Stocks Ruined My Italy Trip

Posted October 30, 2024

Chris Campbell

I’m bad at traveling.

I just spent the last two weeks in Italy. My father retired last year, and after years of hemming and hawing we finally decided to make the trip.

We couldn’t have picked a better time to travel. It was an unseasonably warm second half of October in my surname’s country.

The weather never touched about 70 degrees (Fahrenheit, since I’m still an American). The humidity was mild. And most of the time the skies were completely clear.

So what was the problem?

Well, it’s not that I dislike traveling.

It’s that I’m terrible at “unplugging” when I’m away.

That holds true even for “normal” periods in the U.S. stock market and political cycles.

But what I am seeing now is far from normal.

For a few weeks I’ve noticed an unusual pattern forming inside my favorite part of the stock market.

And it’s leading me to believe we’re about to see a potential rip-your-pants-off rally after Tuesday’s election.

The Isle of Capri's famous "Faraglioni” floating rock structure. Have you ever seen water this blue?

The Isle of Capri's famous "Faraglioni” floating rock structure. Have you ever seen water this blue?

Win or Lose – Doesn’t Matter

Depending on who you ask, the election is still too close to call.

That’s my feeling, anyway.

I won’t get into who I’m voting for or why.

Even though I have very strong feelings about it.

But for my purposes as an investor, I don’t think it really matters.

Institutionally, I think Wall Street sees Harris as more “business as usual.” And although Trump is disruptive – some of his policy proposals could be great for the stock market.

But personally – I think there’s a better than decent chance we’re about to see an absolutely insane stock market rally after the election no matter who wins.

And it’s all thanks to this pattern I mentioned before.

Let me show you.

About the only thing more beautiful I’ve ever seen than the crystal clear blue waters along the Amalfi Coast is this chart I’m about to show you.

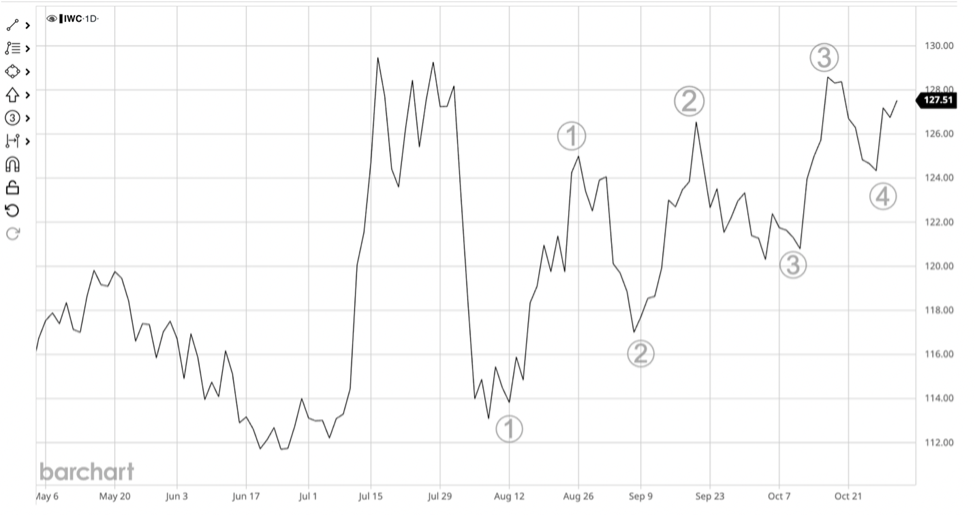

Below is a chart of the iShares Microcap ETF (IWC).

Most people who track small and micro-cap stocks prefer the Russell 2000 ETF “IWM.” I prefer this one because it actually went up more during the last microcap bull market cycle between 2020 and 2021.

If this chart makes instant sense to you, you probably get why I had a bit of a hard time focusing on my vacation in Italy. If it doesn’t make sense, I’ll quickly explain what I’m seeing.

You’ve inevitably heard some of us talking about how microcaps tend to outperform larger stocks in periods when the Federal Reserve is cutting interest rates.

When you look at that chart, you can see the clear spike in July when it became clear the Fed was preparing to cut. This was after we got some inflation news that suggested price increases were getting closer to the Fed’s 2% target.

And then – you can see when the market gave up ALL of those gains.

And then you can see what happened next.

First, prices never went lower than they dropped before that euphoric jump in July.

And what followed over the last two months was a series of higher and higher lows. Unlike July, it hasn’t been a straight shot up. Because that’s how you get a straight shot back down.

Instead, the market has been “testing” prices gains in microcaps. They gain a bit, then drop – but not lower than the previous fall.

Then the same pattern again. And again. And again.

As you can see, we’ve seen four series of consecutively higher lows over the last three months. As well as three corresponding higher highs. Now, prices have now more or less returned to where they peaked in July.

You’ll understand why I’m so excited about this setup once I show you the next chart.

The New Market Leaders

Big Tech has led the bull market higher since stocks bottomed out in October two years ago.

(It feels like yesterday, right? Doesn’t that feel like yesterday?)

And since microcaps have more headwinds with higher rates, investors haven’t given them much attention before now.

But now that the Fed has entered a new rate cut cycle … once the big “what if” of the election passes next week, I suspect investors are about to start piling into these smaller stocks.

This chart shows you how the Nasdaq 100 tech ETF (orange line) and the S&P 500 (blue guy) have performed relative to IWC (that black line at the bottom).

They’ve absolutely beaten the pants off of it. Tech stocks as a whole have done five times better and the S&P has done three times.

But markets are forward-looking. And as investors start searching for the real opportunities (i.e. the stuff that hasn’t gone up a bajillion percent already) they’re going to be forced to reallocate some money to microcaps.

I’m not saying Big Tech is about to fall. Just so we’re clear.

Nvidia has gone up 1,000% over the last two years. For all I know, it could still double over the next two.

But that’s it.

100% gains in Nvidia from here – maximum.

That’s my take. Some might disagree with me.

Meanwhile, I suspect a lot of microcaps will make Nvidia-like returns of 1,000% or more over the next two years by virtue of the fact that they still haven’t gone up yet.

I’ve found a lot of microcaps that are still trading below book value. That’s a market inefficiency that can happen when demand for these stocks hits dramatic bottoms.

It’s also a sign that these stocks have bottomed and are gearing up for a big run.

A few months ago, James and I launched a new product, Microcap Millionaire, where we share our top microcap stock ideas.

We’re starting to see some good results. Two of our stocks are already up 20% and one position is up 50%. The overall portfolio is now showing a nice gain.

But we’re not going for double-digit gains. We’re looking for massive, explosive, triple-digit winners or more.

It’s Not Just in Microcaps, Though…

By the way, I’m seeing this same pattern all over the market.

I’m equally bullish on crypto. And it’s because the flagship coin for the “alt coin” universe, Ethereum, is showing the same pattern I’m seeing in microcaps.

Higher and higher lows since September…

Ethereum hit $4,000 in March. It’s trading for about $2,700 today. I personally believe it’ll return to its $4,000 price level by the end of the year.

I personally don’t think financial markets care much who wins the U.S. presidential election. I think assets haven’t gone up yet because investors have been wary of any weirdness leading up to the election.

After Tuesday, it’ll be game on, though.

That’s my take, anyway.