X Money: How Musk Breaks the Banks

Posted January 15, 2025

Chris Campbell

It starts the way many stories do these days: Elon Musk.

Whether you cheer him on, roll your eyes, make memes at his expense, or secretly think he’s a Vogon in disguise (or, like me, you’re all of the above), one fact remains…

When Musk sets his sights on a new domain, Earth has a strange way of tilting in his direction.

(They say when Musk dreams, cherubs weep, economists reach for smelling salts, and Jeff Bezos schedules an emergency forehead massage.)

Lately, the buzz isn’t about Tesla or SpaceX.

It’s about money.

Specifically, the future of money.

Specifically…

X Money

As you’re probably aware…

Musk’s plans for X go far beyond the colossal collective awkwardness of renaming “tweets".

It’s about wallets. Payments. Currency. Digital dollar bills.

X isn’t just a social media platform—it’s a Trojan Horse.

But before you roll your eyes at another "Musk takes over the world" theory…

Let’s connect some dots.

Musk’s ambitions are no secret: X will be the next big "everything app". Meaning, it’ll offer a wide range of services beyond social media.

Not unlike the super apps that have gained immense popularity in Asia, such as WeChat in China.

WeChat allows users to chat, pay bills, book appointments, and even manage investments—all from a single app.

We also mentioned Ant Group yesterday -- an all-in-one financial superapp with global ambitions.

And there’s also Grab Holdings in Southeast Asia -- the “Everyday Everything App” that allows users to rent cars, hail rides, order groceries, borrow money, and track a package.

All in one place.

Musk wants X to become the Western equivalent…

Fulfilling his original plan for X.com all the way back in 1999 -- pre-PayPal.

And, at long last, it’ll all kick off this year.

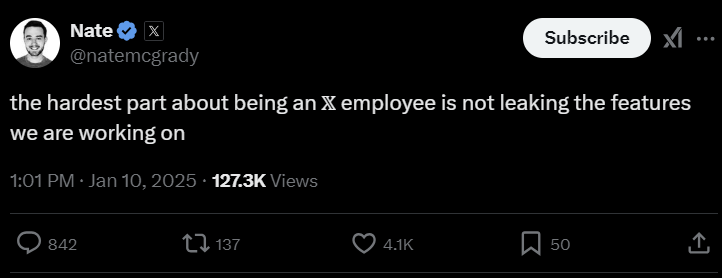

CEO Linda Yaccarino just confirmed it: X Money is coming in 2025. And X employees, like Nate McGrady, have been dropping hints like seagulls scattering fries on a crowded beach.

With over a billion users and plans to integrate payments and financial services…

X Money has the potential to make managing your digital life as seamless as sending a tweet.

But there’s one thing he’s been pretty tight-lipped about: crypto.

For good reason.

Kaboom.

If we’re right about what’s coming, X Money will usher in a paradigm shift in banking…

Forcing institutions, among other things, to lower fees, improve services, and adopt more customer-friendly policies.

And there’s no doubt in our minds crypto will play a role.

We received “soft” confirmation of this back in 2022, when James posted this… and Musk liked it.

“One prediction I will make,” James said over two years ago, “is that Twitter is going to be the ultimate cryptocurrency digital payments platform. That’s Elon’s ultimate goal for Twitter.”

How to Play it

In economics, the concept of "complements" refers to goods or services that gain value as another related item becomes more accessible or affordable.

Think peanut butter and jelly: when peanut butter prices drop, jelly sales often rise.

The same principle applies to financial services.

If X Money succeeds in driving down transaction fees, improving customer service, and generally forcing traditional banks to adopt more customer-friendly policies…

Investors should look to the complements of these changes—sectors and companies poised to benefit as financial friction decreases.

For example, lower fees would unlock growth for e-commerce platforms, smaller players, and subscription-based models by reducing the friction of micro-transactions.

A move toward improved customer service will boost demand for fintech innovators offering user-friendly tools, data analytics companies, personalized service companies, and cybersecurity firms.

Finally, cryptocurrencies and on-ramps will also thrive as traditional banking’s advantage diminishes, shifting the narrative.

The bottom line? As X Money reshapes the financial landscape, the ripple effects will create opportunities far beyond Musk’s platform.

Smart investors are positioning themselves in industries that amplify or benefit from this evolution—where value is most likely to flow next.

One Crypto Set to Fly

Right now, I’m working up an article exclusive for Altucher’s Investment Network on the BIGGEST asymmetric bet in crypto.

Once X Money launches, I think this relatively-ignored crypto could go gangbusters…

Because of moves Musk is ALREADY making behind the scenes.

(Very few people are talking about it. Even fewer understand the implications.)

If you’re an Altucher’s Investment Network subscriber, sit tight.

It’s coming.

The article -- with the full story and the crypto -- will drop in this month’s issue.