Six Bullish Things Before Breakfast (ETH)

Posted June 21, 2024

Chris Campbell

Let’s see…

[clears throat. checks notes]

→ SEC approves Ethereum spot ETFs

→ The SEC drops investigation into Ethereum 2.0, implying Ethereum is a commodity (orange grover owners are furious)

→ Bitwise drops two Ethereum ETF commercials, suggesting approval is around the corner (July 4 is the common sentiment)

→ Pantera expresses interest in buying a whipping (yes, a whipping) $100 million worth of Bitwise shares

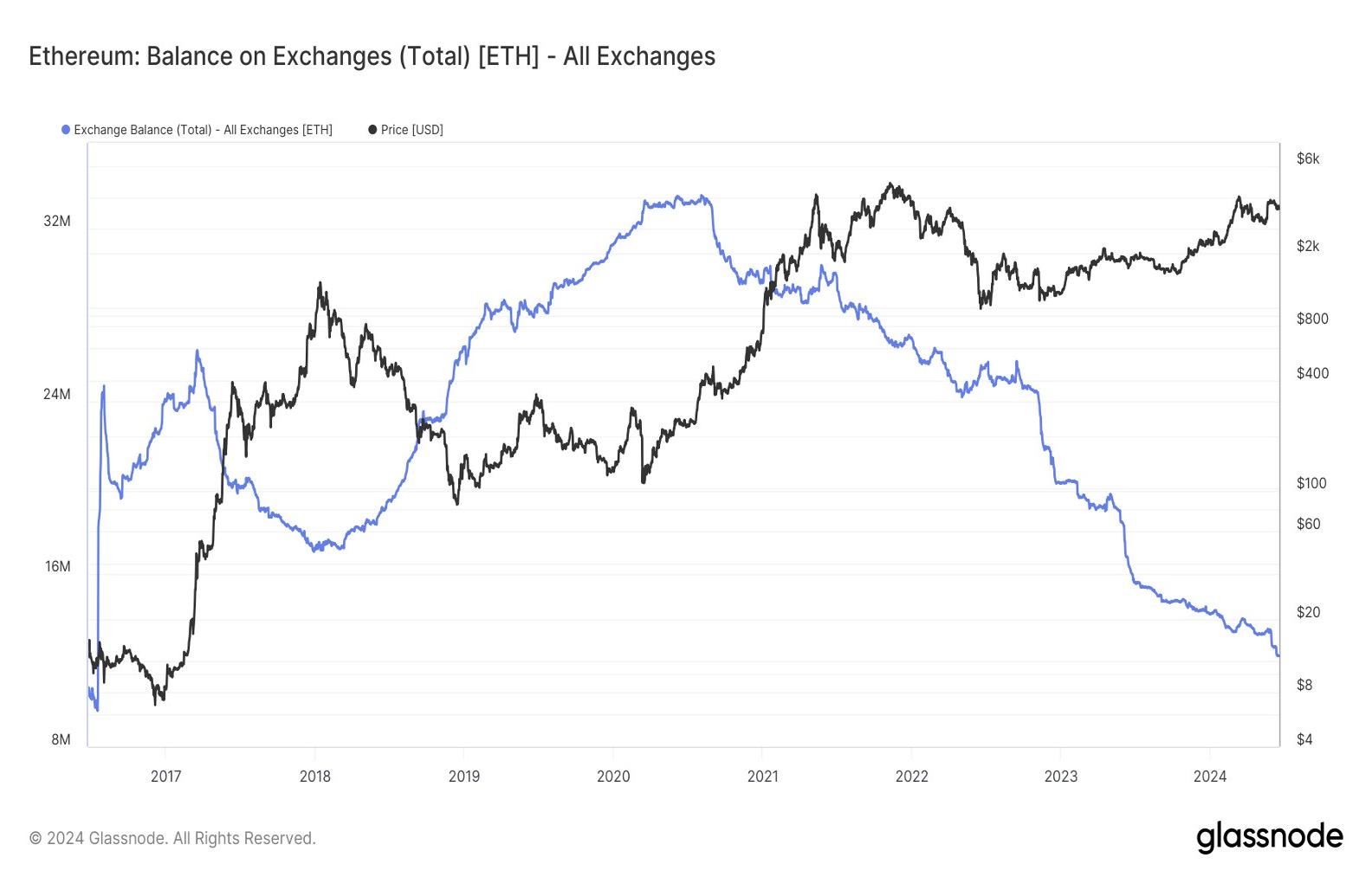

→ According to chain sleuth Glassnode, Ethereum balance on exchanges has hit an 8-year low, signaling ETH holders are becoming ‘irresponsibly long’

Does this mean crypto is going to skyrocket tomorrow? No.

BUT

It’s good news for those taking the slow and steady approach.

(Did you take your vitamin DCA today?)

The Most Bullish Thing About ETH

"The most bullish thing about ETH right now,” says Wall Street vet Sam Jernigan on a recent Bankless podcast, “is that TradFi thinks it's like Bitcoin. I think when they fully understand it, it's going to blow their brains out.”

Jernigan has spent the last 15 years trading on Wall Street. He also built and ran the crypto division at Moore Capital, one of the largest and oldest macro funds in the world.

"Ethereum is a crypto like Bitcoin, but it has some utility," is a common response he gets when asking TradFi folks about their knowledge of Ethereum.

But he thinks they’re not fully “grokking” its potential.

Ethereum, he says, has the potential to revolutionize the global financial system by providing a decentralized, permissionless settlement layer for financial transactions.

Ethereum can be thought of as a combination of SWIFT, the messaging system used by banks to communicate about the sending of dollars, and CHIPS, the system used for the settlement of those funds.

This combination of messaging and settlement on a single decentralized platform, says Jernigan, is a game-changer for the financial industry.

When asked about the addressable market for Ethereum compared to Bitcoin, Jernigan thinks it’s obvious: Ethereum's market opportunity is much larger.

Jernigan offered some simple advice for those looking to get exposure to Ethereum:

"ETH is like Apple. Own it, don't trade it."

Of course, James and I are bullish on ETH…

But we’ve identified a few cryptos we think will do WAY better in the coming bull.