Tokenizing the Apocalypse

Posted October 02, 2025

Chris Campbell

In the early 1600s, merchants had a problem.

No, it wasn’t the plague, famines, or an ever-looming sense of doom.

Everyone had the plague, famines were run-of-the-mill, and the apocalypse was perpetually trending—they hardly counted as problems anymore.

The real problem:

Merchants wanted to fund risky, expensive expeditions… to the East Indies, Africa, the Americas… and capital formation was a NIGHTMARE.

Ships cost fortunes. Crews had to be fed, armed, and promised hazard pay. Voyages stretched for years, tying up (literal) boatloads of cash.

Raising funds meant leaning on cousins, creditors, or whoever was foolish enough to buy in. Deals relied on personal relationships. Outsiders didn’t invest because contracts weren’t standardized and risk was concentrated—if one ship sank, so did your wealth.

Capital wasn’t just scarce.

It was clunky, slow, and stranded.

The Magic Fix: Shares

And yet, at the dawn of the 17th century a new way emerged.

The Vereenigde Oostindische Compagnie (VOC), also known as the Dutch East India Company released a thing called shares—tradable paper slips that turned risky voyages into fractional, portable claims.

For the first time, investors didn’t need to bankroll an entire fleet. And merchants, instead of begging both family and friend for silver, could tap a city-wide pool of strangers.

Risk could be spread across hundreds or thousands of participants, each holding a slice of the action. Even better, instead of waiting years for a ship to return, investors could sell on Amsterdam’s exchange.

Standardized paper made trust scalable. And turned long, dangerous expeditions into the world’s first liquid, global asset market.

Of course, not everyone was thrilled about these newfangled “shares.”

The old guard loathed them. Preachers called it gambling, saying participation would almost certainly corrupt the soul. Aristocrats sneered that real wealth was land, not flimsy slips of ink. Notaries were furious too—shares erased the need for their family-loan contracts overnight.

Everyone had a reason to hate it. Everyone swore it wouldn’t last. And yet, those paper slips became the foundation of global capitalism.

The critics weren’t wrong—they were gambling chips. But those chips rewired the entire world economy.

The result? The first true “tokenized” equity market.

Just Don’t Call it “Shares 2.0”

Just like the VOC’s shares…

Tokenization in the 21st century takes frozen, expensive assets—real estate, treasuries, private equity—and smashes them into tradable slices.

Fractionalization. Liquidity. Scale. Standardization.

It’s the same cheat code the Dutch East India Company used—only running on digital rails.

BUT…

This brand of tokenization isn’t just “shares 2.0”—it’s shares that can “think.”

Old paper slips gave us fractional ownership, but they were stuck in banker’s hours, locked in silos, and dumb as bricks. Tokens run 24/7 on open rails, settle instantly, and can be programmed to pay dividends, enforce rules, or plug into DeFi like money-Lego.

They slice billion-dollar assets into $10 pieces, make them tradable anywhere on earth, and do it all with built-in transparency. Shares turned voyages into markets; tokenization turns markets into software.

And yes, just like in 1602, there are critics.

Banks grumble, regulators posture, middlemen see their margins evaporating. The same kinds of people once called shares “gambling chips.”

They weren’t wrong—those chips built the global economy.

That’s the point: every great financial innovation looks like a casino at first. Then it rewrites the rules of money.

Tokenization isn’t hype. It’s history, repeating in real time.

Vlad: “It Will Eat Everything”

Robinhood’s Vlad Tenev just put it bluntly in Singapore: “Tokenization is going to eat the entire financial system.”

Robinhood has already launched tokenized stocks in Europe. Not CFDs, not knock-offs—actual on-chain claims to U.S. equities.

They settle instantly, trade 24/7, and can be held anywhere on earth with a wallet. Next on the menu? Real estate. The world’s most sluggish, illiquid asset class, sliced into digital shares that trade like stablecoins.

Every era has its paper slip. In 1602, it was the Dutch East India Company share.

In 2025, it’s the token.

And like the 17th century merchant said, this thing isn’t a fad. It’s a freight train—and it’s not slowing down for anyone.

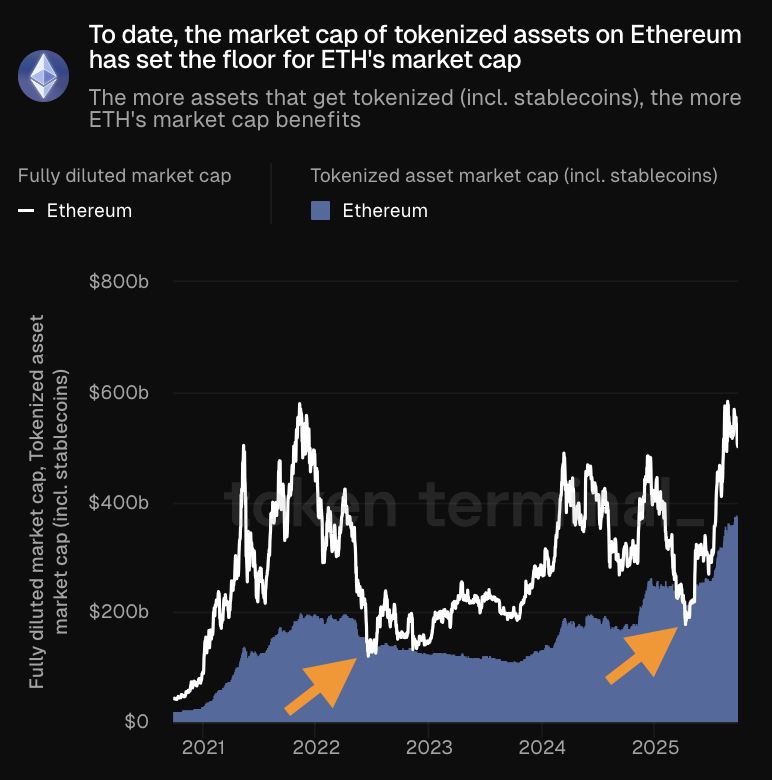

Who’s the clear leader in tokenization so far? Ethereum.

And, in fact, tokenization seems to create a price floor for the ETH asset.

It’s a simple equation: The more assets that get tokenized on Ethereum (including stablecoins), the more ETH's market cap benefits.

The question is then begged: How much will ETH benefit in the near future?

More on that—and where we think ETH’s price could be headed by year-end—tomorrow.