The Irresistible Urge to Print

Posted May 31, 2023

Chris Campbell

“All paper money returns to its intrinsic value, that is, zero.”

-Voltaire

“Hey guys,” said the TikToker. “I have a radical idea.”

"Why don't we just print more money? I know what you're gonna say. 'Oh, it's gonna decrease in value and then everything's gonna just come to nothing.' I don't care. We have money printing machines. Print more money."

Unfortunately, this is far from a “radical idea.”

In fact, without knowing it -- and in only 59 seconds -- the TikToker summed up the past decade-plus of monetary policy around the world.

And they'll be right back their default mode in no time. (Largely, as we'll see, because the benefits outweigh the costs.)

And, here’s the kicker…

During a time of high debt and high interest rates (which is, as our colleague Dan Amos pointed out this morning, inflationary)...

It behooves all of us to search far and wide for alternatives.

But more on that in a moment.

Is Inflation Good?

The irresistible urge to print is often rationalized by the idea that inflation is a net positive for society -- until there’s too much of a good thing.

But how much is too much?

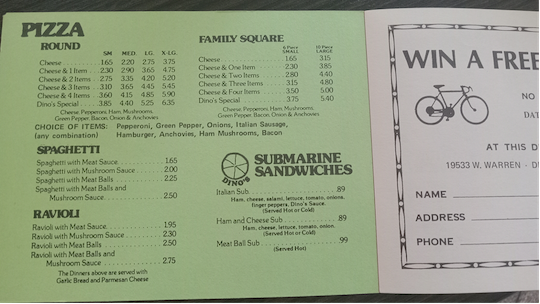

Yesterday, I came across an old pizza coupon book from 1975.

An extra large cheese pizza is $3.75. An order of spaghetti is $1.65. An Italian sub? 89 cents.

Also, there was a coupon for free delivery, so long as you spent $3 or more.

Today, the pizza place down the street charges $25 for an extra large. Another one charges $30. And although there’s nothing on the menu cheaper than $3, they won’t waive the delivery fee.

Is this a good thing? Many economists would argue yes. And that’s fine.

But this wasn’t always the popular sentiment.

According to James Turk, author of Money and Liberty, the delegates who met in the summer of 1787 to draft the U.S. Constitution believed inflation was a crime against humanity.

The founders saw how many civilizations in the past that adopted inflation as a policy and crumbled as a result.

Athens adopted a combination of taxation and inflation as a policy 2,500 years ago to finance their war against Sparta.

That spelled the beginning of the end for Athens.

The Roman emperors used the same basic template 2,000 years ago to finance Rome’s expansion.

That spelled the beginning of the end for the Roman Empire.

Norwegian Viking, King Harald Hardade, did the same thing when he tried to conquer England almost 1,000 years ago.

That spelled the beginning of the end for the Viking Age.

Even Nicolas Copernicus, known for his insights in astronomy, wrote about the dire effects of inflation in the 16th century.

But what about the case for inflation?

The Case For Inflation

The book Introduction to Macroeconomics by Leiv Opstad offers the following explanation. It’s basically the same explanation given across the world to budding economists.

On top of the state’s ability to print on a whim, Opstad adds “bracket creep” as a benefit of inflation, citing the fact that people are easily duped by inflation’s hidden tax:

"The fact that many people are deceived by nominal numbers instead of real numbers can also offer advantages. The authorities can thus collect more tax by not adjusting the tax rates for inflation. Thus, they can change the tax level without getting protests from the taxpayers."

Let’s unpack that.

Nominal numbers are the face value of money. For example, if you earn $100, that's a nominal value.

Real numbers, on the other hand, take into account the purchasing power of that money. Because of inflation, the cost of goods and services tends to rise over time. So your $100 may not buy as much in the future as it does now.

Now, let's consider taxes.

In many countries, people pay taxes based on their income, and the tax rates often have different brackets. For example, you might pay 10% on the first $10,000 you earn, 20% on the next $20,000, and so on.

Now, let's say due to inflation, your wages increase.

You might be earning more money in nominal terms, but in real terms (taking into account inflation), you might not actually be richer. However, because the tax brackets are typically based on nominal values, not real values, you might now fall into a higher tax bracket and thus have to pay more taxes.

The authorities haven't actually changed the tax rates.

They're still 10%, 20%, etc. But because those rates are applied to the nominal amount you earn, not the real amount, you end up paying more in taxes if your wages increase due to inflation. This is often referred to as "bracket creep."

And because the tax rates haven't technically changed, people might not protest as much as they would if the government openly raised tax rates. So in a sense, inflation can allow authorities to subtly increase tax revenue without facing as much public pushback.

Quite the benefit.

There are other “benefits” to inflation to explore. And we’ll see them sprout up soon enough.

But rather than taking it on the chin, consider this:

The “Uninflatables”

Due to inflationary scares, some intrepid souls are beginning to adopt a secret “uninflatable” currency in the US.

(It’s not crypto.)

And just recently, Jim Rickards is giving our readers to claim some for themselves.

One catch: You only have a limited time to claim some of them for yourself.

You just have to watch this short 2 minute video Jim recorded for you and respond by TONIGHT at midnight.

If you don’t respond, you’ll forfeit this offer and these “uninflatables” may be gone for good.

Don’t get caught blindsided. More on how to protect yourself tomorrow.