The Nvidia Playbook - Here’s What Happens Next

Posted August 29, 2024

Davis Wilson

Nvidia reported another blowout quarter last night.

Here’s the breakdown:

- Earnings per share: 68 cents adjusted 64 cents expected

- Revenue: $30.04 billion $28.7 billion expected

- Nvidia expects $32.5 billion in current quarter revenue, versus $31.7 billion expected

Excellent results by any measure.

The stock still sank on the news…

Investing is hard.

So what happens next?

Let’s look at the playbook.

By “playbook” I’m referring to an interesting trend in Nvidia’s valuation over the last three quarters.

I think it can tell us what direction this stock will move over the next few months.

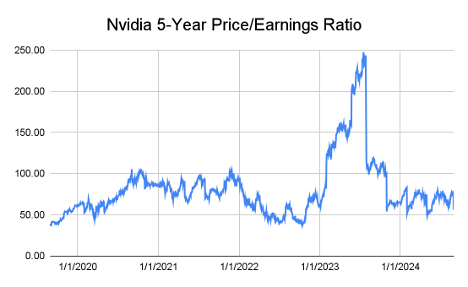

To start, let’s take a look at the stock’s historic price/earnings ratio.

The stock is very much in line with its five year average.

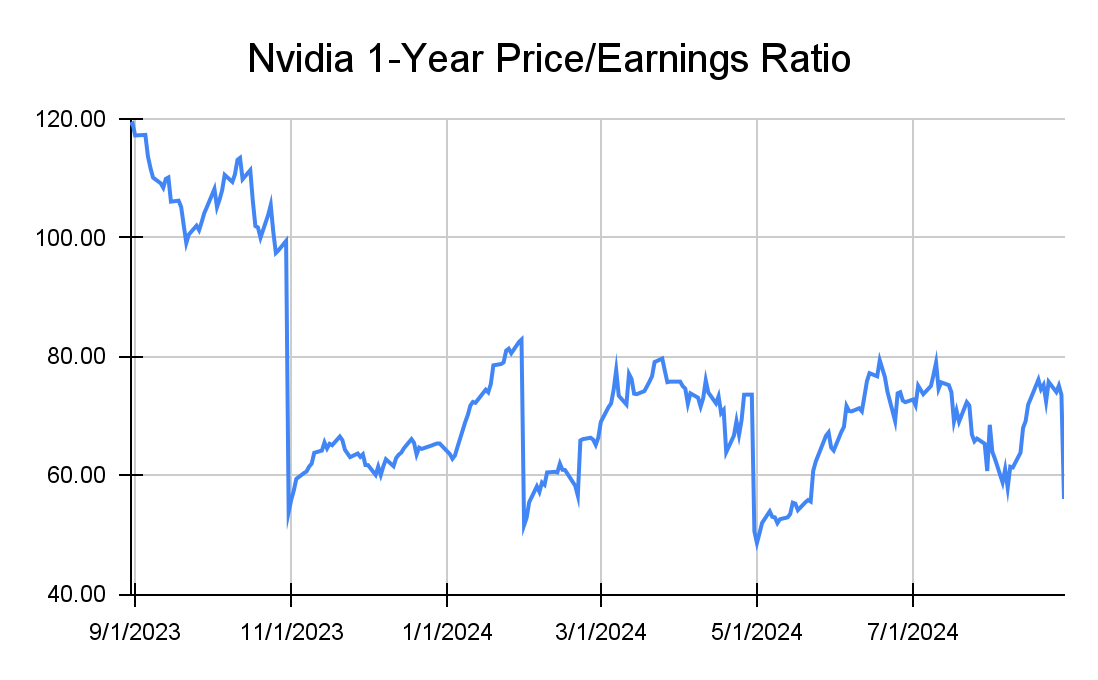

Now zoom in on just the last year.

The dramatic drops lower coincide with earnings releases.

The “E” in P/E gets larger as the company reports higher profits, hence the overall P/E ratio decreases.

In other words, Nvidia gets cheaper when this chart goes down.

You can see an interesting trend appearing.

In each of the last three quarters, Nvidia announces earnings and the P/E ratio drops to ~50x.

Then, over the next three months the stock price rises, hence the P/E ratio increasing until the next earnings report.

When that next earnings report is released the same playbook gets executed. The P/E drops sharply to ~50x and the stock slowly ticks higher over the next three months.

This playbook has happened like clockwork over the last three quarters.

The reason is simple: Investors realize they can buy the most powerful, profitable, and important AI company at a bargain valuation.

Well, today we woke up after last night’s earnings and Nvidia is once again trading around ~50x.

What do you think? Is this time going to be different?

Let’s continue to look at the facts.

- Last night on the call, Nvidia CEO Jensen Hwang reiterated the fact that demand for Nvidia products is still incredibly strong and that we’re still in the early stages of developing AI.

- Microsoft, Amazon, Alphabet, and Meta all recently announced they’re not slowing their AI development spending anytime soon.

- The Blackwell delay is a non-issue. Previously this was the stock’s biggest red flag.

Plenty of positive news regarding Nvidia’s business. Very few negatives.

Yet, this time is different and Nvidia should trade at a lower valuation than it has in years?

I’m not buying it.

After last night’s earnings, Nvidia’s trailing twelve month earnings is $2.16 per share.

The stock has consistently traded up from ~50x P/E after reporting earnings to ~80x over the last three quarters.

I’m betting this quarter is no different.

$2.16 in earnings multiplied by an 80x multiple gets you to a $173 price target.

My guess is we’ll see this by mid-October.

According to the playbook.