The Melt-Up Begins

Posted November 12, 2024

Chris Cimorelli

No, I’m not Chris Campbell.

I’m his evil twin, Chris Cimorelli.

As I mentioned yesterday, Chris is out on vacation this week and asked me to tell you about the OTHER big opportunity as we prepare to enter 2025.

You can think of me as what Chris is for crypto under the Altucher Investment Network franchise, except for microcap stocks.

This week, the total market cap for all of crypto surpassed its previous high of $3 trillion set in November 2021.

It’s an exciting moment for crypto. The entire sector is up about 250% since it bottomed out in December 2022.

And hitting new all-time-highs this early in the cycle means there’s a whole lot of upside still left (if historical trends continue, crypto won’t peak until next November 2025. Although there are arguments to be made it will go past that. A discussion for another time).

Here’s the difference. Unlike crypto, the microcap bull market has only just started.

And it’s already starting to outperform the rest of the stock market.

That last time this happened was during the explosive bull run from March 2020 to November 2021.

During that run, microcaps led the way higher – outperforming even some of the top stocks in the Nasdaq technology index.

I’m convinced 2025 is going to be a repeat of 2021. Let me give you my top three reasons why.

Reason #1—

The Fed Punch Bowl Is Back (And It Tastes Delicious)

For the first time in a long time, last week’s Federal Open Market Committee meeting got almost zero press because apparently there was an election last week or something.

Last week, the Fed cut interest rates by another quarter basis point. In September, they cut by half a point – meaning interest rates are now down 0.75% from their peak just two months ago.

Oh, and there’s still a greater than 50% chance we’ll see another quarter point cut in December.

Historically, microcap stocks outperform when the Fed begins cutting rates.

That’s because lower rates means businesses pay less money on any debt.

Smaller companies tend to fuel growth with debt because they don’t have enough revenue.

And these companies typically get stuck with debt with variable (not fixed) interest rates. Banks won’t lock them in to a fixed, reduced rate because smaller companies are riskier.

All this is to say – rate cut environments benefit smaller, less established companies than larger, more established ones.

Now, here’s the caveat. In Microcap Millionaire, we’re focusing on microcap stocks that have zero debt (or close to it).

But it doesn’t really matter. In a bear market OR rising rate environment, even the high quality microcaps are guilty by association. It’s a weird form of stock market prejudice that develops where small = bad.

Investors pile into the large caps because they’re perceived as being safer.

Once the market switches back to a risk-on environment, investors panic because they forgot all about these incredible, high quality, tiny companies that can generate some of the biggest returns in the market.

So that’s #1. The great thing about higher rates is, the Fed has plenty of ammunition to fight any sort of hiccup that pops up inside the economy.

Recession? Who cares? If things get bad enough, the Fed can always cut rates back to zero and the stock mania will resume.

