James: “Forget the Recession”

Posted June 04, 2024

Chris Campbell

In 1991, a reporter asked Sam Walton what he thought about the recession.

“I’ve thought about it,” he said, “but I’ve chosen not to participate in it.”

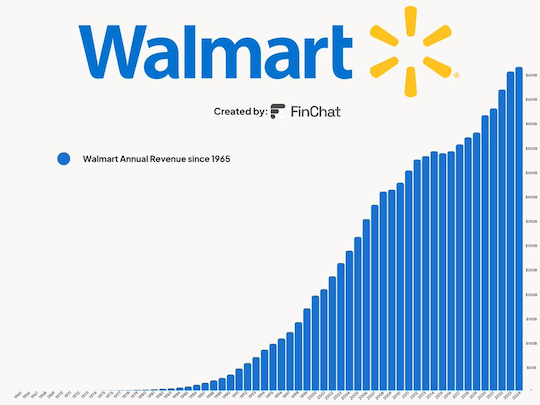

Caption: "Weeeeeee!"

Caption: "Weeeeeee!"

Even when things get tough, there's always somebody out there who's making moves.

(BTW, Walton’s autobiography is a masterclass.)

Doesn't matter if it's a pandemic or a recession, there's always people who find a way to come out on top.

Best part? Every day is an opportunity to be one of them.

Along that vein…

In a recently “leaked” phone call, James shares his contrarian take on the current economic climate with Doug Hill, our VP of Publishing.

Today, I’m sharing the “best hits.”

(With their permission, of course.)

The larger discussion has to do with a unique AI investment opportunity Team Altucher recently uncovered…

And the 800-pound gorilla behind the wheel.

Much more on that in a moment.

First…

The Big Picture

While economists fret about interest rates and recessions, James urges investors to instead focus on the unprecedented wave of innovation poised to reshape our world.

"You have all the economists worried about interest rates and recessions. But I don't think we should be thinking about that at all," said James.

“On the one hand, everyone's scared about politics, wars, the economy, and I get that. But on the other hand, there's so much excitement about the innovation happening in society that it's world changing. What's going on now is inning zero of a world where we won't even recognize it at the end.”

That’s why, says James, "We're looking at companies that are going to change the world, not ones that are going to be strictly correlated to interest rates or inflation or the dollar."

Take, for example, the rapid rise of computing, healthcare, AI, crypto, and robotics.

"These things are all converging for the first time -- those are the companies and the investments we should be looking at. Innovation is happening so fast, faster than ever before in history."

While the short-term direction of the markets remains uncertain, "at the end of the year, there are going to be surprises and innovation and things that amaze us. Nothing's going to stop innovation in the private sector."

Google's AlphaFold is a prime example -- by mapping out the structure of proteins at an unprecedented scale, this AI system could accelerate the development of life-saving drugs by "a thousand or even a million times."

Other key areas to watch: AI-powered personal assistants, cybersecurity, crypto and decentralized infrastructure, autonomous driving, and robotics.

But, this week, nothing beats the:

The 800-Pound Gorilla

Apple, says James, is the 800-pound gorilla that everyone can’t help but side-eye right now.

The tech giant’s been uncharacteristically quiet about its AI ambitions, even as rivals like Google and Microsoft have rushed to showcase their products.

Behind the scenes, however, Apple has been on an acquisition spree, snapping up more AI-related companies than any of its peers.

"What Apple is planning is going to be big,” says James. “It's not going to be small. It's going to be Apple size.”

Now, here’s where it gets juicy…

In just a few days, Tim Cook will take center stage and make a huge announcement.

And potentially unlock a quick 10X opportunity.

This Thursday, James is going live to talk all about it. (Don’t worry. We’ll make sure you don’t miss it.)

The gist:

With an arsenal of cutting-edge patents and a potential hush-hush partnership with Apple…

One under-the-radar AI company is poised to explode when Cook takes the stage -- and YOU could be among the few who ride this tidal wave.

Of course, geopolitical risks like the upcoming election and ongoing global conflicts can't be ignored entirely.

But for forward-thinking investors, the message is clear -- refuse to participate in the recession mentality, and focus on the innovators who are busy building the future, regardless of the short-term economic noise.

In other words, take a page from Walton’s book:

You can acknowledge the recession, but you don't have to let it stop you. Visionary companies certainly aren't.

More tomorrow.