Why I’m Mega Bullish Right Now

Posted May 03, 2023

James Altucher

I was at the gynecologist's office in early 2000 with my pregnant then-wife. It was about 9 am. We were going to find out the results of some random test I can't remember the name of. But right when the doctor started explaining I had to leave her office and go outside in the hallway.

I got a call from my stockbroker (people had stockbrokers back then.).

"Guess what! ABCD, that stock you own, is getting bought. They just announced. The stock is up 10 fucking bucks."

It's the best feeling. I mean, having a kid is pretty good. But having a stock you own get acquired is like a miracle. I'm only being slightly facetious. It really is incredible.

I mean, for a brief moment I had the biggest return on a stock that I ever had.

I say "brief moment" because this was 23 years ago and I still had a lot to learn about investing and I, unfortunately, learned it the hard way.

But still, oh man, I want that to happen more in my life.

And it will. Because this year all of the evidence is that this will be the biggest year for acquisitions of public companies ever.

I've never seen an environment like this. It's the perfect storm for more stocks than ever.

What makes an environment that is great for companies to be built:

A) When companies have more cash than ever. They want to use that cash to grow their business. The best way to grow quickly is to buy other companies.

B) When private equity funds have more cash than ever. Their ONLY job is to buy companies. They have to put their cash to work.

C) When companies are cheaper than normal because the market has not been good. People tend to do irrational selling of both bad and GOOD companies (just like they do irrational buying in bull markets).

D) When interest rates are going down. For almost a year and a half now interest rates have been going up. With a recession being heavily predicted for this past year, the Federal Reserve has already begun lowering the amount they raise each session and once there is a Recession or inflation falls at an even faster rate (it is already falling) then the Federal Reserve will start lowering interest rates.

Why does this affect acquisitions of public companies? Because private funds borrow money to buy companies the same way you and I borrow money to buy a home. The lower the interest rates, the cheaper it is to buy a company.

E) When there is a heavy amount of shareholder activists demanding that companies change management because the stocks are so low.

Management does not like when activists (many of whom are multi-billion dollar hedge funds) want to fire them. So they hire a bank to put the company up for sale and they go to the highest bidder.

So what does that have to do with now? Today.

------

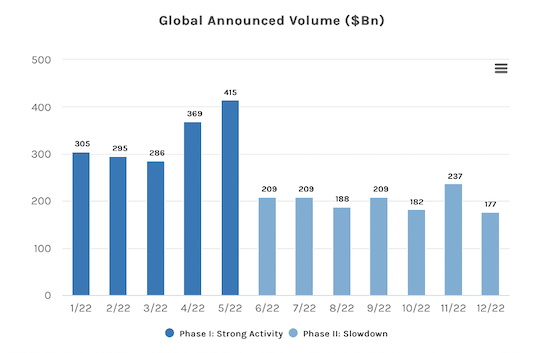

Here's the amount of dollar volume in takeover activity of public companies this past year.

Source: Morgan Stanley

Note how low it goes in 2022. Why is this important?

Check out the next chart:

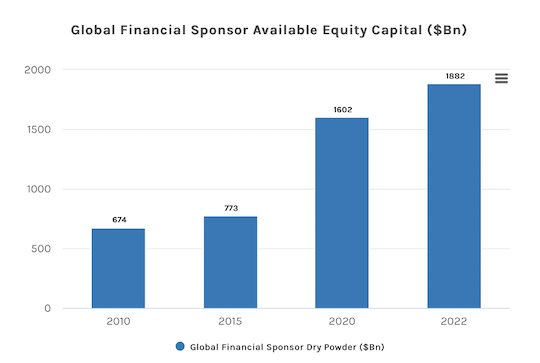

Source: Morgan Stanley

This is how much cash private equity funds have had in the bank each year over the past 15 years.

It is FAR higher than ever right now.

Why? Two reasons:

A) the US printed up four trillion more dollars in the past few years.

That money has to go somewhere. It doesn't go to the schoolteachers and janitors and waiters. It goes to the richest of the rich - the private equity funds.

B) last year they hardly bought any companies. So in addition to all the money floating around, they haven't used.

THEY HAVEN'T USED THE CASH THEY HAVE.

What happens to the people who manage all that cash when they don't put it to work? Eventually, they get fired and their dreams of working on Wall Street and getting rich are over.

THEIR ONLY JOB IS TO BUY COMPANIES. They have no other job. This is what they do. They have to buy companies and they have not been doing their jobs lately.

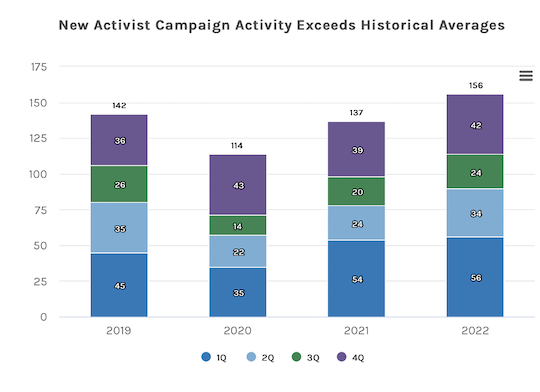

So when companies are cheap, interest rates are lower, there's more cash than ever, and, by the way, here's the level of shareholder activism — higher than ever:

Source: Morgan Stanley

This is the perfect trifecta. Just like there is more cash than ever being held in the banks by potential acquirers, there will be more companies bought for higher prices than ever.

So how to find these companies?

Here are some thoughts:

A) Biotech. Big Pharma patents on top-selling drugs are expiring. They will need to buy smaller biotech firms to keep making profits.

B) Technology. Companies like Google and Amazon and others often buy a company a week in far worse conditions than this.

C) Energy. A combination of higher oil prices, more need for alternatives, and more focus on things like carbon capture and other environmental initiatives will mean more buyouts.

Here's an interesting thing that I've been researching for a while. I want to find these companies early. I can guess and analyze and do whatever. But it's good to have additional resources.

A recent paper describes research they did about uncovering companies that might be acquired.

Here's their conclusion:

"The authors find that the volume of options traded is abnormally high over the pre-rumor period while the direction of option trades (abnormal call volume minus abnormal put volume) prior to takeover rumors predicts forthcoming takeover announcements, rumor date target firm returns and post-rumor target firm returns. "

In other words, the more unusually high the options volume is on a stock (as measured by how many standard deviations the volume is from the average) the more likely a company is to be acquired and for a higher price than normal.

So how can you benefit from this knowledge?

First, there is the awareness that this is going to happen.

There's a method for finding the companies that will get bought. There are the industries where the most acquisitions will occur. They won't be happening this month, but soon. I'll keep writing about this.

Meanwhile, my then-wife was upset at me back in 2000.

Maybe it's unfortunate that I was much more focused on money than my relationships 23 years ago.

But my first daughter was born healthy and I love her and she's 23 years old this month. I am luckier than I deserve.

[Ed. note: James has a big announcement -- and a brand new project -- coming up next week. In the meantime, stay tuned. We’ll be leaking details until then.]