The Strange Reason I Own Bitcoin

Posted November 13, 2024

Davis Wilson

Davis is on a mission to turn $100,000 into $1 million. Follow along with his journey and get the opportunity to follow along in your own portfolio for free by clicking here.

Bitcoin topped $90,000 this week.

I own Bitcoin and I always will.

I can’t see myself ever selling it.

My reasoning is pretty unique and stems from a previous career I had in venture capital.

My job was to find and invest in great startup companies.

If you’ve ever seen the TV show Shark Tank, you can think of my job as basically one of the “sharks.”

Although investing in startup companies is very different from investing in stocks/bonds/crypto, my time in venture capital completely reframed how I invest my own money.

In fact, my time in VC is what led me to attempt the audacious goal I’m pursuing here at The Million Mission.

Here’s what I mean…

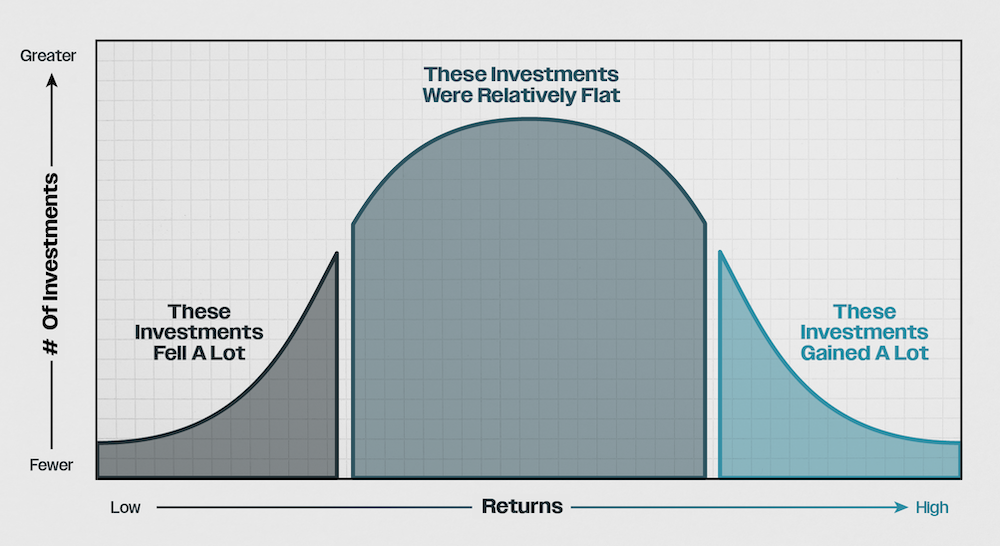

Take the average Main Street investor. Their portfolio probably looks something like this:

- 20-ish total investments give or take.

- Out of those 20 investments:

- 5 have appreciated significantly in value.

- 5 have depreciated significantly in value.

- 10 are relatively flat – up or down a few percentage points.

Maybe you recognize this portfolio as a “bell curve.”

This bell curve illustrates the typical Main Street investor’s portfolio – some investments gain a lot, some investments fall a lot, and most end up somewhere in the middle.

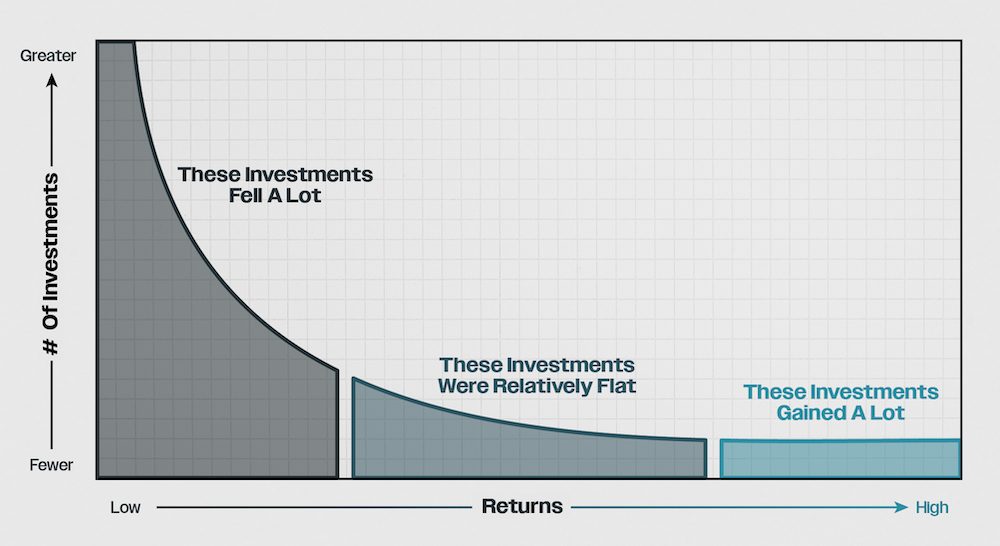

Now let’s look at a typical venture capital portfolio that consists of riskier investments. (Bitcoin falls into this category.)

- 100-ish total investments.

- Out of those 100 investments:

- 1-2 have appreciated significantly in value.

- 60 have depreciated significantly in value (total losses).

- The rest are distributed somewhere in the middle.

This is what’s known as “Power Law,” where 1-2 investments gain a lot, 60 are total losses, and the rest end up somewhere in the middle.

In venture capital, it’s the 1-2 that matter. We call these “outliers.”

Outliers don’t just double or triple… They 50X, 100X, 1,000X, or more.

That’s right. I previously worked at a VC fund where our best investments returned over 2,000X.

2,000X!

What’s important to know is that when VCs are looking for great investments that can 2,000X, they don’t care if 60% of their investments will be total losses and they don’t really care about those investments in the middle ground either.

When on the fence about investing or not, a VC nearly always writes a check just because the risk of not investing – and missing an outlier – far outweighs the risk of investing and losing a relatively small amount.

Again, they just need to hit one outlier to recoup the money spent on all other investments plus a potential windfall of profits on top.

In short, my time working in VC changed how I invest my own money. It changed how I approach investing here in The Million Mission. And it’s the reason I own Bitcoin.

Bitcoin crossed $90,000 this week which is the highest the coin has traded in its history.

I currently hold Bitcoin in the speculative portion of my portfolio along with some other high-risk/high-reward bets.

I treat this portion of my portfolio similar to how a VC treats their portfolio.

Even at $90,000, I believe the risk of not owning Bitcoin for years to come far outweighs the risk of losing my initial capital.

Like a VC, I just need 1 or 2 of these high-risk/high-reward bets to pay off.

Love it or hate it, Bitcoin has proven to pay off for the last 15 years and will likely continue to pay off for years to come.

That’s why I own it – the risk of missing out is far too great.

I recommend you own some yourself.