Trump and Dump?

Posted January 22, 2025

Chris Campbell

Back in August, Donald Trump Jr. threw cold water on the idea of an official Trump memecoin.

Yet, last week, not one but two coins dropped—Trump’s and Melania’s.

Both came with a blitz of retweets from the Trump camp…

Giving just enough fodder for crypto enthusiasts and skeptics alike to start whispering about a deeper strategy.

Fortunately, James and I have already been on the case for MONTHS.

First thing to know: the Trump crypto agenda is NOT about memecoins.

That’s the sideshow.

The real game, as always, is something bigger.

Way bigger.

Two things you need to know, which we’ll cover today:

One, those who move first will seize opportunities others won’t see until they’re gone. (Poof. It’ll happen fast.)

Second…

The stakes, in Trump’s eyes, are nothing short of defining the next century of economic order.

Let’s rewind.

The Distraction

There’s plenty already said about Trump and Melania’s memecoins.

But let’s just put it like this…

Even Trump loyalists aren’t thrilled.

Although the TRUMP coin certainly raised some eyebrows…

The rushed and poorly executed launch of Melania’s token—a sparse website and constrained payment options—was the moment that truly soured perceptions.

Critics, even from his own camp, called the launches unnecessary. Ryan Selkis, a prominent crypto figure, bluntly suggested firing whoever greenlit the Melania launch.

He’s not wrong.

But the memecoins are the least interesting thing happening.

The Trump family’s bigger move is World Liberty Financial, a DeFi platform hyped by Eric and Don Jr.

The pitch? Take down big banks, level the playing field, and give the little guy a shot.

(Sounds noble, right? Except you’ll need to be an accredited investor to get in.)

But, again, WLF is NOT where the puck is headed, either.

If you’re in crypto, you know this.

Trump’s crypto team knows this.

Everyone knows this.

Here’s what people are only now starting to realize…

Trump’s push for making America the world’s “crypto capital” is about one thing: the US dollar.

One Word: Tokenization

When World Liberty launched, the first thing James and I did was read the white paper…

(Or, in their case, the “Gold Paper”.)

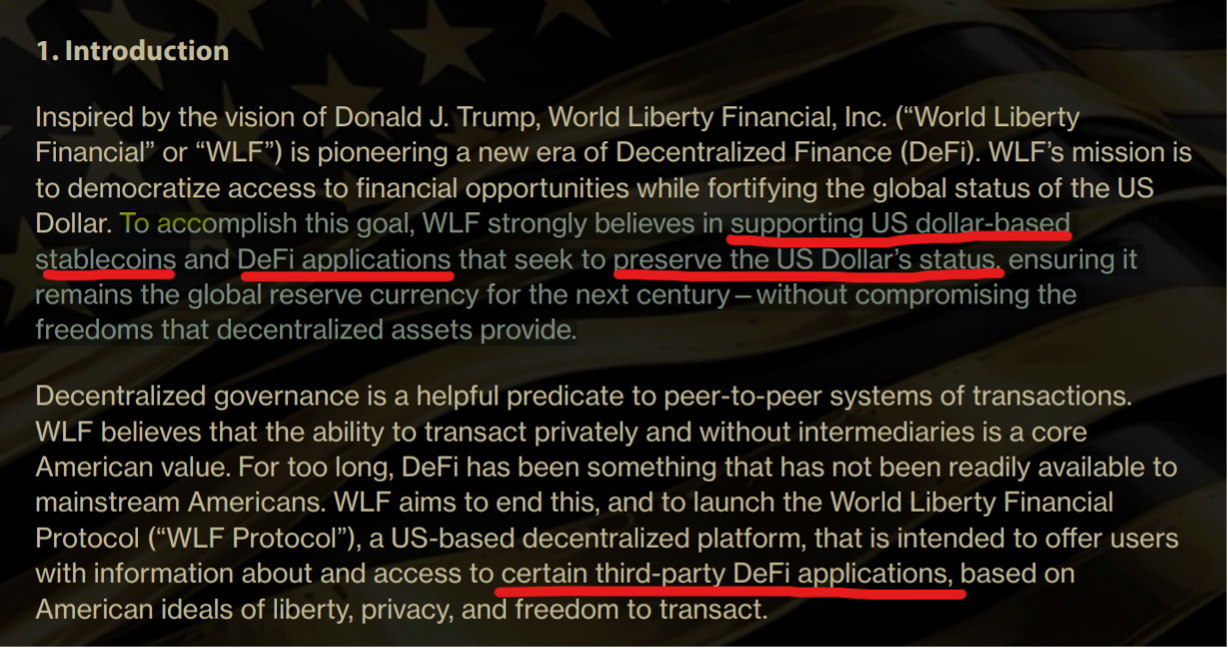

In the first two paragraphs, the Trump crypto team says it straight:

“WLF strongly believes in supporting US dollar-based stablecoins and DeFi applications that seek to preserve the US dollar’s status, ensuring it remains the global reserve currency for the next century…”

And, further down, it mentions that the WLF protocol will offer users access to “certain third-party DeFi applications”.

What they’re REALLY talking about: tokenization.

This means turning everything from real estate to financial instruments into tradeable, blockchain-based tokens…

All while tying them to the strength of the USD.

WLF isn’t just building a DeFi platform; it’s creating an ecosystem where the US dollar remains central in a blockchain-driven economy…

Ensuring its global reserve status even as the world shifts to digital assets.

You've heard of collateral damage.

Well, Trump's crypto agenda is going to create the opposite for certain 'early stage' cryptos.

Call it the Windfall Effect.

And it’s not just about tokenization. Cryptos in adjacent sectors—AI, decentralized data storage, and infrastructure—are primed to skyrocket alongside it.

Fortunately, we’ve been ahead of this trend. Our latest research is designed to help you stay ahead, too.