No Time Machine? Try Microcaps

Posted August 02, 2024

Chris Campbell

“Cocaine in a can”.

That’s what people were calling it in 2000. Some with affection, others in disgust.

Either way, they were onto something.

Because early investors - those who got in when it was 4 cents - would go on to make Pablo Escobar money.

Yes, I’m talking about Monster Energy.

For perspective, a $10,000 investment at $0.04 per share would be worth over $13 million today.

Indeed, everyone wishes they had a time machine to travel back and buy the “ones that got away.” Alas, that technology is limited to Marty McFly and his suspiciously energetic scientist friend. (Hmm…)

But here’s the rub:

Although James isn’t hiding a DeLorean somewhere in Georgia (that I know of, at least)...

We do have the next best thing for you.

This week, James and team launched a brand new project focused on… you guessed it… microcaps.

Paradigm colleague and senior analyst of this new venture, Zach Scheidt, is joining us today to spill the beans on why microcaps are the talk of the town…

And why NOW is the time to jump on this rocket ship.

And because we love our ALC readers (yeah, you), Zach's got a VIP pass with your name on it. He's sharing an exclusive link to peek at the very first Microcap Millionaire call. (Fresh off the presses - just happened today.)

Check it out below.

Read on.

It’s official.

No change in interest rates this week.

That's the news from the Federal Reserve today — pretty much in line with expectations.

And yet, following Fed Chairman Jerome Powell's remarks, the market's smallest stocks began to trade sharply higher.

Here's a quick look at the intra-day chart for the actively traded iShares Russell 2000 ETF (IWM):

Why did microcap stocks surge higher?

Well, Powell made it clear that the Fed is watching the economic period closely and is very likely to cut interest rates at the Fed's next meeting on Sept. 18.

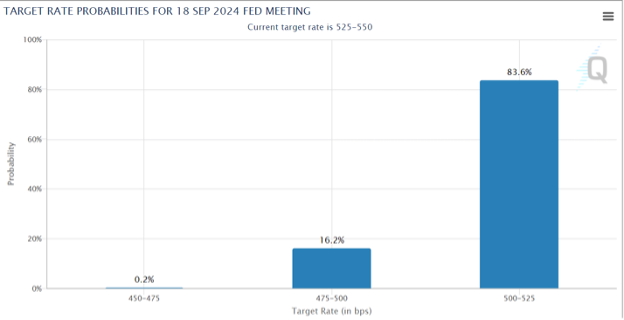

Here's a quick look at what investors are currently anticipating for the Fed's next regularly scheduled meeting…

Investors placed the odds of a quarter-point interest rate cut at 83.6% and pricing in a non-trivial chance of a half-point interest rate cut as an outside possibility.

Of course, Powell is still keeping all of his options on the table. He realizes that it wouldn't be wise to tip his hand well over a month before the Fed's next meeting.

But take a look at this quote from his press conference:

"The broad sense of the committee is that the economy is moving closer to the point at which it would be appropriate to reduce our policy rate."

It doesn't take a genius to figure out that Powell is paving the way for an interest rate cut in the very near future.

That's great news for our positions, as well as the microcap stocks we're watching for potential new positions.

Now that Jerome Powell and the Fed are laying the groundwork for lower interest rates, the market's smallest stocks are poised to go higher.

Here's a quick look at how our portfolio responded:

(Blurred out of respect for our paid MM2 members)

These specific stocks may continue higher, or they may pull back by the time the market closes.

But the key point to notice here is that microcap stocks reacted positively to the Fed meeting — just as we expected.

Now that we're in a new era with the Fed ready to cut interest rates, microcap stocks have been cleared for takeoff.

I'm very excited about the dozens of stocks in this key area of the market that we're watching.

If you’re a member - and even if you’re not - we held our first Microcap Millionaire call this week, where we discussed all of this in more detail.

Click here for the replay.