Grab a Napkin

Posted May 17, 2022

Chris Campbell

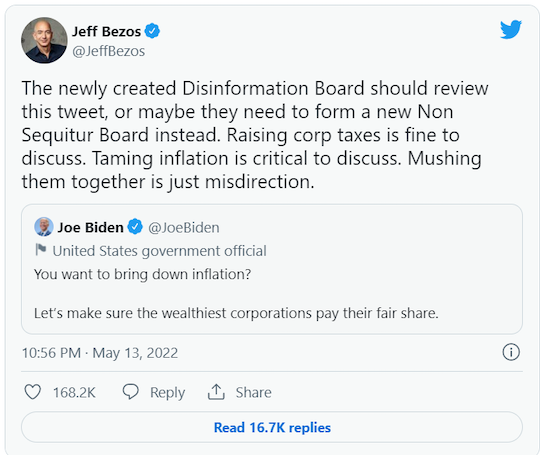

The Twitter wars are on.

In case you’re not caught up…

Biden (or whoever runs his account) recently tweeted that higher and “fairer” taxes on the “wealthiest corporations” is one way to bring down inflation.

Bezos went on the offensive, saying the tweet was a “non-sequitur,” accusing the Biden administration of “mushing” two unrelated issues. Furthermore, he accused the Biden admin of “misdirection” away from their inflation-inducing stimulus policies.

Biden’s account shot back, saying that “reducing the deficit is one of the main ways we can ease inflationary pressures.”

To be sure, the Biden administration is simply following conventional wisdom of mainstream economics: Raising taxes to lower the budget deficit reduces the need for the Fed to step in and cover the deficit with new money.

Even so, it’s not as clear-cut as it seems.

Grab a Napkin

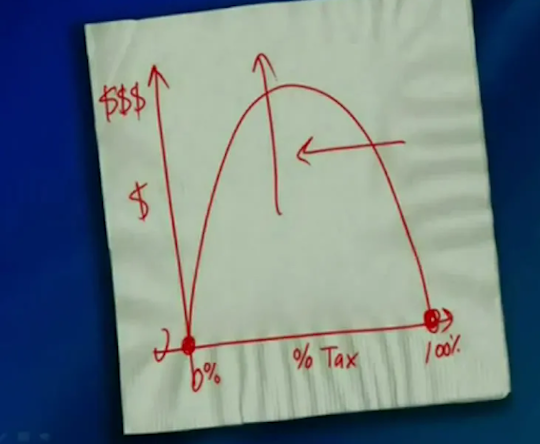

In 1974, Arthur Laffer pulled out a napkin and drew this picture:

Today, we know it as the Laffer Curve.

The curve is meant to show that, after a point, when you tax something more, you tend to get less of that thing.

“The consequences,” he said, pushing the napkin away, “are obvious!”

The Laffer Curve is also used to show that, in many cases, reducing tax rates can actually increase tax revenue.

Thus, it’s not always as simple as “raise taxes, save the world!”

Economics is full of counterintuitive — but simple — concepts like the Laffer Curve.

With all the fuss around inflation, David Sukoff of FEE.org suggests it’s time to take the “napkin approach” to outline another simple truth:

Bezos is right. Printing money — especially during an economic lockdown — causes inflation. Not only that, it creates distortions in the markets that, inevitably, go bust.

The Fed’s New Master Plan

These days, of course, the Fed has been forced to change course. The Fed made it clear it wants to see inflation substantially lower before it relents on its tightening campaign.

According to Jim Rickards, that means the path of least resistance for the stock market is lower — and the bubbles will go bust.

Fortunately, Jim keeps it simple. He also takes the “napkin approach” to explaining these problems.

And he doesn’t just talk about the problem: he also offers a few solutions.

Chris Campbell

For Altucher Confidential