The Prometheus Effect: Altcoins Are Stealing Fire

Posted March 29, 2024

Chris Campbell

Prometheus was a Titan who stole fire from Zeus and gave it to the mere mortals, enabling us to advance and prosper.

This act of defiance sent Zeus into a nosedive of rage…

He punished Prometheus by chaining him to a rock and sending an eagle to eat his liver every day, only for it to regrow and be eaten again the next day.

You might see where I’m going with this (OK, maybe not)…

Bitcoin, as the dominant and original cryptocurrency, is Zeus, the supreme ruler of the cryptoverse.

Altcoins, like Prometheus, are lesser gods who have taken some of Bitcoin's "fire" (i.e., market share, attention, and innovation) -- and in ways that can both burn and illuminate.

Now that the stage is set, three questions:

What effect will the turning of Zeus -- Bitcoin and its halving -- have on the altcoin market?

Will Zeus punish Prometheus?

Will the rest of Mount Olympus stage a revolt?

The answer: Yes.

An altcoin correction could be in the cards early April. But the rest of 2024 is summed up in one word: fireworks.

Let me explain.

Zeus’ Haircut: Right on Schedule

To get a clearer picture of where we are, let’s look at previous halvings.

1st Bitcoin halving — November 28, 2012 — Reward: 50 BTC to 25 BTC

2nd Bitcoin halving — July 9, 2016 — Reward: 25 BTC to 12.5 BTC

3rd Bitcoin halving — May 11, 2020 — Reward: 12.5 BTC to 6.25 BTC

4th Bitcoin halving — April 20, 2024 — Reward: 6.25 BTC to 3.125 BTC

In 2012, the altcoin market didn’t exist, so there’s not much to say.

In 2016, altcoins experienced a relatively cool period following the halving, with prices remaining stagnant for around 7-8 months.

However, it’s important to note that the altcoin market was still in its infancy at the time, with Bitcoin dominating the market with over 95% of the total cryptocurrency market cap.

(Today, BTC market cap domination just fell under 50%.)

The 2020 halving showed a similar picture. The altcoin market didn’t make big moves for months

Now, as we approach the 2024 halving…

The current altcoin cycle seems to be moving way ahead of both 2016 and 2020.

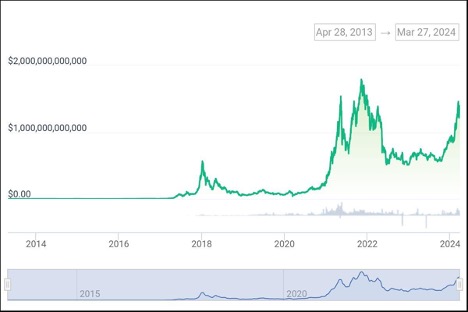

Here’s the total altcoin market cap chart -- everything except Bitcoin.

This acceleration is a result of increased mainstream attention and institutional investment in crypto. With a few impactful catalysts barreling down the pike in 2024, the trend is our friend.

BUT it could also mean the altcoins are getting ahead of their skis.

Watch Out For April 5

Based on the historical data from the 2016 and 2020 Bitcoin halving events, we shouldn’t count out a pre-halving correction.

In 2016, a ~30% BTC correction took place 10 days before the halving, while in 2020, a ~15% correction occurred 15 days prior to the event.

Both corrections were accompanied by increased volatility and trading volumes, as well as a hefty decline in the altcoin market.

With the 2024 Bitcoin halving scheduled for April 20, the estimated correction date is Friday April 5 - Friday April 10.

(Just in time for the eclipse, which I’ll witness from Texas.)

Of course, this time could be different. We’re seeing signs altcoins are beginning to go their own way.

As for the rest of 2024, expect fireworks.

In fact, as the altcoin market grows and matures in 2024, we may see a consolidation phase where successful projects join forces or are acquired by established players.

(We’re already seeing signs of this happening. I’m writing all about it -- and how to play it -- in today’s Early Stage Crypto Investor update. If you’re an ESC member, look out for thisemail: “The Great Crypto Consolidation.” Yet to take the plunge? Click here to see if ESC is right for you.)

Of course, the maturing cryptocurrency market might become more susceptible to external factors…

Such as regulatory changes or macroeconomic events, rather than being primarily influenced by Bitcoin price movements.

How to Play it

Drawing from historical parallels, we can look to the dot-com boom of the late 1990s and early 2000s. During this period, many internet-based companies emerged, vying for a piece of the burgeoning online market.

While some companies, like Amazon and Google, went on to become giants, others faded into obscurity.

Similarly, in the crypto space, we can expect to see a mix of successful projects and those that fail to live up to their promises.

As the altcoin market matures, it will be CRUCIAL for investors to focus on projects with strong fundamentals, real-world utility, and the ability to adapt to the evolving market conditions.

Projects that can navigate the regulatory landscape and deliver value to users are more likely to succeed in the long run.

That’s why James and I are putting together a Post-Halving Report on coins we believe will survive and thrive in the new crypto landscape.

(Note: ESC members will have access to this report.)

More soon.

(NOT AN ESC MEMBER? Then you probably don’t know about James’ “$100,000 in one coin,” idea. He’ll tell you all about it right here.)