite Wall Street.