My #1 Risk to Stocks (Includes Tesla)

Posted December 11, 2024

Davis Wilson

Davis is on a mission to turn $100,000 into $1 million. Follow along with his journey and get the opportunity to follow along in your own portfolio for free by clicking here.

How much should you pay for Tesla (TSLA) stock today?

The answer depends on one important factor – time horizon.

- If you’re a long-term investor, the smart price to pay can be determined by discounting cash flows in Microsoft Excel. (Easier said than done)

- If you’re looking to cash out in one year, pay attention to Tesla’s product sales cycles and do your best to predict if we’ll have a bear market within the year.

- If you’re a day trader, the answer is who cares what price you pay! You’re just trying to make a few dollars before dinner, and that can be done at any price.

It’s important to know that every investor has different goals and time horizons. And all three of these investor types operate daily in the stock market.

So whereas Tesla’s current $400 stock price may look ridiculously expensive to one investor, a different investor may be willing to buy at these prices.

What I want to warn you about is when too many investors rush to bullet #3 – the day trader investor type.

We saw this with Cisco Systems (CSCO) in 2000.

Cisco was the poster child of the dot-com bubble.

The stock began the year 1999 trading around $20. Within 14 months the stock was $80.

In hindsight, it’s easy to see how absurd the company’s valuation was.

Cisco was trading at a 200X price/earnings ratio and a 40X price/sales ratio.

Yet people continued to buy the stock at higher and higher prices.

The reason was that many investors were characterized as day traders at the time (Bullet #3).

Day traders printed money for years in the late-1990’s.

These traders didn’t care about fundamentals, P/E ratios, growth prospects, etc. All they cared about was whether they could accomplish their goal of making a few dollars before dinner – regardless of price.

This is how the bubble began – when the makeup of investors shifted more in favor of short-term traders vs. long-term investors.

These short-term traders took control of stock prices, and the process then began to feed on itself as traders pushed up short-term returns which tempted more traders to pile on.

As we know this didn’t last.

Eventually the bubble burst, wiping out over $6 trillion of household wealth.

I mention this because today, once again there seems to be a subset of companies whose stock prices are controlled by short-term traders.

You know the names – MicroStrategy, SoundHound AI, Robinhood, and I’m even throwing Tesla into this category.

Regardless of price, these stocks continue to get bought.

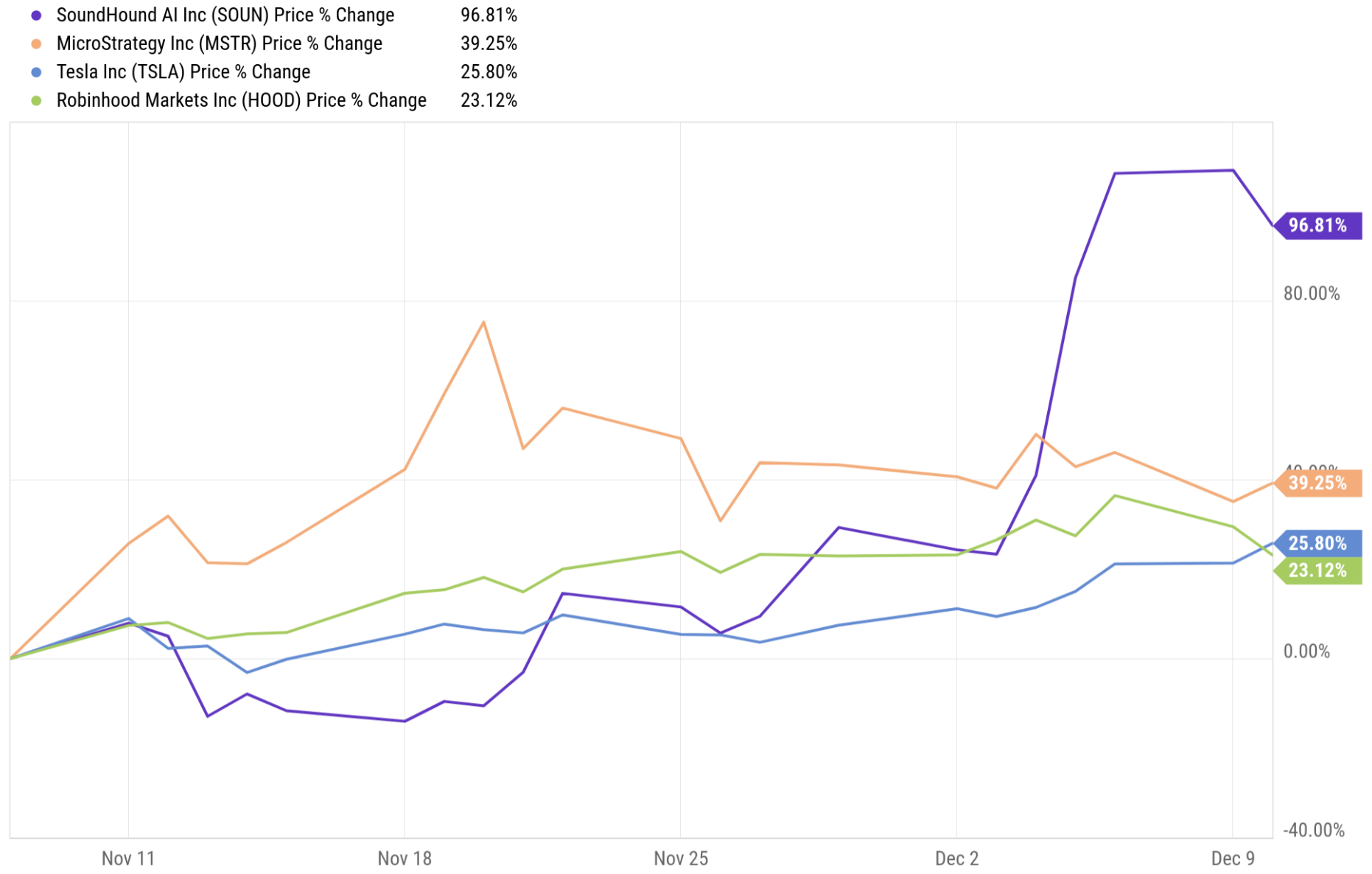

Check out their respective returns in the last month.

SoundHound AI has doubled in one month.

MicroStrategy is up nearly 40% while Bitcoin is up only 26% over the same period.

Tesla and Robinhood are moving higher because of hype and because of Elon Musk’s newfound friendship with Donald Trump – which is apparently worth an additional $400B in market cap in one month…

These are not fundamentally-driven moves.

These prices are rising because short-term traders (Bullet #3) are controlling prices.

We’ve seen this playbook before.

I’m not calling the top yet. But I believe this is the biggest risk to our stock market.

Stay tuned to The Million Mission as I follow this trend closely.