The Great Migration

Posted March 17, 2022

James Altucher

During the pandemic, there was an "exodus" of people leaving major cities like San Francisco, NYC, LA, Chicago…

I know because I was one of them!

My family and I packed up and left our cramped New York City condo, eventually settling on a much larger space right outside of Atlanta, GA.

Sure, the convenience, cuisine, and overall energy of New York City is unmatched. It's known as the greatest city in the world for a reason.

But there’s a BIG unknown that former New Yorkers and other city-folk from other densely populated areas are questioning — how long until things get back to “normal”?

Like me, many are choosing to ponder that question outside of their previous high profile area codes…

Ideally with a place that has a big front porch!

I am trying to gauge exactly how many people “escaped” the urban jungle, but the data is a bit mixed.

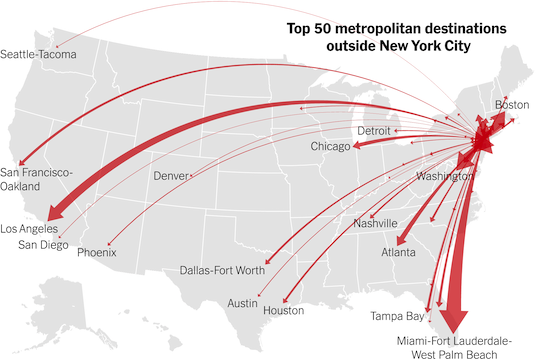

From what I’ve been able to research on my own, about 360,000 net people left New York City…

Ninety-thousand net households left San Francisco…

About 110,000 households left Chicago, to name a few of the big ones.

With this shift of households out of larger cities, comes a shift in where their money is being spent and the power those dollars have in less populated areas.

This got me thinking…

Where ARE People Moving!?

According to data I've gathered and guests I’ve talked to on my podcast, they are moving to states like Florida, Texas, Tennessee, South Carolina, North Carolina, Arizona, Georgia, and, to a lesser extent, Ohio, Colorado, or Utah.

Why?

Tech companies are moving to these states. Taxes are lower than the Northern states, the weather is sunnier, and maybe fewer Covid restrictions played a role.

How do we benefit?

The lowest hanging fruit, and best way to gain broad exposure to this shift from top tier cities is Real Estate Investment Trusts, more commonly known as REITs. These are stocks that own property and pay out 95% of their profits as dividends.

I like them as an investment because you get to make money in not one, but TWO ways…

The dividend, and as the value of the properties go up (which we are already starting to see in many of the states where people from high-cost-of-living cities are moving to) the stock also rises in price.

I wrote up a list for my Altucher’s Investment Network subscribers.

In it, I divided up residential REITs (REITs that buy houses or apartments), industrial REITS (warehouses), storage REITs (self-storage for when people move), healthcare REITs (as boomers retire), etc.

Source: New York Times

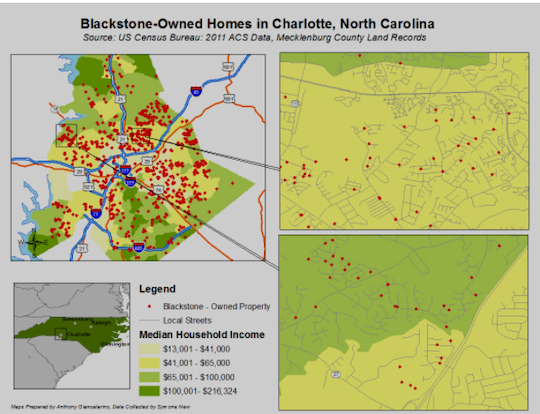

Take, for example, Blackstone.

This is an interesting one, and it’s not something I’ve seen other financial news outlets cover so much.

Blackstone has been quietly buying up houses and apartments in middle-income areas all across the South and Sunbelt states. The only media coverage I’ve seen about this is when the company recently made news in the past few weeks buying up to 12,000 rental units in Florida, Georgia, and Tennessee.

The conspiracy theorist in me thinks we're heading towards a world where huge companies (Blackstone is the largest fund in the world) own all the land and the people are all renters.

In the third quarter of 2021, for instance, 43% of all home sales in Metro-Atlanta were bought by investors. Most of those "investors" were one investor - Blackstone.

Blackstone pays a 3.2% dividend yield.

But Blackstone is far from the best opportunity…

There are many ways to play this ongoing migration. But only a few that will give investors outsized returns.

Until tomorrow,

James Altucher

For Altucher Confidential