The Catcoin Conspiracy

Posted March 26, 2024

Chris Campbell

The dog days are over.

Catcoin summer is here.

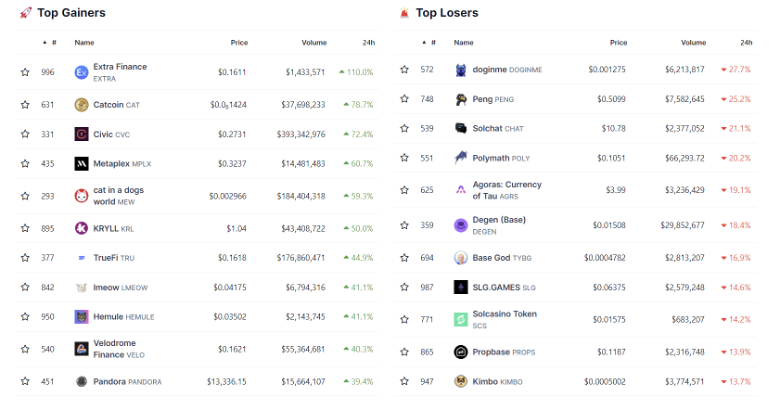

As you might be able to see from the screenshot below…

On the left are today’s top gainers in crypto. On the right are the top losers.

The left is full of cat meme coins, such as “CATCOIN.” The right has a few dog coins, like “DOGINME.”

The cats are outperforming the dogs.

In light of this meme coin craze, every once in a while, we get a question from our paid crypto members. Something to this effect:

“Why don’t you recommend meme coins? People are getting rich!”

Well… that might be true. But it’s also a mirage.

Here’s why we don’t recommend meme coins:

The Truth About Meme Coins

While the meme coin market may seem fun and exciting, with coins pumping to astronomical highs, there’s a dark truth lurking beneath the surface.

The reality is that meme coin pumps are short-lived by design, benefiting the whales and pump-and-dump groups at the expense of average investors.

Meme coins tend to move based on hype generated by influencers, sensationalized articles, and retail FOMO. These are most often coordinated in private telegram groups or Discords.

The hype phase is transient by design, lasting a few weeks before the inevitable crash.

Coins like Shiba Inu and Dogecoin have historically pumped for around 28-35 days before entering prolonged 80-90% corrections.And even though it was ALL manufactured, people keep coming back.

The crypto predators accumulate these coins during the "boring" bear markets when fear is high and prices are low.

They then use the power of influencer marketing, paid articles, and retail FOMO to drive the price up astronomically, at which point they take profits, leaving the retail investor holding the bags.

If you buy the top of these pumps, you'll be forced to wait years just to break even, as meme coins can take 800+ days to reach new all-time highs after their initial pump.

(Assuming, of course, they don’t just go to zero.)

Meanwhile, early buyers take profits and move on to the next opportunity.

Brass tacks, meme coins are designed to enrich the top 0.01% at the expense of the 99.99%.

BUT… we get it.

Sometimes, it’s fun to throw a few hundred bucks into a cat coin to see if the cat can grow wings.

So…

If you’re still keen on taking the plunge into the meme coin casino, here are five things you NEED to know.

Five Things to Consider

Consider this:

- Slippage Kills Gains: Meme coins often have low liquidity, which means that slippage can significantly eat into your profits. You might see the coin is up 100%, but after accounting for slippage, your real gains might be closer to 50%. This is especially true if you're trying to sell during a sell-off.

- Selling Triggers Cascading Sell-Offs: Meme coin markets are fragile and held up by hype alone. Once one big player starts selling, it can trigger a domino effect of panic selling. These sell-offs can be accelerated by bot trading and are often exacerbated by the low liquidity in these markets.

- Wash Trading Inflates Volume: Many meme coins engage in wash trading to artificially inflate their trading volume and create the illusion of popularity. This manipulated volume tricks novice investors into believing there's real demand. In reality, much of the volume may be fake, making it hard to sell when you want to exit.

- Susceptible to Rug Pulls: Meme coins are a breeding ground for scams and rug pulls. With no real product or team behind them, the developers can easily run off with investor funds. Even audited meme coins have fallen victim to rug pulls in the past.

- Opportunity Cost of Capital: By tying up your capital in a meme coin waiting for the next pump, you're missing out on gains elsewhere in the market. Trending sectors like DeFi, NFTs, and Layer-2s often outperform meme coins over a full cycle. Holding meme coins has a high opportunity cost that most don't account for.

The truth is…

Meme coins are a zero-sum game rigged against the average investor.

For every success story you hear, there are 1,000+ untold stories of losses.

Meanwhile, it’s the same whales and pump and dump groups getting rich.

The psychological allure of 100x gains in a couple of weeks is hard to resist, but it's important to remember that meme coin gambling can be just as destructive as casino gambling if you don't know when to walk away.

If you want to build real crypto wealth, it's better to stay loyal to Bitcoin, Ethereum, and high-quality altcoins with long-term value.

Avoid becoming exit liquidity for whales and influencers by steering clear of the meme coin casinos during peak hype.