Inflation for Dummies: Everything you need to know

Posted March 18, 2022

Chris Campbell

Chris here. Today, James and I are sending out important reports to Altucher Investment Network and Early Stage Crypto Investor subscribers. If you’re a subscriber, keep your eyes peeled. Today, for our ALC subscribers, James is going to run through everything you need to know about inflation… what it means… and what to expect in the coming months. Read on.

Inflation for Dummies: Everything you need to know

James Altucher

Everyone is wondering if we are going through inflation.

But there is no one "inflation" and there are many causes of inflation.

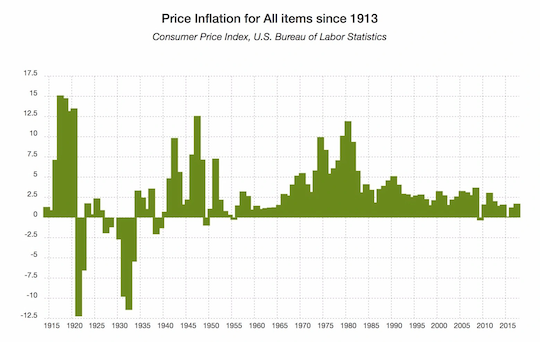

The image below is inflation per year over the past century and I refer to this image later.

First off, a basic, but rough, definition: inflation is when prices rise relative to the currency of the country you are in. So when a Mcdonalds hamburger costs $2 one month and $3 dollar the next month, the price has inflated, but only relative to US dollars. For all we know, the Mcdonalds hamburger did not inflate at all if valued in some other currency.

There are several causes of inflation but ALL of the causes boil down to one thing: price is a function of supply and demand.

If there is high supply and low demand then deflation (as happened in the US only twice: in 1932 during the Great Depression and in 2009 during the Great Recession).

If low supply and high demand, then inflation. But there are several types of supply and demand. What I will call "normal" inflation, "monetary" inflation, and "transitory" inflation.

Right now we are experiencing all three.

Many people think the price of a McDonald's hamburger is a more accurate measure of inflation than the government reported number.

Monetary Inflation

If a country "prints" a lot of money then there is a high supply of money, and demand for money remains more or less the same.

The result? The price goes down. What does it mean when the price of the dollar goes down? It means you have to spend MORE dollars to buy things. This is monetary inflation.

Important historical example of monetary inflation:

The US left the gold standard in 1972 in order to stop the dollar from being pegged to the price of gold.

They needed to do this to pay for the debt the US incurred with both the Vietnam programs and "The Great Society" programs of LBJ.

Note in the chart above how inflation spiked in the 70s after that because that's when we started printing a ton of money to pay our debts.

Is Monetary Inflation Bad?

Not necessarily. A couple of points;

Note the times when there is DEFLATION: During the Great Depression and the Great Recession.

This is because people stopped spending because they were assuming prices would go even lower. And because prices go lower, people say, "Hmm, maybe it will go lower if I wait even more!" and the cycle repeats, leading to a Depression or big Recession.

Monetary inflation makes people feel flush even if they are not. The stock market often goes up during monetary inflation (since stocks will seem cheap relative to dollars) so the nation's wealth appears to increase temporarily.

Note that 120 years ago, 3 cents is the equivalent of a dollar today when taking into account inflation. Is this bad? The past 120 years has seen booms in every area of every economy and industry. From space travel to computers, biotech, the Internet, healthcare, etc. So not so bad for people to feel flush.

Why did the US think they could get away with printing so much money in 2020. 40% of ALL OF THE MONEY PRINTED IN HISTORY was printed in just 2020.

Well, when I spoke with a high up official at the Federal Reserve on my podcast he mentioned to me that the demand for the dollar from other countries was so great that they were not really worried about monetary inflation.

Whether the Fed is right or wrong on this remains to be seen. Everyone has an opinion but nobody knows.

One good aspect (for the US) about monetary inflation is this:

If you borrow a trillion dollars a year, then cause monetary inflation by printing a lot of money, you get to pay back your debt later with a weaker dollar. In other words, the dollar you pay back with is not worth as much as the dollar you borrowed.

Normal Inflation

Normal inflation is when the economy is growing and doing well. Again, people feel flush, so they spent a bit more money and so demand moves up faster than supply and supplies have to catch up. Before they catch up, prices are more expensive.

