Venezuela Beyond the Headlines

Posted January 06, 2026

Chris Campbell

Every so often, the global chessboard registers a shift in alignment.

A soft scrape…

Like a rook sliding across wood.

Last week, that sound came from Venezuela.

If you’re waiting for the mainstream explanation, here it is: this is about oil. Full stop. Move along. Nothing else to see.

But, according to James, that explanation leaves a lot out.

Yesterday, our own VP of Publishing Doug Hill hosted a rare, spontaneous event with James to talk Venezuela. In a moment, I’ll share with you the highlights.

But first, you might be wondering…

What the heck does James know about Venezuela?

Turns out, quite a bit.

In fact…

What James uncovered through his connections points beyond a single trade and toward a broader thesis—one that gives astute readers time to position early.

Let’s dig into the details…

And break down how to think about Venezuela the way hedge funds would (and are right now).

Think Like a Hedge Fund

Behind the scenes at Paradigm, we’ve come to understand one thing about James Altucher.

When he gets excited, it’s often a signal most are looking the wrong way. And right now, he says, people are definitely looking the wrong way.

His weekend notes in our internal Paradigm channels made the importance hard to miss.

Venezuela isn’t a headline trade. It’s a systems trade. Meaning, the consequences cascade across sectors rather than resolving in one obvious play.

It lives at the intersection of geopolitics, capital flows, infrastructure, and more…

Exactly the kind of messy, cross-domain moment hedge fund managers pay attention to and commentators oversimplify.

And as you may know…

James lives closer to the hedge fund world than most analysts who opine on it. He’s spent years inside these conversations.

That’s why, when last week’s events unfolded, he wasn’t refreshing Twitter. He was on the phone with people who already had exposure on the ground.

So while James isn’t normally seen as the “geopolitical guy” and definitely not the “Venezuela guy”...

He draws on a network developed over decades across both Silicon Valley and Wall Street… giving him a lot of “guys” to pull from.

That’s why this call happened yesterday. And here are some of the big takeaways I’ve collected.

The Country That Went Offline

“The situation in Venezuela is underestimated right now,” James said, “because people don't want to give the government credit. I'm not political, I just care about making money.”

Here are the facts, as laid out by James…

For years, Venezuela wasn’t “poor.” It was just inaccessible.

The country sits on more proven oil reserves than Saudi Arabia. It also holds gold, rare earths, fertile agricultural land, and industrial assets that would anchor a mid-sized empire if they were allowed to function.

They weren’t.

So capital fled. People fled faster. Roughly a third of the population left. Markets stopped pricing Venezuela because markets can’t price a system that refuses to settle accounts.

That condition appears to be coming to an end.

No, it’s not happening politely, smoothly, or without consequence.

But James’ core point is simple: once capital senses enforceable rules returning—even imperfect ones—it moves early and it moves hard.

And, right now, it’s starting to swing.

Where the Wild Plays Are

The most immediate effect is already showing up where most least expect it: in crypto.

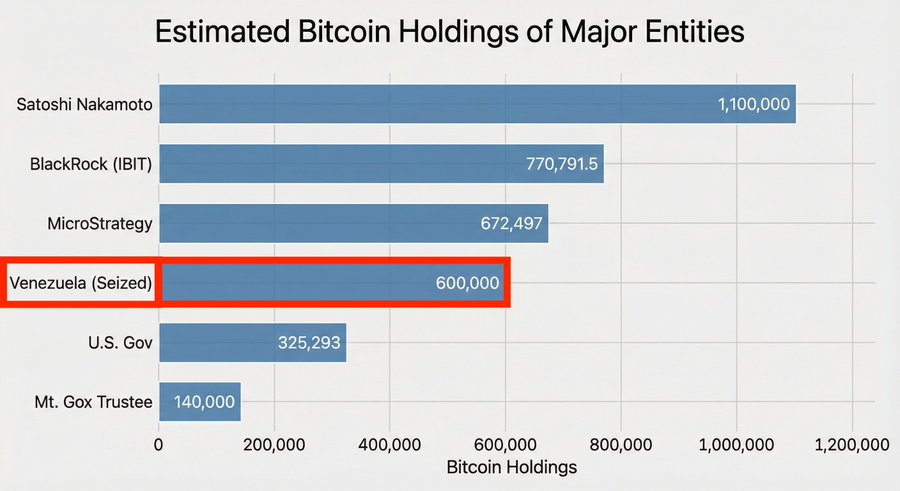

Venezuela’s potentially huge Bitcoin position—and the increasing likelihood of it moving under U.S. control—creates a supply dynamic that repositions Bitcoin as a strategic asset, with knock-on effects across higher-beta crypto.

After years of not recommending it, James is now keen on Bitcoin.

From crypto, James widened the lens. Right now, he’s focused on five pillars.

→ Energy

→ Defense

→ Rare earths

→ Space and connectivity

→ Finance

Here’s how to think about it the way a hedge fund would (and is):

In energy, he’s focused on production, not prices. The early beneficiaries are the companies that get paid when output restarts, not when oil dominates headlines.

In defense, James is paying attention to persistence rather than conflict. Long-term monitoring, logistics, and data infrastructure quietly benefit when security posture changes.

For rare earths? He’s tracking policy signals and sourcing decisions. These moves surface in trade language and export controls well before they reach earnings calls.

In space and connectivity, he’s watching how rebuilds will likely bring satellite connectivity online before ground infrastructure. In the new landscape, satellites tend to move faster than towers and cables.

And in finance, he’s scoping out the first signs of restructuring—debt talks, asset claims, and cross-border deal flow. Those processes precede capital inflows by months.

You don’t have to act on all of this at once. The edge comes from knowing what to watch, and in what order.

James walked through the specific plays he likes—and the timing behind each—during the full briefing yesterday.

Altucher Investment Network subscribers can watch the presentation and see every recommendation by logging in right here at this link.

(The video is titled, “All-Hands Strategy Session — January 5, 2026”.)

More to come soon.