![🔴🟡🟠🔵 Netflix. Amazon. Bitcoin. [Blue.]](http://images.ctfassets.net/vha3zb1lo47k/55qehGOiE7d3dpG22mVCwz/3bc50922f7e0e94ab5a8ec2f7413d7eb/alc-07-09-25-featured.png)

🔴🟡🟠🔵 Netflix. Amazon. Bitcoin. [Blue.]

Posted July 09, 2025

Chris Campbell

Back in the early 2000s, Netflix mailed DVDs to subscribers.

It wasn’t sexy—but it was smart. No late fees. No driving to Blockbuster.

People subscribed because they were lazy. Investors bought the stock because they realized everyone else is lazy too.

Those who saw the future in that red envelope? They could’ve caught a 10,000%+ move.

Another story…

Back in the mid-2000s, Amazon launched Prime.

It wasn’t flashy—but it was fast.

Free two-day shipping. No minimums. No hassle.

People subscribed because they were impatient. Investors bought the stock because they realized everyone hates waiting.

Those who saw the future in that speedy little yellow button? They could’ve caught another 10,000%+ move.

Finally…

Back in 2011, Bitcoin was trading under $10.

It wasn’t regulated—but it worked.

No bank. No middleman. Just wallet to wallet.

People used it to send money. Investors bought it because they saw the potential.

Those who saw something glimmering in that strange orange coin? They could’ve caught a 100,000%+ move.

The people who made those calls weren’t fortune tellers. They just noticed something simple before others did.

A better way. A quiet shift. A small edge. An asymmetric bet.

The red envelope fixed late fees. The yellow button fixed waiting. The orange coin gave billions a choice.

Of course, these types of gains are rare. And they happen only once in a blue moon. That’s exactly why it’s important to notice when the conditions start to look familiar.

Not after the move. Not once it's on CNBC. But in the quiet build-up— before the surface breaks.

Enter the Blue Button

In 2025, it’s not necessarily about streaming, shipping, or currency.

It’s about signals in the noise. Because the noise is louder than ever. Headlines, hype cycles, hot takes—a never-ending torrent begging for your attention.

Most investors have their way of trying to beat the noise. Some go by instinct—trusting their gut, scanning headlines, reacting to whatever’s trending.

It works occasionally, but it’s inconsistent at best.

Others dive deep into technical analysis, stacking indicators, drawing patterns, trying to predict human behavior through lines on a chart.

For most, instead of sharpening the signal, it buries it. Every new layer adds complexity.

Then there are those who try to follow the smart money, watching institutional filings and attempting to reverse-engineer the moves of bigger players.

Problem is, by the time those signals are public, the opportunity’s mostly already passed.

All three are on the right track. Because they all know there’s always some signal beneath the surface…

A change in volume. An unusual cluster of trades. A pressure point forming just beneath the surface.

And the best investors catch those signals before anyone else. (By no coincidence, they also happen to have a floor of analysts and an army of algorithms.)

BUT…

What if you had a system that simply noticed what was already starting to move—before it broke the surface?

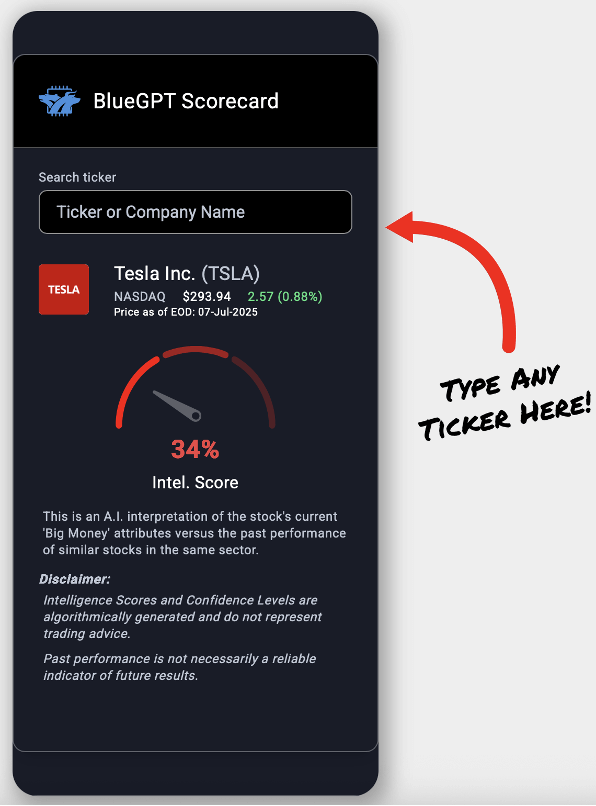

That’s the idea behind James’ new AI research software: BlueGPT. Officially called Deep Blue 2.0.

For now, you can try it for free before tomorrow morning. (Link below.)

It doesn’t chase headlines. It doesn’t rely on speculation. And it doesn’t wait for confirmation.

Instead, it tracks real market activity and distills it all into one simple number: the Intel Score.

Some are likely testing it because they’re curious. Some because they’re tired of guessing. Some because they’ve seen what happens when you notice something early—before the rest of the world catches on.

Until tomorrow, you can try it for free too.

Type in a ticker. See the score. But don’t do anything with the score… yet.

The Intel Score isn’t a buy or sell signal—it’s a reflection of hidden pressure, movement, and buildup before the move.

Tomorrow, James is walking through how the Intel Score works, what it sees, and how some of these quiet signals preceded huge gains—all before they hit the headlines.

It’s all happening July 10 (tomorrow) at 10AM.