The Ugly Truth About CBDCs

Posted June 23, 2022

Chris Campbell

"I'm going to make him an offer he can't refuse."

You no doubt recognize it as an iconic line from The Godfather.

According to Jim Rickards, it could also have everything to do with the coming rollout of Central Bank Digital Currencies (CBDCs).

I’ll explain what that means in a moment.

First, you might’ve noticed…

Though the conversation surrounding CBDCs aren’t new, they’ve been ramping up in a big way lately.

Sure, Fed Chairman Jay Powell has somewhat played the role of a CBDC fence-sitter in the past…

But don’t be fooled.

The CBDC race is on.

Consider that, in May 2020, only 35 countries were on record considering a CBDC.

According to the Atlantic Council’s Central Bank Digital Currency Tracker, that number is now a whopping 105 countries, representing over 95% of global GDP.

And, just last week, Powell said that the U.S. doesn’t intend on being the laggard:

“As the Fed’s white paper on this topic notes,” Powell said, “a U.S. CBDC could also potentially help maintain the dollar’s international standing.”

The Age of Credibility

The philosophical argument for CBDCs was laid out last January by Agustin Carstens, director of the Bank of International Settlements.

In his speech called “Digital currencies and the soul of money,” Agusten invoked the book Faust to explain how central bankers think about the “soul of money.”

(Recall, Faust is a book about a guy who sold his soul to a demon in exchange for power and material gain… so take that for what it’s worth.)

According to Carstens, the soul of money is trust.

“Central banks,” he said, “have been and continue to be the institutions best placed to provide trust in the digital age.”

But I guess a lot can happen in six months.

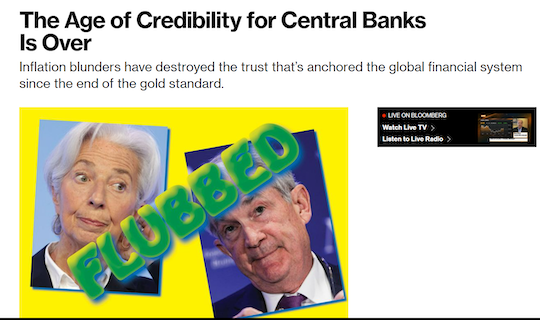

Meanwhile, John Authers published a Bloomberg piece today outlining why the central bank’s “Age of Credibility” is dead.

"After a series of bad calls,” he said, “they can no longer confidently guide the markets on their next steps."

“The implicit plan of the bankers,” Authers goes on, “is that after some now unavoidable ’70s-like chaos, central banks will regain their credibility and order will be restored. But that’s going to be difficult to achieve. Trust in all institutions is painfully low as it is. The word of Powell or Lagarde is no longer as good as Volcker’s, and it’s certainly not as good as gold.”

So, if the central banks don’t have trust… what are they going to do?

That’s simple.

They’ll pull a page from The Godfather…

They’re going to try to make you an offer you can’t refuse.

Rickards says that, as far as the U.S. goes, it’s all laid out in Section 4 of Biden’s Executive Order 14067.

In case you missed it…

Jim Rickards just gave a talk about this executive order, and what he believes is coming down the pike:

Chris Campbell

For Altucher Confidential