Why James Sold ALL His Bitcoin

Posted June 24, 2024

Chris Campbell

In 2016, after the halving, the Bitcoin price dropped from about $1,300 to $950.

Sounds trivial in retrospect, but…

It shook A LOT of people out.

Then what happened? It soared from $950 to $20,000 within a year. The people who sold got left behind.

In 2020, the same thing happened after the halving…

Bitcoin dropped from about $20,000 to almost $15,000.

Again, sounds trivial - but a lot of people called it quits and ran for the hills.

Then, Bitcoin skyrocketed to over $68,000.

Fast-forward to now:

Bitcoin fell from $72,000 to [checks price] a little over $60,000.

Can it go lower? Of course.

But it can also go higher - a lot higher. And if it repeats past post-halving runs, we’re looking at prices that will shock even ardent critics into FOMO.

There’s not just one thing that’s driving the price.

Mainstream media likes to parade around the things that are easy to understand:

-> Mt. Gox repayments.

-> Germany sells its dark web money.

-> Miners are selling big-time

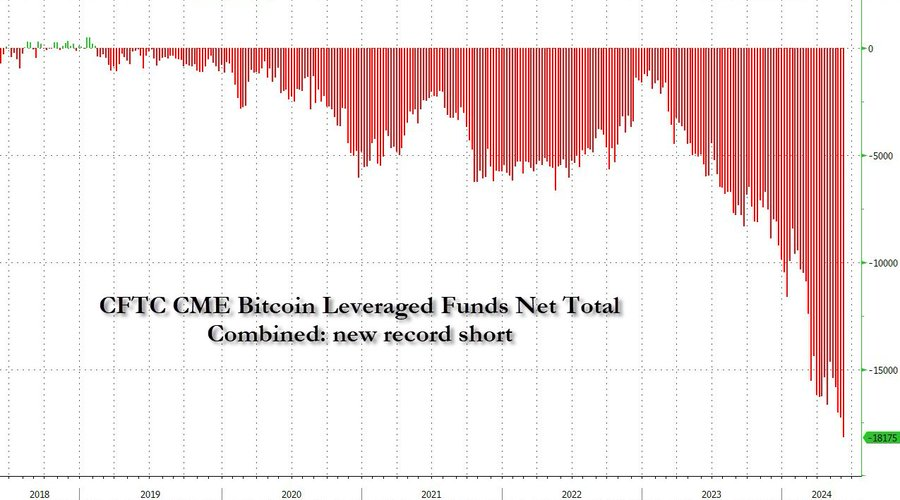

-> Record shorts!

-> Record outflows!

-> Record inflows!

Most of the time, the people pushing these stories want to scare you. So they don’t take the time to explain the more complex stuff.

They want you to think the price is being manipulated and suppressed.

Today, I’m going to break down a simple trade that most Bitcoin holders don't understand - and risk getting shaken out because of it.

I’ll cover:

A.] Why it’s happening

B.] What it means

C.] Why it’s bullish

D.] Why James sold all his Bitcoin

Long Spot, Short Futures

Since early June, crypto traders have been scratching their heads watching three things happen despite all the bullish catalysts;

- Reports of record short positions in Bitcoin futures.

- Reports of record outflows of Bitcoin

- Bitcoin continuing its downsloping chop, despite all of the seemingly bullish catalysts.

Earlier this month, for example, Zero Hedge posted this chart, revealing Bitcoin hedge fund net shorts - absolute record-breaking:

Many interpreted this as institutions being mega-bearish on Bitcoin.

Wrong. Institutions were just taking both sides.

The simple term for it: Cash and carry trade.

The cash and carry trade is a common practice in futures and more recently crypto markets. It involves buying Bitcoin in the spot market (buying the actual Bitcoin now) and selling futures contracts (agreeing to sell Bitcoin at a future date for a set price).

Traders were paying an interest rate (10%) to use leverage. Other traders can use this premium as an arbitrage opportunity.

It's like buying apples today for $1 each and agreeing to sell them in six months for $1.10 each, guaranteeing a profit of $0.10 per apple.

It's as close to a “riskless” profit as one can get in crypto (barring any unforeseen counterparty risks, of course).

By being long on the spot market and short on futures, traders are not affected by Bitcoin price changes. They won't be liquidated unless they mishandle their collateral or strategy.

What it Means

In theory, this trade is supposed to be neutral.

In practice, it can cause downward pressure. When traders want to unwind this trade, they must sell the spot ETFs and long the futures. Spot and ETF markets are much smaller than futures markets, and are more sensitive.

This can then lead to a chain reaction where the basis (price difference) collapses, leading to more selling.

This can also cause FEAR.

Right now, about 25% of short-term holders are currently in profit - meaning, 1 in 4 positions are held at a loss. This means they are more likely to panic sell.

It seems we’re starting to see a bit of that. Funding rates are down, making this trade less attractive. Also, ETF volumes are low, making it harder for the market to absorb large sell orders.

Don’t panic.

The overall trend remains bullish.

A storm is swelling to the upside.