Yes, Silver v. Bitcoin

Posted May 31, 2024

Chris Campbell

In 2012, a friend approached me and said, “I have $5,000. What should I buy and hold for the next ten years?”

He was looking for something fun, off the beaten path.

Edgy.

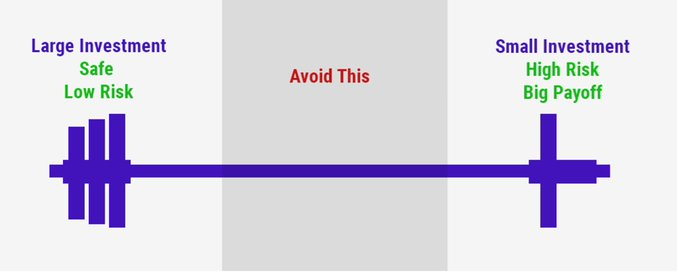

I told him to get both silver and Bitcoin, a variation of the barbell strategy.

Silver was never going to zero. Odds are, it would eventually go up. Bitcoin could go to zero, but it could also go to $100,000 or more.

He looked at me like I was a lunatic.

Bitcoin was around $100. There was no friggin’ way it would ever see $100,000.

“That’s a $2.1 trillion market cap,” he said. “Do you know how much $1 trillion is?”

In his defense, you have to understand: $1 trillion isn’t what it used to be.

Also…

In 2012, nobody in the alt financial media was talking about Bitcoin. If they were, they were talking about how it was a scam.

EVERYONE was talking about silver.

He bought $5,000 worth of silver at $34 per ounce.

Twelve years later, he’s still down.

Meanwhile, $2,500 in Bitcoin back then would be worth over $1.5 million.

My friend has done very well for himself without a big bag of Bitcoin -- he takes the ribbing in stride.

He still has the silver, too.

“As a reminder,” he once told me.

A reminder of what? No clue. I’m afraid to ask.

Despite all of that…

If the question is, “Should I buy silver or crypto?”

My answer, to the horror of my friend, is still the same: “Why not both?”

The Case For Silver

In recent months, a flurry of headlines has highlighted the increasingly bullish case for silver.

Executives from silver mining companies and analysts who follow the sector closely believe that silver is on the cusp of a major bull market, driven by a perfect storm of supply and demand factors.

(For real this time!)

One of the key drivers is the widening supply deficit in the silver market. For four consecutive years, silver demand has outstripped supply, with the deficit expected to grow to a staggering 250 million ounces in 2024.

This structural shortage is the result of years of underinvestment in new mine supply, coupled with rapidly growing demand from both industrial and investment sources.

On the demand side, solar panel manufacturing has emerged as a major consumer of silver, accounting for around 35% of total demand(!).

With the global push towards renewable energy, solar adoption is set to accelerate, and newer panel technologies are using even higher loadings of silver. Some projections show solar demand rising to 50% of total silver consumption in the coming years.

50%!

Add to that, investment demand for silver is also heating up, particularly in the key Asian markets of India and China.

In recent months, silver imports into these countries have shot up, with India importing more in the last three months than in all of 2022 and Chinese imports hitting record levels.

Analysts believe that buyers in these countries have a clearer view of the supply/demand fundamentals than western investors, prompting them to stock up on the metal.

$66 is the Base Case

The supply picture for silver looks increasingly constrained. Around 70% of silver is mined as a byproduct of base metal mines like copper, lead and zinc.

However, developing new mines in these sectors faces long lead times and growing challenges, meaning silver supply could tighten further as these sources see limited growth.

Best estimates suggest that primary silver mines, while benefiting from higher prices, would require silver prices to more than double to incentivize meaningful new production.

Resource nationalism in major silver producing countries like Mexico, Peru and Chile is compounding the supply challenges.

Governments in these countries are looking to take a larger share of mining profits, while tighter regulations and social opposition are making it harder than ever to build new silver mines.

Finally, the monetary backdrop is also supportive for silver.

Central banks around the world are accumulating gold at the fastest pace in decades, as confidence in the U.S. dollar wanes.

This shift will benefit silver, which tends to follow gold directionally but with higher volatility.

While often overlooked in favor of its yellow cousin, silver's moment in the spotlight may have finally arrived.

I’ve heard it all before, of course.

But I can’t help it. I still love silver.