Recession? (Exotic Dancers vs. Economists)

Posted May 06, 2024

Chris Campbell

Introducing Dace, a lady of the evening from the Mustang Ranch in Nevada.

On TikTok, Dace recently shared that her earnings took quite a dip last year, dropping by a whopping 64%.

This, she believes, is a surefire indicator we're heading into a major economic downturn.

Dace might be onto something.

Some have taken note of this phenomenon, dubbing it the "stripper index."

The idea: When times get tough, people prioritize essentials over luxuries, and the world’s oldest profession feels the pinch early on.

It's anecdotal, but intriguing.

While the official numbers from economists are basically telling us not to worry…

Guys like Jeff Bezos, the CEO of JP Morgan, Zuckerberg, and even the Walton family have been selling off significant portions of their stock holdings.

And there’s other not-so-great news:

DEBT!

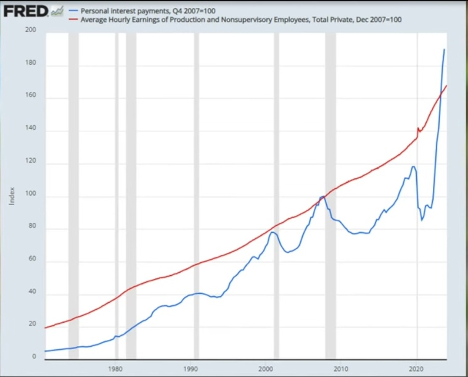

This chart shows personal interest payments rising sharply above wage growth for the first time since 2008.

It’s simple: inflation over the past 3 years caused costs to rise faster than incomes. High interest rates are making debt more expensive to service.

This benefits savers but is costly for those with large debts.

You’ve probably noticed:

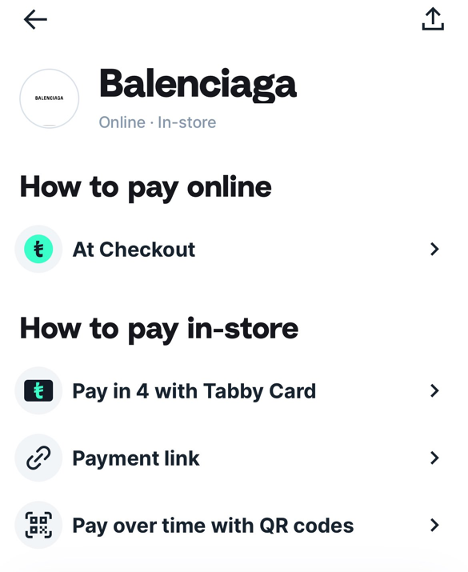

Buy Now Pay Later (BNPL) financing has become common even for small purchases.

If you’re buying Balenciaga at all, you’re a sucker. But if you’re buying Balenciaga using BNPL? Hopeless.

And although the rates go as high as 30%...

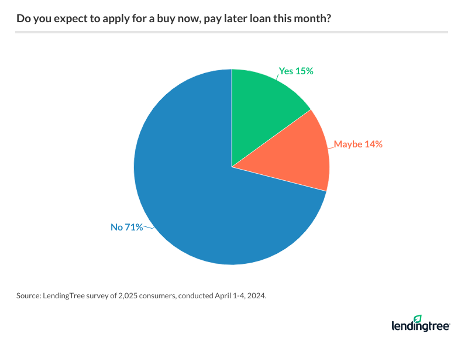

A survey from LendingTree found that almost 30% of Americans use BNPL or consider using it.

In fact, The Bank for International Settlements (BIS) published a report in December 2023 according to which BNPL activity increased more than sixfold from 2019 to 2023 globally.

No less…

Commercial real estate could be in trouble. Four Seasons hotel in San Francisco defaulted on a $72M loan.

More bank failures are expected…

Politicians on both sides have failed to address the growing national debt.

Making you anxious? Repeat after me:

“I Refuse to Participate”

Despite these worrying signs, there are still reasons for optimism.

Big tech may be slowing, but in areas like AI, crypto, cybersecurity, and more…

Innovation continues to plow forward.

Moreover…

There are ALWAYS people who make fortunes during big downturns.

Every economic crisis creates opportunity if you know where to look.

We have agency in how we respond.

That’s why…

While I trust Candy more than I do economists…

I’m still not worried.

Takeaway: Prepare for anything.

More on that tomorrow.