Example: During the Internet boom of the 90s an entirely new industry was booming and millions of jobs created. People were doing well so inflation went up. The Federal Reserve began raising interest rates (perhaps incorrectly) in 1999 and this caused the brief recession of 2000-2001 when the Internet stocks collapsed.

Transitory Inflation

This is when an unusual event happens that disrupts the normal supply chain. If the supply chain is disrupted then even if demand remains the same, supply goes down, so prices go up.

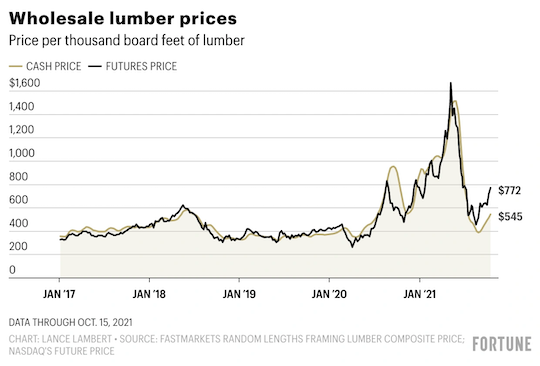

Example today: During the economic lockdowns of 2020, nobody was cutting down trees. That industry temporarily shut down. Nobody was building houses.

In 2021, everyone who had been putting off buying a house now wanted to buy a house, particularly since with remote work, more people are moving and working at home. So they want to buy a home.

Well, there's no lumber because nobody had been cutting down trees for 1 year. So the price of lumber shot up. Here's the chart of the price of lumber. Note that it has now come down as the disruption to the supply chain of lumber has calmed down a bit.

Another example: Because Chinese factories shut down for months, as well as the ports in LA, there's a backlog of ships from China waiting to deliver supplies. Turns out China made EVERYTHING we use: from pharmaceutical drugs, to iphones, to clothes, to processed foods.

Add in the geopolitical tensions with China and we have what is hopefully just a temporary supply chain disruption but often something temporary turns into something more permanent when it becomes a habit.

The Federal Reserve assumed that the current inflation was transitory but now they are not sure, hence they are raising rates.

Two inflations are very bad: Stagflation and Hyperinflation. Note also, as mentioned above, Deflation is very bad even though prices are going lower.

Stagflation

Stagflation occurs when the economy is not doing well for various reasons AND prices are going up because of supply chain disruptions.

It's a combination of recession and transitory inflation.

Example: In the 1970s, the US had hit peak oil (temporarily) and was reliant on the Saudis for oil.

But we were also having geopolitical conflicts with all of the oil producing countries because for various reasons.

Because of the recession, people had less money, but prices were also going up because the price of oil was going up.

Less money but higher prices = stagflation = a bad time for everyone.

Hyperinflation

Hyperinflation is when inflation becomes exponential. This has never happened in the US but has happened notably in Zimbabwe, Germany in the 20s, and will certainly happy in Russia now.

Nobody knows the exact cause of hyperinflation but it's usually a function of war mixed with borrowing debt in another country's currency.

When Argentina borrowed dollars in the 80s, they had to pay back in dollars. But they didn't have the dollars, so they rapidly printed pesos in order to get the dollars to pay down their debts.

The rapid printing of pesos (monetary inflation) scared the population who started withdrawing money from banks to get their pesos out of the country. The country banned that, creating a panic that the peso was collapsing which triggered the peso to collapse, making hyperinflation.

Hyperinflation is the worst. You work your whole life saving up money and in a week or two it becomes worth zero.

The hedge against hyperinflation is buying hard assets like land ("The thing about land is they don't make it anymore" - Mark Twain) and perhaps stocks and perhaps (I would suggest) crypto.

Summary and What I am Doing

Summary: there's inflation now, but:

- some of it is transitory but hopefully it does not become permanent (e.g. lumber)

- some of it is monetary but there is also great demand for the dollar at the moment. So as long as we reduce the money printing before demand weakens, the monetary inflation should be ok.

- we are far from any hyperinflation scenario - the fears about war will also reduce any overheating of the economy, stemming inflation.

- Stagflation could be a worry if the supply chain disruptions don't go away.

What I am doing now to hedge against this: buy stocks of good, growing companies (don't' be too speculative though. Make sure they are good companies). Buy hard assets like land. And I am also bullish on cryptocurrencies in general.

Until next time,

James Altucher

For Altucher Confidential