The Coming Collectible Craze (2024)

Posted December 19, 2023

Chris Campbell

Sneakers. Cards. Coins. Comics. Rare video games.

You name it.

I used to be obsessed with the collectibles market as a kid.

I studied the markets like a historian studies ancient relics.

Of course, I still am obsessed.

But there’s only one collectible I hold like a winning lottery ticket.

It’s one that, in some higher grades, has gone up 15-20%+ on average per year since 2000.

Mind Your Business

My favorite collectible of all time? Fugio coins.

It has all the right elements of a great collectible investment.

Historical significance. Rarity. Consistent demand. Artistic merit. (Benjamin Franklin.) Exciting story. And more.

Minted in 1787, was the first official cent of the United States.

Its creation was authorized by the Continental Congress (though it never reached circulation -- a scandalous story), making it a key piece in the early monetary history of the U.S.

On one side it says “We Are One” and “Mind Your Business” on the other.

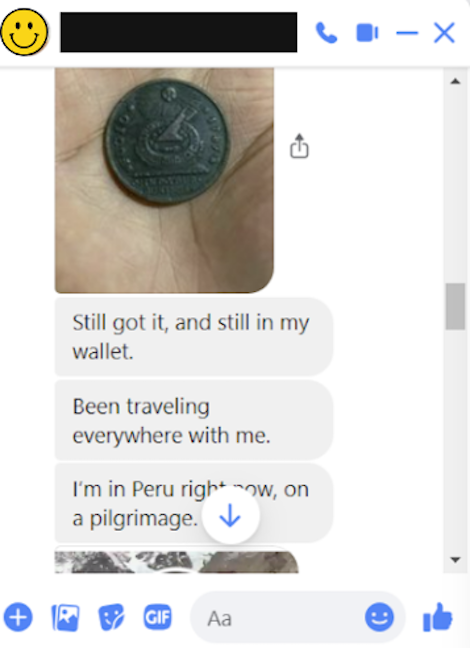

I’ve been buying them for years.

As said, some of the higher grades -- which are getting harder and harder to find -- have been on a tear.

It’s also just an awesome piece of history.

Back in my traveling days, I used to carry a bunch of replicas in my bag and give them out to people I connected with. To this day, I still get messages from people I haven’t seen in years.

And, even better…

In 2022, PCGS, the biggest coin grading service in the US, officially recognized Fugio as America’s first coin. (They’ve been a leader in coin recognition.)

Boom.

While I’m permanently bullish on the Fugios, James sees a widespread “collectible comeback” in 2024.

(I, for one, am here for it.)

Below, he explains why…

Read on.

The Collectible Comeback of 2024

I remember it well.

I was nine years old and convinced my life was over.

I had just shoved six packs of football cards into my pocket at the Kaybee-Toy and Hobby Shop at the local mall in New Jersey.

An employee came up to me and said, “Can you come into the back with us, sir?” It felt weird to be called sir at such a young age, but I wasn’t worried about that at the moment.

In the back of the store, the manager asked me to empty my pockets. I started crying hoping I might be able to play the pity card. He asked me who he should call and I gave him my grandfather’s phone number.

“How could you do something so stupid?” My grandfather asked as we walked out of the store.

I had no words.

I had to have the cards, they were the key to the material success I knew I wanted, even at a young age.

Football cards were the coolest thing to have in school, one of the most valuable currencies on the playground.

And although I didn’t know it at the time, what was happening on my elementary school playground was actually part of a bigger trend.

It was the early years of sports card mania – when the price of sports cards could seem to go nowhere but up.

Although enthusiasm for trading cards dropped off for two decades between the 1990s and 2010s, the easy money of the pandemic shifted the market back into full swing.

That is – until inflation picked up in 2021.

The Fed began to raise interest rates shortly after, leading to a sell-off in risky assets like cryptocurrency, tech stocks, biotech, and baseball cards.

Eighteen months later it looks like we might finally be turning a corner.

Cashing in on Collectibles

Year-to-date, cryptocurrency was one of the best-performing asset classes of 2024. Other risky assets are also on the rise, suggesting that we might see a comeback in baseball cards and other collectibles.

Of course, all of this depends on the Fed’s next move.

Market observers are estimating an average of five rate cuts next year.

Whether that will pan out is still unknown. Some banks, like Goldman Sachs, believe the Fed will only cut interest rates twice. The Fed itself is estimating it will only cut rates once.

The good news is that almost everyone is in agreement that interest rates have probably reached the top.

Which brings us to collectibles.

Collectibles like coins and trading cards do not make money the way that some other investments do.

When interest rates are high, people can earn more interest in a savings account or bonds. So they won't want to pay high prices for collectibles that just sit on a shelf and look nice.

However, these investments can start to look appealing again once interest rates begin to plateau.

Ultimately, the short-term success of these investments will depend largely on interest rates.

However, long-term investors might be less concerned with this. Historically, collectibles have been one of the best-performing asset classes and have even outperformed the market in some circumstances.

If you have the luxury of a long time horizon, collectibles could be worth a look at this point in the cycle.

Markets like Rally allow investors to buy fractional shares in extremely rare and priceless collectibles. Although this significantly reduces flexibility to sell, it also provides exposure to the high-end of the market that has historically seen the best returns.

My team and I plan to continue to monitor the collectible market in 2024 and keep you updated as we identify opportunities.