Mo’ Money, Mo’ Mania

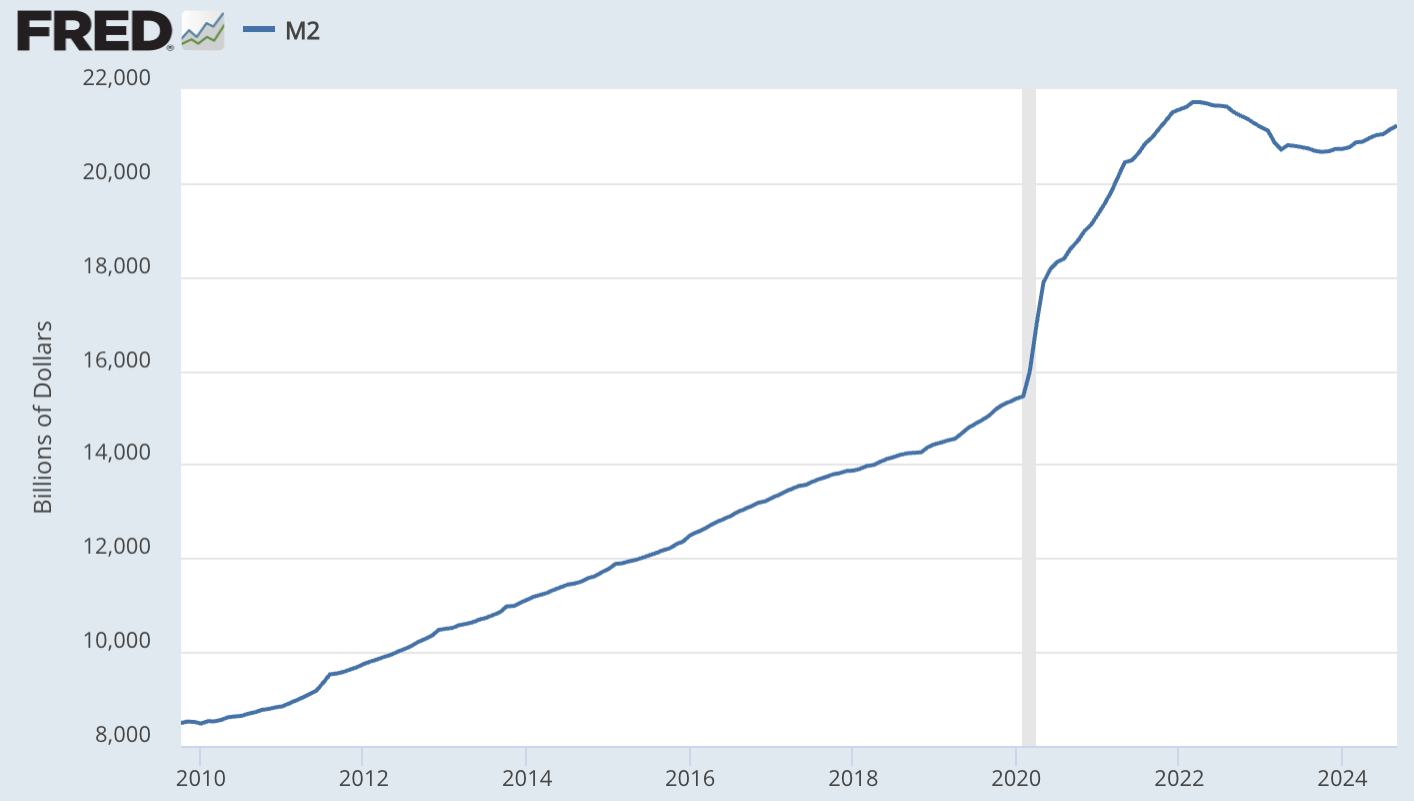

The second reason is a little more basic – the money supply is just as big as it was in 2020 and 2021 when the Fed printed a boatload of money to fight Covid.

Put another way, all the money that caused those insane stock gains to happen before is still out there.

The only reason the last bull market was cut short is because inflation started to spin out of control and the Fed was forced to raise rates.

Stocks hate higher rates because it puts a cap on their bottom line.

Now that the Fed is cutting rates, all that new money is back to doing its job – looking for the best places to grow.

Here’s a graph of the money supply. As you can see, there was a slight dip in 2022 and it’s been creeping back up over the last year. But we’re talking about meager differences compared to the huge jump we in 2020 and 2021.

More money equals more money looking for a place to live. When rates were on the rise, record levels of cash piled into money market funds where you could get a crisp, clean, risk-free 5% on your cash.

Now, money is gushing out of those same funds and rushing into the top opportunities in a risk-on environment – which is crypto and microcaps.

But the third reason trumps all of them.

Election Aftershock

Here’s the thing. I don’t think it really mattered too much who won the election.

Last Monday, I told our Microcap Millionaire subscribers that microcaps were going to take off after the election regardless of who wins.

That’s because I was predicting a divided Congress in the off-chance Harris won. Which meant it would have been difficult for Harris to raise the corporate tax rate after Trump’s cuts expire next year.

And stocks like maintaining the status quo.

Of course, that didn’t happen. Republicans will officially control the White and both branches of Congress beginning in January.

But my same prediction played out either way – last Wednesday, microcaps outperformed the rest of the market by more than 2-to-1 (about 6% for the microcap index vs. 2.5% for the S&P 500 and Nasdaq).

There’s a bigger story at play here though.

There is typically a major “aftershock” that plays out the year after the U.S. presidential election.

That’s because investors are hesitant to deploy new cash before an election. They want to know what policies will be in place next year before making new moves.

Once the road becomes clear, massive amounts of money reallocate – and even more, new money comes in.

The same thing happened four years ago when Joe Biden won and carried both branches of Congress with him.

It didn’t matter that he was the Democrat. Markets actually viewed Joe as a return to normalcy (at least in his first year).

So, stocks took off after the election.

I mentioned this yesterday, but this past week was personally my best week as an investor since the week after the November 2020 election.

This is not a coincidence. The same thing happened again back in 2016 – when Trump swept everything back then. Stocks took off and 2017 was a banner year.

And actually, the year after the 2012 election was a really killer year as well.

Investors brace for political chaos before the election. They lean in after.

And now that we know Trump’s tax cuts will remain in place for the foreseeable future, microcaps are the place to be.

In the past week, we’ve had three different stocks in the Microcap Millionaire model portfolio cross the 100% mark.

Based on the calculations I ran yesterday, we were outperforming the market by about 3-to-1 since we launched the service in July.

But it’s still early. I’m predicting we’ll see some 300% … 500% … possibly even those rare 1,000% winners.

That’s because things can get really, really nutty during these microcap manias. Because these stocks are so small, it doesn’t take THAT much to send one of these stocks up 1,000%.

For instance, a $500 million stock can go to $5 billion and it’s still technically a small cap.

It’s worth noting that I’m seeing big institutional players like BlackRock, Vanguard and State Street take up sizeable positions in these companies.

Once the whales move in, it doesn’t take a whole lot for these stocks to pop.