Countdown to Cashout Cataclysm

Posted May 04, 2023

Chris Campbell

In the large and unwieldy financial universe, it's always quite the sight to see a financial comet come crashing down.

But when several comets come crashing down at once, it's no longer an idle spectator’s sport.

One instead begins to wonder if it’s time to seek refuge in a secret doomsday shelter in Greenland, because perhaps the proverbial "S" is about to hit the archetypical "F".

First it was Silicon Valley Bank… Silvergate.. Signature… First Republic… and now PacWest Bancorp.

Is there more to come? Time will tell.

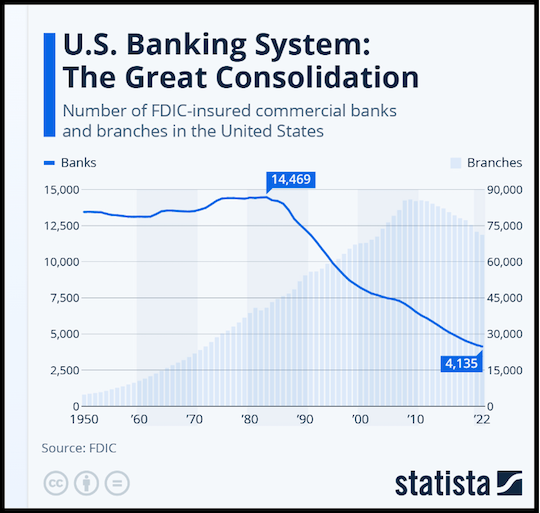

This, by the way, is another data point in a longstanding trend.

In the 1980s, there were about 15,000 FDIC-insured commercial bank branches. Today? Just over 4,000.

The argument has long been made by both politicians and bankers that there are just too many banks…

The idea being that greater bank consolidation will reduce systemic risk -- that “too big to fail” is a feature, not a bug, of the US banking system.

That’s the news we can’t do much about.

But there’s another story behind the fold not being told. Not even in the mainstream (and alternative) financial news…

That is, how to take advantage of what’s to come.

Cashout Cataclysm

Yesterday, James outlined in these digital leaves why he believes 2023 will be the biggest year for buyouts of public companies ever.

For several reasons:

1.] Companies have more cash than ever

2.] Private equity funds have more cash than ever

3.] Companies being cheaper than normal

4.] The Fed will start lowering interest rates

5.] High levels of shareholder activism

Whenever a buyout transaction occurs, investors who already owned the stock getting bought out typically walk away with a windfall overnight gain.

That’s because when a buyout occurs, the acquiring company typically offers a premium on the target company's stock price, meaning stockholders get a nice boost in their investments.

Sometimes, it’s a really nice boost.

In the 2014 Merck acquisition of Idenix Pharmaceuticals, investors raked in a massive 238% premium on their shares.

As Gilead Sciences acquired Immunomedics in 2020, shareholders reaped the rewards of a staggering 108% premium.

When Google acquired Motorola Mobility in 2011, investors saw a 63% premium.

And shareholders of Red Hat struck gold with a 63% premium as IBM acquired the company in 2018.

The list goes on.

A wave of buyouts are coming. As usual, there will be winners and losers. We’re setting up for the former.

James’ Big Announcement

Soon, James will announce a brand new project that focuses not only on uncovering these buyout opportunities…

But also maximizing the potential gains.

Expect an announcement in these pages soon.

And keep in mind…

While investing in potential buyout targets can lead to significant rewards, it's essential to approach this strategy with caution and proper due diligence.

That’s where James comes in.

More on that soon. Stay tuned.